JPMorgan’s market-moving quant guru Marko Kolanovic and chief U.S. equity strategist Dubravko Lakos-Bujas said late last week that investors need not worry about more trade war bombshells, and should instead buy the dip as the market continues to sink.

“We see this sell-off as a medium-term buying opportunity,” Kolanovic and Lakos-Bujas wrote in a note to clients on Thursday. “After a short period of stabilization, markets will likely regain previous highs.”

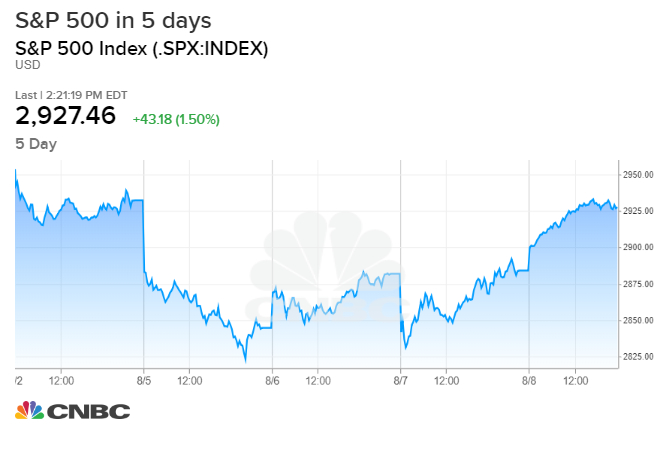

The market suffered its worst day of the year on Aug. 5, with the S&P 500 falling 3%, the Dow Jones Industrial sank 2.9% and the Nasdaq fell a whopping 3.5%. China allowed its currency, the yuan, to fall to the politically sensitive level of 7.0-to-$1 while also ending imports of all U.S. agricultural products, sending the markets into a tailspin in direct retaliation for U.S. President Donald Trump’s latest announcement of tariffs.

At the end of the previous week, Trump announced 10% tariffs on the remaining $300 billion worth of Chinese imports. The sell-off came shortly after the S&P 500 hit a record high of 3,025 on July 26, and by Thursday had regained the market’s losses from earlier in the week.

However, Kolanovic and Lakos-Bujas said the worst is over and we shouldn’t expect anymore bombshell announcements out of the trade war.

“The risk to this view is further uncontrolled escalation of trade tensions, which we see as a less likely scenario, given that we’re approaching an election year and a trade-war-induced recession would greatly reduce the probability of the president’s re-election,” the pair wrote.

They also wrote that strong wage growth and better-than-expected corporate earnings have set the table for markets to move higher.

“The current macro environment is far from perfect, but macro fundamentals likely justify higher equity prices,” they said. “Services and new economy sectors have held up relatively better. … Guidance on most important macro companies was better than expected.”

Many expected an earnings recession during quarter 2, but 76% of S&P 500 companies reported positive numbers.

“With central banks globally in easing mode, cash is becoming less rewarding leaving equities as potentially the only alternative with an attractive yield and long-term growth potential,” they wrote.

Additionally, they said further escalation from Trump is unlikely given the 2020 election is right around the corner.

“The risk to this view is further uncontrolled escalation of trade tensions, which we see as a less likely scenario, given that we’re approaching an election year and a trade-war-induced recession would greatly reduce the probability of the president’s re-election,” they wrote.