As we prepare for the investment wonders and horrors that will strike our world in the months ahead, the time is now to tell you a tale of two financial geniuses.

The first was so accurate at predicting financial disaster, he was murdered by his own government.

The second was so good at forecasting every major move in stocks, bonds and gold markets for so many years, he was followed by hundreds of thousands of investors around the world before he died.

And he did such a good job of sharing his knowledge that his successor has been avidly followed by hundreds of thousands since.

The Murder

The story begins more than eight decades ago.

The story begins more than eight decades ago.

The date is Saturday, Sept. 17, 1938. The place, the Kommunarka firing range near Moscow.

A slight, bookish-looking man is marched out of his cell. He is a Russian economist.

As he faces the firing squad, he is informed that his death has been personally ordered by General Secretary of the Soviet Communist Party, Joseph Stalin.

His crime: The discovery of a cyclical pattern in global economies that accurately predicts every major boom and bust since the Industrial Revolution.

The problem: His long-term cycles chart also predicts the death of the Soviet Union. And in 1930s Russia, that’s enough to get you killed.

Today, this economist’s name, Nikolai Kondratieff, lives on as the father of one of the most accurate economic forecasting tools known to science.

It helped predict America’s postwar boom in the 1950s, the stagflation of the 1970s, the dot-com crash of 2000, the housing bust of 2008, and the bull market that followed.

And right now, the same cycle is showing its gravest warnings ever: A global economic collapse of biblical dimensions. Plus, it also reveals how you can use this information to help multiply your money many times over.

The Death

The second story is about Larry Edelson, our colleague who died in 2017.

The second story is about Larry Edelson, our colleague who died in 2017.

He dedicated most of his life to studying Kondratieff’s discoveries and those of other scholars who followed.

Larry pinpointed the exact bottom of the great bull market in gold in the early 2000s and predicted precisely where gold would go — from $250 to over $1,900 per ounce. Then in September 2011, he said gold prices would plunge. And they did, right on cue.

Thanks to Larry’s work, we also predicted the housing crisis, saying it would take down the stock market and the U.S. economy with it (it gives me no pleasure to say we were right).

And in March 2009, we announced the worst was over; that it was time to buy stocks again. Over the next 10 years, the S&P soared fourfold.

Thanks to Larry, we’re on record for saying the Dow would surge past 20,000, when it was trading for little more than half that much.

We will reveal the details of our new forecast tomorrow. (To register for this event, free to subscribers, go here. Today is the last day to do so.)

In the meantime, I think you first need to know more about this:

Why Stalin Murdered Kondratieff

Kondratieff was killed because of a book he had written: “The Long Waves in Economic Life.”

The book (really just a pamphlet) was only 23 pages long. But it contained an idea so revolutionary, so incendiary, so threatening to the Soviet Union that he was executed for it …

Kondratieff effectively predicted communism would fail and be replaced by capitalism.

It wasn’t an opinion, said Kondratieff. It was a virtual certainty. Because human economies move in waves. And when you stop and think about it, that should come as no surprise.

Science has taught us, after all, that everything in the universe moves in waves. Sound and light move in waves. Electromagnetic waves are what let us listen to music on the radio and watch shows on television.

Is it any wonder human economies move in the same way?

Kondratieff proved that economies act much like waves in the physical world. What’s more, economic waves come in cycles that make changes in the economy possible to predict.

What Kondratieff called “The Long Wave” — which was later named “The K Wave” in his honor — shows the changing cycles of private and public influence in the economy.

During the private cycle, free enterprise leads to increasing growth and prosperity. Think of the Roaring ’20s, for example.

Eventually, the wave reaches a crest and begins to collapse on itself. This collapse is triggered by a stock market crash, a housing bust, or a run on the banks.

This is what happened in the 1930s. Then the government intervenes in the economy. They print more money. They manipulate interest rates. They increase government jobs, welfare and handouts.

For a while, everything seems to work fine. But this phase, too, leads to a crash. Because even governments must obey the laws of economics. And the most basic law is this:

You can’t keep spending money you don’t have!

This is how Kondratieff knew that Soviet Union communism would be replaced by capitalism. He predicted it 61 years before it happened.

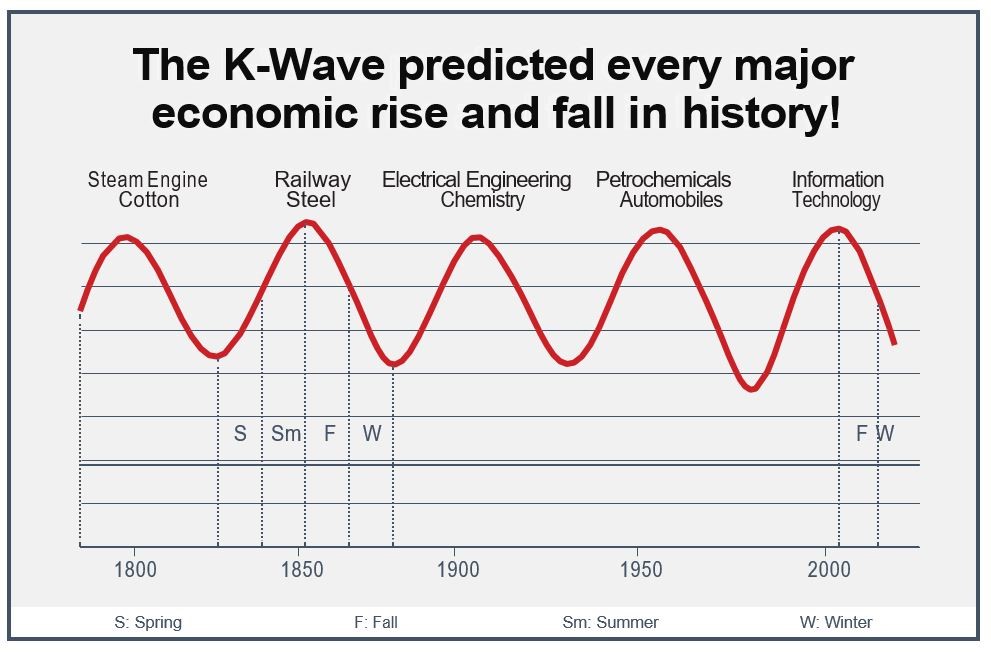

According to Kondratieff, the K Wave has a frequency of 47 to 64 years. And if you look back through history, you’ll see how accurate the K Wave is.

From crest to crest, you can see the cycles coursing through time: The dawn of the Industrial Revolution. The golden age of railroads and steel. The onset of electrical and chemical engineering. The age of the automobile and oil. And, most recently, the information age, which reached a major peak with the rise of internet stocks in 2000.

But you can also see the Panic of 1819. The “Long Depression” of 1873. The “Great Depression” that began in 1929. The stock market crash of 1973, when the market lost 46 percent of its value, ushering in a period of “stagflation.”

Take a closer look at one wave and you’ll notice a pattern that’s common to all of them. Each wave shows a “seasonal” pattern. Kondratieff said these patterns resemble the seasons of the year.

In the SPRING phase (S in the chart), new technology creates a period of innovation and wealth creation.

In the SUMMER (Sm), there is a growing mood of affluence in society. But there’s also growing tension between the “haves” and “have-nots.”

In the FALL (F), the financial markets reach their peak. But serious trouble is just around the corner.

Finally, the WINTER stage (W) arrives. Now the economy faces severe recession and eventually depression.

So where are we now?

If the K Wave is correct, the global economy is already in the midst of a global recession and could sink into depression, which we see starting in Europe.

It could include seismic shifts in the fabric of society. You’ve already seen some of those seismic shifts take place with anti-EU movements spreading across Europe.

But what we’re talking about here is much bigger than one country or one political trend. We’re talking about a rippling effect that will roll through the entire globe and leave economic destruction in its wake …

Wiping some investors out of their life savings … while making others rich beyond their wildest dreams.

Of course, you could write this off as the hare-brained theory of one mad Russian scientist. But as we’ll see in a moment, Nikolai Kondratieff was not alone. Over the decades, several economists have confirmed his theories.

And before he died this year, Larry and I co-founded The Edelson Institute, to which he donated his life’s work.

In fact, our Edelson Institute team has used these wave patterns for years. Right now, we’re developing even more accurate ways to predict major shifts in the economy.

Because one thing is certain:

Human beings tend to make the same mistakes, misjudgments and misunderstandings again and again. And they do so in predictable patterns that often resemble “waves.”

Mark my words: A new tidal wave is headed our way.

Whether you are totally wiped out — or whether you ride the “crest” of this wave to a level of wealth you never dreamed possible — depends entirely on what you decide to do today.

According to MIT research, tidal waves in the economy work a lot like those in nature.

Deep beneath the ocean floor, two tectonic plates rub against each other to create a fissure or fault line. As the pressure builds up over the centuries, a rupture occurs.

It’s an earthquake. But it’s happening underwater. So nobody can see it or hear it. Until it’s too late. The earthquake displaces massive amounts of water, which move outward in waves at speeds of up to 500 miles an hour.

When the first wave hits the shore, it causes utter devastation. According to National Geographic, the enormous energy of a tsunami can lift giant boulders, flip vehicles and demolish houses.

But from a financial standpoint, the K Wave will be even worse. Millions could see their life savings wiped out. Businesses, large and small, could close their doors.

But where is the fault line today in the global economy?

When will it rupture?

Where will the next tidal wave of money emerge and in what direction will it flow?

Which specific investments will be washed away, and which will ride the crest of the wave to new, higher levels?

What steps must you take now to protect your wealth and profit?

Sean Brodrick and I will give you our answers to these questions — and more — in an urgent briefing at 2 p.m. EDT tomorrow.

I believe it is our mission to help you survive this new wave with your wealth not only intact but growing.

To register now, go here.

We will give you our startling forecasts for 2019 and beyond. And we will explain what you must do before to prepare.

Good luck and God bless!

Martin