Since I moved to South Florida, I’ve dreamed of owning a boat.

Cruising off the coast for the weekend is my definition of relaxing!

I always see boats for sale, but they don’t last long:

Data firm Boats Group recently released its midyear review of the market.

The time boats stayed on the market stood out. (You can see that in the chart above.)

In the U.S., the average “for sale” time for boats decreased 38.8% over three years.

Despite inflation and recession fears, the boating market is surging. Folks are wasting no time buying.

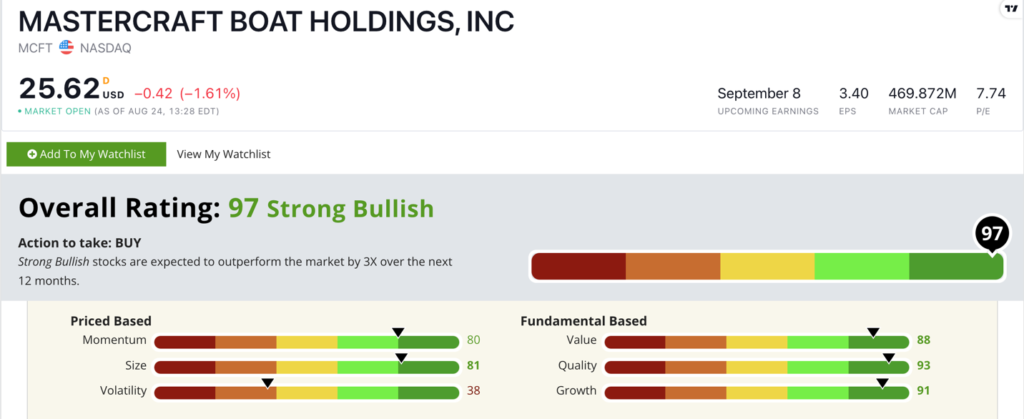

That brings us to today’s Power Stock: recreational boat manufacturer MasterCraft Boat Holdings Inc. (Nasdaq: MCFT).

MCFT Stock Power Ratings in August 2022.

Rather than expensive yachts, MasterCraft makes and sells more affordable fishing and family powerboats.

MasterCraft Boat Holdings stock scores a “Strong Bullish” 97 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

MCFT Stock: Top Fundamentals

MasterCraft set records in its last fiscal quarter.

Highlights include:

- Net sales were $186.7 million — a 26.3% increase from the same quarter a year ago!

- It was the most profitable quarter in the company’s history — and the sixth straight quarter of sales gains.

Those sales numbers show why MCFT scores a 91 on our growth metric.

MCFT is a high-quality stock.

Its return on assets is a healthy 23.1%. The leisure goods industry average, on the other hand, is negative 2.9%.

The company’s return on equity is seven times higher than its industry peers! This tells us MCFT knows how to turn a consistent profit.

As you can see in the stock chart above, MCFT had a strong February. It closed in on its 52-week high from November 2021.

But broad market headwinds and recessionary fears pushed the stock to a 52-week low by May.

From that low to mid-August, the stock rose 29.8% and is now looking to break out higher.

MasterCraft Boat Holdings stock scores a 97 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Folks aren’t letting inflation or recession fears stop them from buying what they want.

Buyers are snapping up boats at a faster pace, increasing demand.

I’m confident you can see now why MCFT is a strong potential investment for your portfolio!

Stay Tuned: Transportation Leader

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a top transportation company that started with a single milk truck in 1946.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.