Medicare open enrollment for 2020 has been underway for a couple weeks now, which means it’s open season for scammers looking to steal from millions.

Patti Poss, a senior attorney at the Federal Trade Commission, says open enrollment is one of many events that sees a major increase in shady activity against the program that has around 60 million beneficiaries. The enrollment period ends again on Dec. 7.

“Any time there’s anything in the news — whether open enrollment, a disaster or a law change — scammers like to latch on to it,” she said in an interview with CNBC. “They use things that are true to add credibility to their story and get you to respond.”

This can be anything from someone pretending to work for Medicare to fish for information, or even a fraudulent organization attempting to prescribe services or medical equipment. Their main objective is always the same, though: stealing private information or funds.

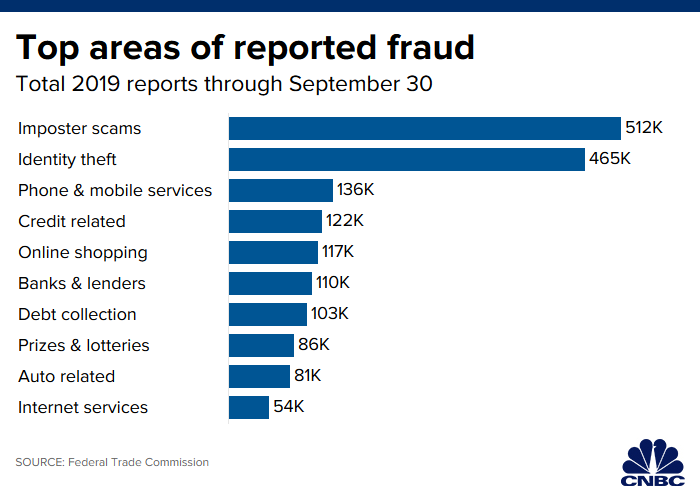

Through only Sept. 30 of this year, over 2.4 million fraud claims have been made to the FTC for reported losses of over $1.2 billion.

Here are two telltale signs that you are dealing with a Medicare scammer:

- Anyone asking for payment with gift cards or a wire transfer in exchange for services.

- Anyone seeking identifying information like a Social Security number, bank account or Medicare number.

“I tell my own parents, ‘Medicare won’t call you and ask for your Social Security number,’” Lewin & Gavino founder Elizabeth Gavino said. “If this happens, hang up.”

The FTC made note of two scams that have gained popularity this year. One offers back or knee braces for free, or for very cheap, in an attempt to get an individual’s Medicare number. Another, which was busted by the feds in the last few months, offered free DNA testing. Scammers can use someone’s Medicare information to file a fake claim and drain a person’s account of its funds.

Poss warns that phone calls are easily the most popular means to execute scams like these, but email and even physical mail is used as well. What makes phone calls so lucrative is the ability of scammers to create spoof numbers that can make a call look official.

“These scammers are very good at what they do,” Poss said.

Boomer Benefits co-founder Danielle Roberts says these scammers aren’t afraid of getting aggressive, either.

“Sometimes the caller will become stern and demand information, or they may hang up and then call you repeatedly,” Roberts said. “Don’t fall for it.”

Call Medicare at 1-800-MEDICARE to report any suspected fraud. If you think you may have already fallen for a scam and given up some of your own personal information you can report it to the FTC at identitytheft.gov or 1-877-FTC-HELP.