In this week’s Marijuana Market Update, I provide some analysis on MediPharm Lab Corp.’s stock and have an update for the Cannabis Watchlist.

If you’ve been investing for any amount of time, you’ve run across a common saying as any stock takes a dive.

“Buy the dip,” investors of all kinds suggest.

It can be tempting, especially in an exciting and ever-changing market like cannabis, to take chances, to be risky and buy a dip in a stock. I’m not advising against that approach — I just want to make sure your approach is strategic.

Predicting the bottom for a stock is almost impossible. That’s why our strategy at Money & Markets is to target stocks in an uptrend.

In today’s Marijuana Market Update, I showcase a cannabis stock that highlights the risks of buying the dip.

I learned about this company from Melanie, who emailed me at feedback@moneyandmarkets.com.

She said:

Love your platform. Straight-forward information with no BS. Excellent job, and keep up the great work.

Would you mind looking into MediPharm Labs for us? It used to be a hot stock but it seems it has fallen off the radar totally.

Thank you!

-Melanie

Thank you for your email and kind comments, Melanie!

About MediPharm Labs Corp.

MediPharm Labs Corp. (OTC: MEDIF) is a Canada-based company that produces and sells pharmaceutical-grade cannabis oil and concentrates for derivative products in Canada and Australia.

It also provides contract-processing services to licensed cannabis producers and growers in Canada.

Melanie is right: The company fell off the radar after reaching highs in late 2019.

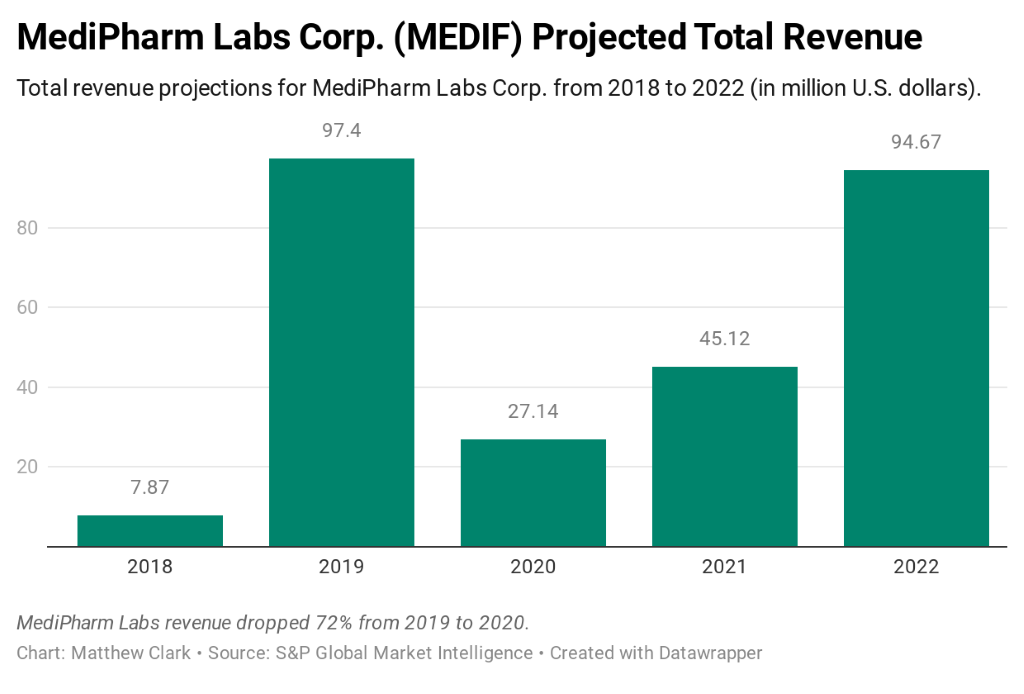

This is due, in part, to a drastic drop in revenue. The company‘s total revenue dropped 72% from 2019 to 2020.

MediPharm’s revenue went from $13.9 million in the second quarter of 2020 to just $4.9 million in the third quarter.

The third quarter also came with two sizable write-downs:

- A $6.3 million non-cash write-down of inventory.

- A $1.5 million write-down of non-current deposits given to vendors for cap-ex.

It was a rough year for MediPharm.

MediPharm Stock

MediPharm’s stock price hit a high of $5.40 in August 2019, but, in the last 12 months, that high was only $2.38 in February 2020.

Now the stock price is around $0.62 per share — a 74% drop from its February 52-week high.

It’s a drop of 89% from its all-time high set back in 2019.

MEDIF (Red) Drops 74% in 12 Months

While revenue projections for MediPharm are expected to get back to 2019 levels, that won’t happen any time soon.

The company had to reinvent itself to continue making money, and it’s going to take time before we see if that reinvention worked.

Watch my latest Marijuana Market Update here for more on MediPharm stock’s future.

Cannabis Watchlist

Now, I want to talk about our Cannabis Watchlist.

It continues to perform well, with an average gain of 52.8% as of February 18, 2021.

- Planet 13 Holdings (OTC: PLNHF) — The Nevada-based cannabis company has started construction on its massive new superstore in Orange County, California. The 55,000-square-foot facility is expected to open later this year. After being down as much as 11% early on, Planet 13 stock is now up around 28% since it was placed on the watchlist in January.

- Scotts Miracle-Gro Co. (NYSE: SMG) — A blowout in quarterly earnings helped push this traditional fertilizer producer up nearly 41% since it was added to the watchlist in September 2020.

- Schweitzer-Mauduit International Inc. (NYSE: SWM) — The company that produces things like rolling papers used by the tobacco and cannabis industries will release its quarterly earnings report right after this story was published on Friday, February 19. Its stock has consistently grown in value and is up 50% since I recommended it to the watchlist in September 2020.

- PerkinElmer Inc. (NYSE: PKI) — A couple of asset management groups recently sold off some part of their stake in PerkinElmer. That pushed the price down a bit, but it has rebounded since last week and is up 20% since it was put on the watchlist in September 2020.

As always, my team and I love the feedback we’re getting on our YouTube channel and through email.

Feel free to send comments, questions and stocks you want us to examine to feedback@moneyandmarkets.com — or leave a comment on YouTube!

Where to Find Us

To watch the Marijuana Market Update before anyone else, just subscribe to our YouTube channel and get an alert when we release a new update.

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.