It’s human nature to chase “moonshot” stocks.

We’re drawn toward volatile opportunities, even if the odds of cashing in are limited.

That’s why so many investors dumped piles of cash into “meme stocks” like GameStop Corp (NYSE: GME) and AMC Entertainment (NYSE: AMC) back in January of 2021 — then again last week.

Practically everyone knew these stocks were a risky investment.

But after seeing share prices soar by double or even triple digits, some decided to invest anyway.

And in both cases, many Main Street investors ended up losing a fortune over the long run.

That’s because one of the core assumptions made by 99% of investors is actually wrong…

Risk = Reward?

Since the 1960s, the capital asset pricing model (CAPM) became to investors what the Bible is to Christians…

It was an unquestionable “North Star” that tied everything in the belief system together. For decades, it upheld its status as finance’s most sacrosanct law, embedding itself deeply into investors’ minds.

Regrettably, CAPM has now been wholly disproven. And it’s led investors like lemmings off a cliff alongside the high-risk stocks they thought would deliver “high expected returns.”

See, the CAPM essentially says there is a positive linear relationship between a stock’s volatility and its expected future return. The more volatile the stock, the higher its expected future return.

Many investors have taken this to mean: “If you want to earn a higher return, you should invest in stocks with higher volatility.”

That’s why traders dove right back into GME and AMC last week.

And why they lost a fortune on regional banks like New York Central Bank (NYSE: NYCB) over the last few years.

These stocks are certainly volatile, but digging deeper reveals that this doesn’t always work in our favor.

Slow and Steady Wins the Race

Dozens of academic studies demonstrate the market-beating premium investors can earn by investing in low-volatility — not high-volatility — stocks.

This directly contradicts CAPM.

And the evidence for this stretches back more than 90 years, so it’s no fleeting anomaly.

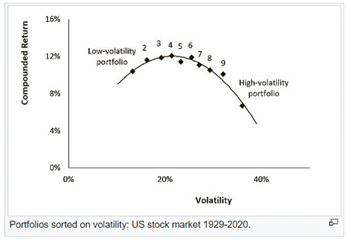

The chart below shows the compound return of low- and high-volatility portfolios from 1929 to 2020.

The existence of this counterintuitive relationship between volatility and expected returns has a few explanations…

For one, most investors have an aversion to using leverage — which is when you borrow money to invest in a position larger than the cash you have on hand.

In the absence of that aversion, it would be rational for an investor to build a portfolio of low-volatility stocks … and then lever it up conservatively so that it matches the return of a higher-volatility portfolio.

But “leverage” is a dirty word to most folks.

Instead, investors who seek higher returns forego that option and invest in stocks with higher volatility — as they did with moonshot stocks like GME or AMC.

How has that played out for those two tickers since last week’s lightning-quick rally?

Shares of AMC are trading 35% lower after peaking last Tuesday at $6.82, and shares of GME have lost almost 60% since last Tuesday’s top!

This is a studied and documented psychological phenomenon…

It’s called the “lottery effect,” and it explains why some investors are so eager to take on a large risk in exchange for a slight chance of making significant returns.

However, as the chart above shows, this strategy simply doesn’t work in the long term.

Keep Things in Perspective

Paid-up Green Zone Fortunes subscribers already know that my team and I consider a stock’s volatility before we recommend it.

In fact, “Volatility” is one of the six factor categories that my Green Zone Power Ratings model is built on.

We don’t always seek stocks with the absolute lowest volatility, but we most certainly avoid stocks with the highest volatilities … since doing so is a consistent and effective strategy for boosting overall returns.

In many market environments, it pays to take on some additional volatility.

This means that a stock that ranks in the middle of the pack in terms of volatility may indeed be worth the risk and outperform some of the lowest-volatility stocks in the market.

That’s precisely the case with the newest addition to my Green Zone Fortunes portfolio, a stock that’s quickly become the darling investment of Wall Street’s biggest Tech Titan…

To good profits,

Adam O’Dell

Chief Investment Strategist, Money & Markets