Anyone who knows me will tell you I have a few loves in life.

One of the biggest … aside from my family … is soccer.

I’ve loved the sport since I was a kid growing up in the Midwest — where the “other” football was more prominent.

It’s great to see the sport grow over the years from random high school and college teams to a significant national league with broad media exposure.

Last week, that exposure hit a fever pitch with the “Greatest of All Time” player joining America’s ranks.

If you already know what I’m talking about, you might not think this news is investable. But, surprisingly, there’s a way to potentially profit from this development.

Today, I’ll tell you why … and show you what our Green Zone Power Ratings system says about one stock in the middle of it all.

The Messi Effect

Growing up as a fan of the global game, I dreamed of playing like Brazilian greats Pelé or Cristiano Ronaldo.

Today’s youth have a different idol, but one who’s no less talented. Many even consider him to be the world’s greatest player: Lionel Messi.

After this year’s World Cup, the Argentinian has achieved everything there is to achieve as a soccer player: league championships, European championships, player of the year and World Cup champion.

His journey for that last accolade captured the hearts of millions around the world … even here in the U.S.

Last week, his journey took another turn when he left the riches of Europe and turned down a billion-dollar deal from Saudi Arabia to play for … U.S. Major League Soccer team Inter Miami.

Messi hasn’t even suited up yet, but the impact of his generational talent was immediately clear:

Ticket prices for MLS games skyrocketed last week to see a player from Rosario, Argentina, play here in the States.

Here in South Florida, ticket prices for Inter Miami shot up more than 1,000% in a matter of minutes.

It speaks to the impact a player the caliber of Messi has (and will have) on soccer here in the United States.

But it wasn’t easy for Inter Miami and MLS to become the epicenter of global soccer overnight…

It took one unexpected company’s involvement to land the deal…

Apple Helps Get Messi to Miami

The allure of playing for David Beckham (a soccer great in his own right and part owner of Inter Miami) likely wasn’t enough to draw a player like Messi to the U.S.

While the precise structure of his deal to play in MLS isn’t fully known, some pieces are. And one includes a publicly traded company that’s all over the news…

A piece of Messi’s deal to play in Miami includes a revenue share with Apple Inc. (Nasdaq: AAPL). This deal is on revenue generated by Apple for its MLS Season Pass subscription service. And Apple owns the exclusive rights to broadcast MLS games through its Apple TV platform.

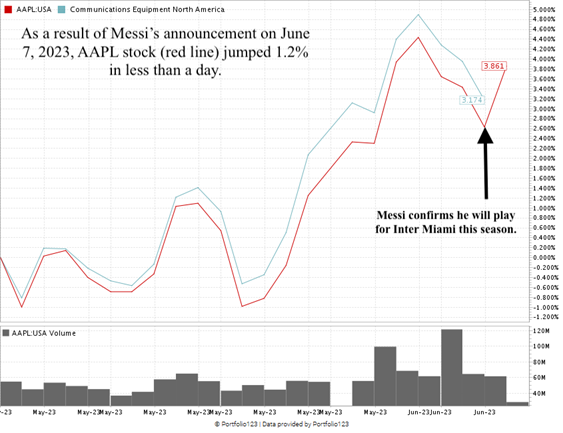

It’s unclear what the percentage is, but it is clear what the impact of bringing Messi to the MLS had on Apple stock:

Created in June 2023.

Despite its product announcements earlier last week, AAPL stock suffered a 1.7% drop from June 2 to June 7.

Following Messi’s announcement to play in MLS (and information leaking about his revenue share deal with the company), AAPL shot up 1.2% in less than a day.

That boost helped the Nasdaq shoot over 1% higher on Thursday (AAPL makes up 12% of the entire index).

But even with this deal, is AAPL a good buy for your portfolio?

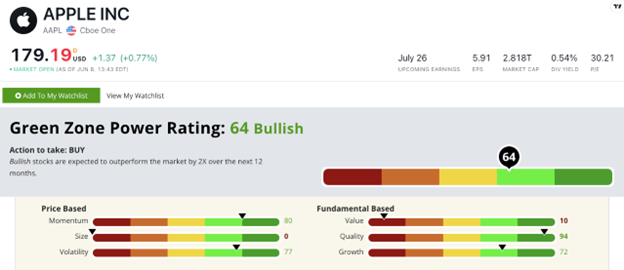

To answer that question, let’s turn to our proprietary Green Zone Power Ratings system to take a deep dive into AAPL:

AAPL Green Zone Power Rating in June 2023.

AAPL rates 64 out of 100 on our system. That means we are “Bullish” on the stock and expect it to outperform the broader market by 2X over the next 12 months.

The stock scores a 94 on our quality factor with returns on assets, equity and investment all higher than its communication equipment peers.

And, aside from its lackluster launch of new virtual reality goggles at its recent developer conference, the stock’s momentum has been solid.

AAPL’s growth is also bullish with a one-year sales growth rate of 7.8% and an earnings-per-share growth rate of 8.9%.

Though, its current price does make it slightly overvalued — its price-to-earnings ratio is 30.2 compared to its peer average of 27.7.

Bottom Line: AAPL was a solid stock even before the deal with Messi became public.

Throwing in the fact that millions of soccer fans worldwide will be clamoring to sign up for its MLS broadcast package just to watch the greatest player in the world tells me there is still room for this stock to run. (Full disclosure: I signed up for the package as soon as Messi’s announcement was verified.)

That is a strong reason to consider AAPL for your portfolio.

Stay Tuned: Dissecting the Blistering Nasdaq Rally

Tomorrow, Adam O’Dell will give you good reason to be cautious of the Nasdaq 100’s huge rally in 2023.

Adam recently proved to his 10X Stocks subscribers that the more than 100% of the Nasdaq’s gains are in the hands of the same old mega-cap tech stocks. But is that enough?

Tune in to see how each of these stocks rates under the Green Zone Power Ratings system, and why you might want to take some chips off the table.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Market