This week, I want to talk about a hot-button topic: Mexico’s pending legalization of cannabis.

This is huge news for the cannabis industry. It will create a massive legal market — almost three times what it was before.

Mexican legalization also impacts cannabis stocks all over the world. And that’s what I want to focus on in today’s Marijuana Market Update.

Check it out below.

Mexico’s Journey to Legal Cannabis

Legalization has been in the works for a while.

In November, Mexico’s Senate of the Republic (upper house) passed a bill to legalize recreational cannabis.

Its Chamber of Deputies (lower house) passed the legislation, with some changes, last week.

Now, the bill will go back to the Senate, where it is likely to be approved and signed into law by Mexico’s President Andres Manuel Lopez Obrador.

In 2015, the Supreme Court in Mexico ruled that prohibiting people from medical cannabis use was unconstitutional. Then, in 2018, the court ruled that the same prohibition on recreational use was also unconstitutional.

After several deadline extensions, the Mexican government has until April 30, 2021, to enact legislation.

Mexico Is a Huge Market

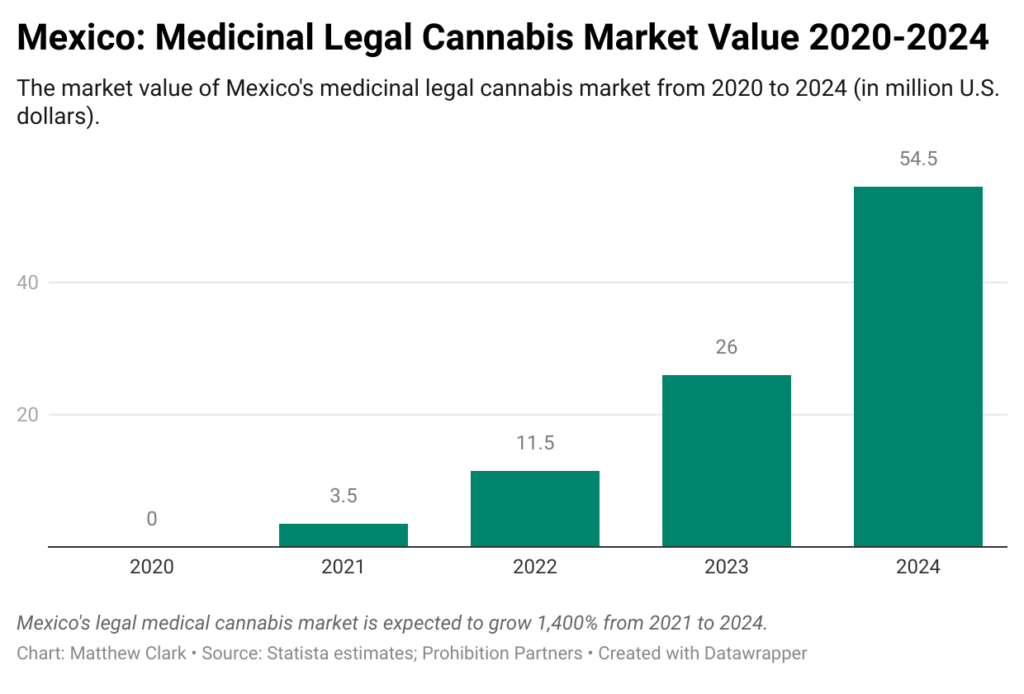

Let’s look at the medicinal side of the Mexican market:

From 2021’s expected market value of $3.5 million to $54.5 million in 2024, there’s a 1,400% jump in the country’s market size.

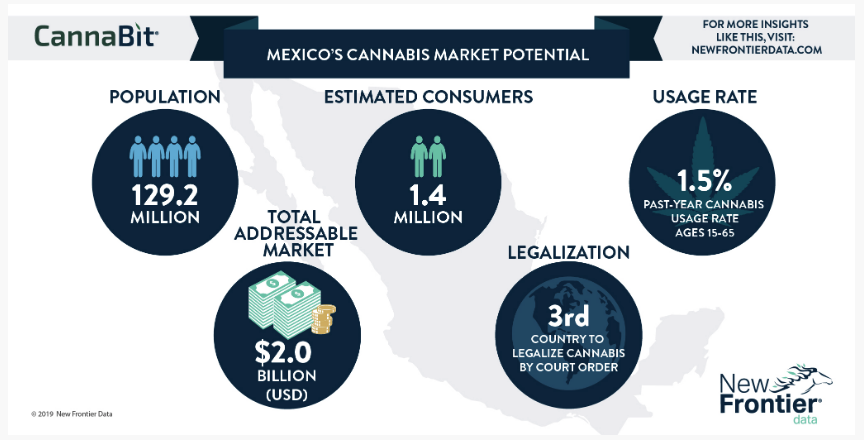

Mexico will become the largest country in the world to legalize cannabis on a national level.

Canada and Uruguay also legalized cannabis. The combined total population of both of those countries is about 41 million people.

The population of Mexico is nearly 130 million people, making it a massive market for legal cannabis.

Mexico will open the doors to 1.4 million customers and reach a total addressable market of $2 billion, according to New Frontier Data.

In the future, the Mexican legal cannabis industry could be worth as much as $3.2 billion.

The bill will open the door for larger cannabis companies to gain an integral license, which would give them access to the market from seed to sale.

Pushback on Legal Cannabis in Mexico

Cannabis legalization isn’t fully supported in Mexico.

In a Politico report, a July 2020 survey found 58% of the Mexican population actually opposed legalization. Only 38% supported it, and the rest were undecided.

Like the U.S., cannabis legalization in Mexico is court-ordered, not voted into law.

Mexico’s precarious path to legalization can provide some insight into the U.S.’s future path to legalization.

When one state legalizes, it has a domino effect on the states around it. For example, when Oregon legalized cannabis in 2014, Washington, California and Nevada legalized recreational use in the following two years.

Back in November, I made a video about five other states that could legalize cannabis in the immediate future because of the November 2020 elections.

I’m skeptical that federal legalization will happen this year, but Mexico could be a tipping point.

Cannabis Watchlist Impacts

Large companies like Canopy Growth Corp. (NYSE: CGC) and the pro forma company of Tilray and Aphria’s merger could stand to benefit as they have the resources to expand into the market.

Cannabis companies with a high percentage of cash on hand compared to liabilities could also try to swing into Mexico.

With that said, let’s look at the Money & Markets Cannabis Watchlist.

Cannabis stocks took a hit before Mexican lawmakers advanced the legalization bill.

Our watchlist continues to perform well as our average total gain is up to 48%.

Here’s a breakdown of our watchlist:

- The Miracle-Gro Co. (NYSE: SMG) — A great quarterly report led by solid sales pushed this fertilizer company’s stock even higher. SMG is up 35% since I recommended it in September 2020.

- Schweitzer-Mauduit International Inc. (NYSE: SWM) — Like SMG, Schweitzer had a strong quarterly report, driving its stock price higher. SWM is now up more than 58% since I added it to the list in September 2000.

- PerkinElmer Inc. (NYSE: PKI) — This stock had me a little worried as it was approaching a break-even point. But the recent run up of cannabis stocks has pushed it back on more solid footing. PKI has moved up more than 6% since September 2020.

- Turning Point Brands Inc. (NYSE: TPB) — This traditional tobacco company has been one of the strongest performers on the list. It’s now up more than 68% since it was added in October.

- GrowGeneration Corp. (Nasdaq: GRWG) — This was the first true cannabis play added to the watchlist, and it hasn’t disappointed. The stock was up as much as 115%. It fell back but has started to storm ahead. GRWG is up 83% since it was added in November.

- Planet 13 Holdings Inc. (OTC: PLNHF) — This is another pure cannabis play that started to dip into negative territory after it was put on the watchlist in January. However, it is back up and going strong. It’s up more than 11% since January.

- High Tide Inc. (OTC: HITIF) — This stock tested resistance around our price paid at $0.63 per share. And it’s still testing those levels at the moment. After Thursday’s close the stock was down a little more than 3%.

Congratulations on your gains! If you followed my watchlist, I’d love to hear about it and how you’re doing. Email me at feedback@moneyandmarkets.com or leave a comment on our YouTube channel.

Where to Find Us

To watch the Marijuana Market Update before anyone else, just subscribe to our YouTube channel and get an alert when we release a new update.

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.