Microsoft just announced it plans to lay off 10,000 employees as the tech exodus continues. What does that mean for Microsoft stock?

Microsoft is one of the most recognizable technology companies in the world and for good reason.

The company has revolutionized the way we use computers, from its early days as a software developer to its current cloud-based services.

With its innovative technologies and strong financial performance, Microsoft could have a strong 2023.

Let’s see what’s on the horizon for MSFT and how Microsoft stock scores within our proprietary stock Power Ratings system.

Microsoft’s Business Model

At its core, Microsoft is a software company that provides a wide range of products and services.

Its flagship product is its Windows operating system, which powers virtually all personal computers worldwide.

It offers a wide range of products outside of its claim to fame:

- Office Suite (Word, Excel, PowerPoint).

- Cloud-based services such as Azure and Teams.

- Video gaming products like Microsoft Xbox and Xbox Game Pass.

- Hardware such as Surface Laptops and HoloLens glasses.

- Artificial intelligence (AI) solutions like Cortana and Dynamics 365.

That’s only a taste of everything Microsoft is involved with.

This diverse portfolio allows it to tap into multiple markets simultaneously while continuing to innovate new products.

Microsoft’s outlook for 2023 looks promising.

The company continues to invest heavily in cloud computing infrastructure with plans to expand its data centers around the world.

Its emphasis on artificial intelligence (AI) initiatives will help it stay ahead of the competition as demand for AI solutions grows exponentially over the next few years.

Furthermore, Microsoft’s investments in gaming have paid off with over 25 million subscribers on Xbox Game Pass as of January 2022 — an impressive feat by any measure!

But has that translated into a good rating for Microsoft stock?

Microsoft Stock Power Ratings

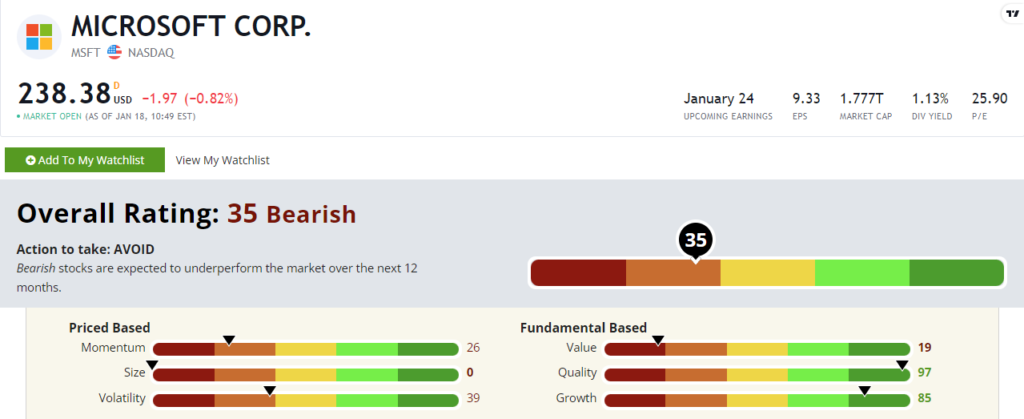

Digging into our Stock Power Ratings system, and you can see that Microsoft stock scores a “Bearish” 35 out of 100. That means the system expects MSFT to underperform the broader market over the next 12 months.

Looking a little closer, I want to focus on Microsoft stock’s size. With a market cap of $1.78 trillion, Microsoft is one of the largest companies trading on the New York Stock Exchange today. Don’t expect a small-cap bump when trading this stock. It rates a lowly 1 out of 100 on our size factor.

Sticking to price factors, Microsoft stock’s price action over the last year explains its low momentum (19) and volatility (40) scores.

MSFT has lost 21% of its value over the last 12 months!

Even still, its price-to-earnings ratio is at 25.6. That’s even higher than the broader Technology Select Sector SPDR Fund (NYSE: XLK), which trades at a 21.9 P/E ratio.

That’s partly why Microsoft stock scores a 16 out of 100 on our value factor.

Bottom line: 2023 could be an exciting year for Microsoft.

But our Stock Power Ratings system says this is one to avoid for now.

What about you? Have you owned MSFT in the past, or do you own it now? Let us know how the stock has performed for you by emailing us at StockPower@MoneyandMarkets.com!