The first six months of 2025 have been a roller coaster.

Between global conflicts and turbulent policy decisions in Washington, D.C., the strength of the market from 2024 has been called into question. But even after a rough start, investors are still broadly bullish as major indexes trade around all-time highs.

Being the first week of July, I thought now was the perfect time to examine the first six months of the year and how the market has performed.

I’ll look at stocks, the U.S. dollar and what to look for in the coming months.

Let’s dive into it…

Stock Market Closes First Half of 2025 On a High

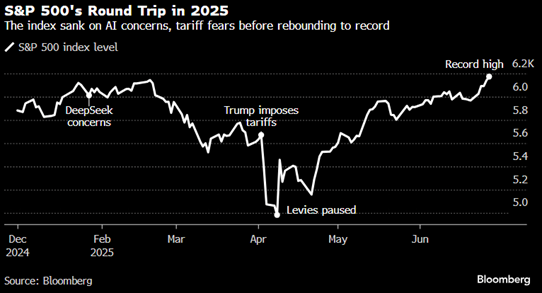

The S&P 500 entered the new year on a bullish run that continued through January.

However, markets came to a screeching halt in February when DeepSeek, a popular generative AI platform in China, claimed it could run large language models cheaper and more efficiently than some of its U.S. counterparts, triggering an AI-driven sell-off.

It called into question the entire global AI infrastructure — the same mega trend that kicked off the bull market when ChatGPT was released to the general public in late 2022.

Then, in April, just as markets were starting to rebound, the Trump administration announced its long-awaited reciprocal tariffs that drove stocks into a tailspin.

From April 3 — the day after Trump’s “Liberation Day” tariff announcement — through April 7, the S&P 500 lost 10.5%, while the Dow Jones Industrial Average fell 9.5%.

It marked the largest two-day loss in market history, with more than $6 trillion wiped out from the markets.

The losses were not contained to just the U.S … global markets fell just as hard.

However, the market reversed course on April 9, when Trump announced a 90-day pause to his reciprocal tariffs and major indexes recorded their largest single-day point gain in history.

In May, further trade developments and talks with China helped the benchmark index turn positive for the year.

That run continued through the end of June, when the S&P 500 and Nasdaq Composite both reached all-time highs. You can see the market’s round trip in the Bloomberg chart below:

In the second quarter of 2025, the S&P 500 posted its largest quarterly percentage gain since the fourth quarter of 2023, and the Nasdaq had its best quarter in five years.

Overall, year-to-date, major stock market indexes in 2025 are showing positive gains:

- The S&P 500 is up 5.6%.

- The Nasdaq is up 4.7%.

- The Dow Jones Industrial Average is up 4.9%.

Now let’s shift gears to the U.S. dollar…

The U.S. Dollar Slumps

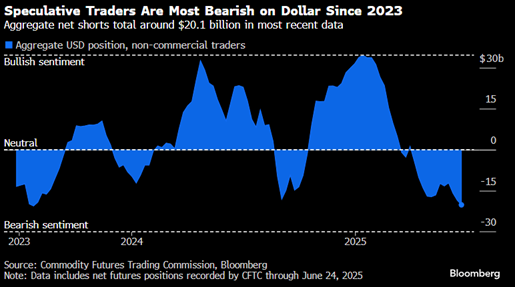

On the last day of the second quarter (June 30), the U.S. dollar fell against a basket of currencies, including the euro, and hovered near three-year lows.

The euro, on the other hand, rose to its highest value in nearly four years.

Persistent recession fears, trade issues and potential tax cuts proposed in President Trump’s “One Big, Beautiful Bill” making its way through Congress have been the biggest reasons for the dollar’s drop this year.

The U.S. Dollar Index posted a six-month losing streak in the first half of 2025, falling 11%.

Global demand for the dollar has weakened as central banks are shifting their reserves to gold and other currencies.

The outlook for the dollar doesn’t look that great either.

According to data compiled from Bloomberg, speculative traders are the most bearish they have been on the dollar since 2023.

Net shorts — where investors’ short positions exceed long positions — on the dollar totaled around $20.1 billion at the end of June.

How do things look as we enter the second half of 2025?

Here’s what’s on my radar…

What to Look for in the Second Half of 2025

Aside from any future Federal Reserve benchmark rate cuts, Wall Street is keeping a sharp eye on July 9.

This is the date the Trump administration has set for countries to reach trade agreements with the U.S. or face tariff consequences.

Those without a deal in place will be hit with significantly higher tariffs than the current 10% level applied to most countries.

Deals have been reached with some countries, but not all of them.

In the coming weeks, we’ll also enter into another cycle of earnings.

The market rally since April has been supported by the corporate resilience shown in the latest quarter’s earnings report.

ICYMI: I do a deep dive into earnings every Friday on What My System Says Today. Check out my latest analysis here.

The danger is that, while earnings were strong in the first quarter of 2025, many companies pulled their full-year forecasts because of weaker consumer sentiment and cost increases due to potential tariffs.

Other things to watch out for in the coming weeks and months:

- Geopolitical instability — Tensions between Israel and Iran have cooled, which has lowered oil prices. This helped calm investors who were worried about how higher oil prices would impact inflation and the path that would allow the Fed to cut interest rates. However, the region remains unstable, and those tensions could reignite at any time.

- Debt — In May, the U.S. lost its last top credit rating as investors remain concerned about growing debt. The latest version of Trump’s tax-and-spend bill moving through Congress is projected to add trillions to the federal deficit over the coming years.

- Valuations — Stocks are already trading at 22 times estimated earnings for the next 12 months, according to Bloomberg. The estimated earnings multiple for the S&P 500 is also above its 10-year average of 18.6.

Despite a wild ride to start 2025, the rally since April isn’t showing many signs of slowing down, especially with the Fed considering its first interest rate cut since December.

However, policy missteps, weaker earnings and growing global instability are things to watch out for.

That’s all from me today.

I’ll be back tomorrow, right before the Fourth of July holiday.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets