People move for all kinds of reasons.

Maybe they’re looking for better weather, different surroundings or, if you’re like me, for a job.

I moved my family from South Carolina to Florida more than five years ago for the opportunity to work with Adam O’Dell and the Money & Markets family.

It wasn’t my first move, but it certainly was the biggest.

Just last year, 8.7% of the U.S. population uprooted and relocated. That’s more than 27.3 million Americans finding new communities.

Today, I’m going to show you relocation trends and highlight one company, using Adam’s proprietary Green Zone Power Ratings system, that’s poised to benefit. Its market-beating momentum is especially strong.

Head South, Young Man…

Those four words best explain the relocation trend in the U.S. over the last two years.

More Americans are moving to the South than any other region in the country:

From 2021 to 2022, Florida, Texas and South Carolina had the largest population increase due to migration.

On the other hand, New York, Illinois and Oregon saw the largest outflow of people.

The reasons for moving vary from wanting a warmer climate, lower taxes, better job opportunities or simply looking for a change of scenery.

But more people means an increased need in services and, perhaps most importantly, more places to live.

Forestar Group Homebuilder Stock Fills the Housing Need

Based in Arlington, Texas, Forestar Group Inc. (NYSE: FOR) is a $1.4 billion company that develops and sells single-family lots to homebuilders.

As of June 30, the company was developing communities in 52 markets across 20 states — including Texas, Florida, South Carolina, Georgia, North Carolina and Tennessee (states with some of the largest population growth).

And that’s created a fantastic opportunity for this homebuilder stock.

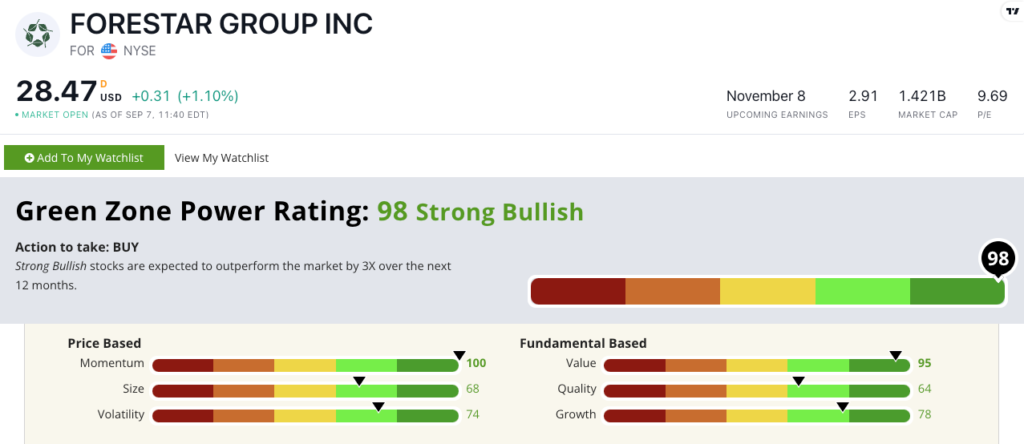

FOR earns 98 out of 100 on our proprietary Green Zone Power Ratings system. That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by 3X over the next 12 months.

It rates in the green on all six of the factors of our system. But I want to pay particular attention to Momentum, where it rates a perfect 100.

The housing market in the U.S. has been anything but robust. With record-breaking interest rates and a lack of existing houses for sale, it’s hard to find an affordable home to buy.

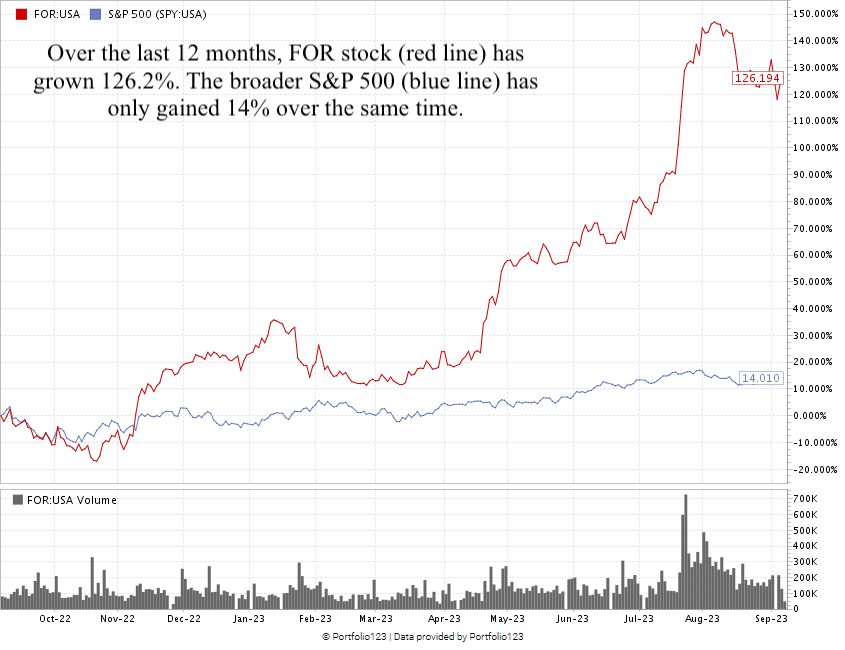

So potential homebuyers are turning to new construction to find their dream homes … and Forestar has reaped the benefits:

Created in September 2023.

As you can see, FOR stock has grown more than 126% over the last 12 months, while the broader S&P 500 has only gained 14%.

FOR shows the “maximum momentum” Adam and I love to see in stocks.

To put a finer point on it, Forestar stock rates 95 on Value with a price-to-earnings ratio more than three times lower than the real estate investment and services industry average.

This tells me that, despite its big run-up in price, the stock remains undervalued compared to its peers and still has room to run higher.

Bottom line: Millions of Americans relocate every year and the trends show they’re moving south.

But they need places to live, which is where Forestar steps in by developing land for single-family homes.

With market-beating momentum and a valuation showing even more future potential, FOR is a compelling potential for your portfolio.

I mentioned wanting to focus on this stock’s momentum, and that’s for a couple of reasons.

You can see what happens when a stock gains momentum as investors jump in and push the stock price higher. And when a stock has strong factor scores in Green Zone Power Ratings, it creates an incredible opportunity like we see with FOR.

I also bring up momentum because Adam is releasing a brand-new way to trade later this month. He’s created a system that’s based on targeting 10 of the highest-quality stocks with healthy momentum each month.

The best part, outside of the back test showing this strategy beat the market by an astonishing 300-to-1 going back to January 1999, is that it only requires about 10 minutes of trade management each month.

He can’t wait to show you more in the coming weeks…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets