Last week saw some sectors sink as investors tried to figure out what’s next on the global trade war front.

The EU and Mexico are back in President Trump’s crosshairs as he announced a 30% tariff starting on August 1. Negotiations seem to be underway to reduce those levies, but it’s clear that this trade strategy is, and will continue to be, core to the Trump administration’s playbook.

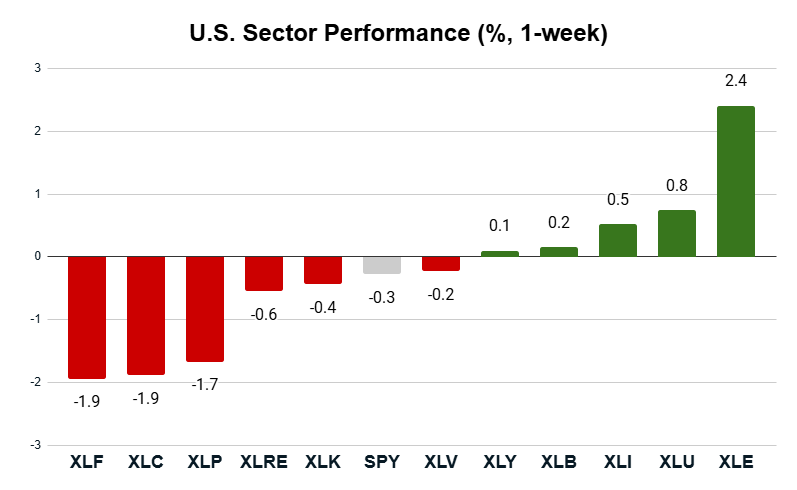

Looking at last week’s sector performance, we can see a real mixed bag of results as investors test the overall health of the bull market:

Key Insights:

- The S&P 500 (SPY) closed the week -0.3% lower.

- The energy sector (XLE) rose 2.4%.

- The financial sector (XLF) and communications sector (XLC) were the worst performers, losing 1.9%.

- Six sectors beat the S&P, while five sectors underperformed.

After being the worst-performing sector two weeks ago, the energy sector (XLE) reversed course and has been on a steady run higher as investors bet on friendlier policy within Trump’s Big Beautiful Bill.” Deregulation should be a boon for U.S. oil and gas companies, and investors have been putting their chips down.

Looking at the worst performers, the financial and communications sectors dragged the broader market lower.

Let’s see what our screen reveals, including how some of these stocks stack up in my Green Zone Power Rating system…

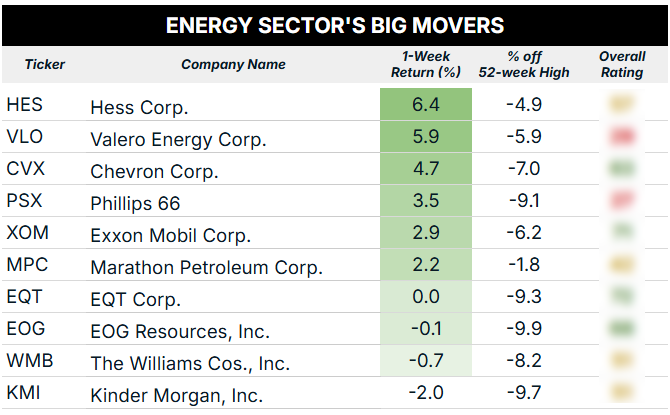

Energy Sector Performance: Top Stocks

After screening for all S&P 500 energy sector stocks that closed last week within 10% of their 52-week highs, here’s how things shook out:

One thing is clear from these “big movers” … investors are betting on Big Oil! The top six stocks in the table above are some of the most prominent oil producers in the U.S., and the other four companies aren’t slouches, either.

But I will note that it’s a real mixed bag when looking at each stock’s overall Green Zone Power Ratings:

- Four stocks rate “Bullish,” which sets them up for 2X outperformance over the next 12 months against the S&P 500.

- Four stocks rate “Neutral,” which means they should track the broader market’s performance.

- Two stocks rate “Bearish,” which points to underperformance.

What’s more, none of the stocks above currently rate “Strong Bullish,” the category that denotes the strongest expected outperformance (3X or more).

That’s not a knock on the sector, just more of a reflection of the sector’s slow recovery in recent years. Investors have looked elsewhere, chasing tech growth, and that approach became especially fruitful when AI was the only game in town.

Now that we’re seeing bullishness broaden out to other sectors, and with friendlier energy policy under Trump, I think the energy sector is one to keep a close eye on in the coming months.

If you’d like to see how we’ve positioned my Green Zone Fortunes model portfolio on this front, click here to see how you can join today. As an added perk, you’ll also gain unlimited access to my Green Zone Power Rating system, so you can look up any of the tickers above to see their complete ratings picture.

Now let’s run last week’s worst-performing sector through my screen…

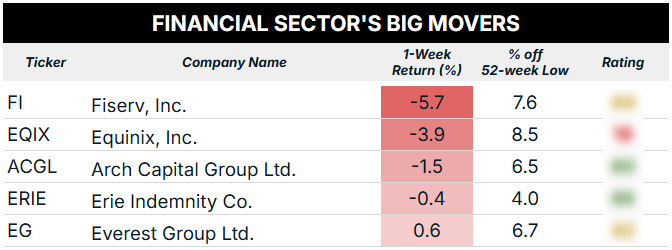

Financial Stocks Lagged

The financial sector (XLF) just barely edged out communications, with both losing roughly 1.9% last week. And the financial stocks below led the charge lower:

As we’re largely “trend-and-momentum” investors, we caution against buying anything that’s closer to its 52-week low than its 52-week high — a concerning feature of each of the stocks above.

Instead, make sure your Green Zone Fortunes subscription is paid-up and you’ll see how two of the last three recommendations we made are financial services companies that are, well, highly rated and trading at their highs!

Otherwise, another earnings season is kicking off this week, and while none of these companies are set to report until later this month (some of the larger firms are), investors will be tracking quarterly calls closely.

As Matt touched on Friday, investors are tuned in to what companies have to say about Trump’s tariff policy and what it means for both the bottom line and future growth. While he continues to seemingly kick the can down the road before massive levies go into effect, no one likes the uncertainty.

Speaking of last week…

Some of you wrote in pointing out a mix-up in Friday’s earnings look-ahead. Thank you for writing in! I’ve attached the correct “bearish” earnings table below so you can be ready for when these quarterly numbers drop this week:

To good profits,

Editor, What My System Says Today