Times during the pandemic felt hopeless.

There was uncertainty that things would go back to normal.

Then came the vaccine research. Pfizer, Moderna and Johnson & Johnson got to work.

Celebrities were coming out of the woodwork to help fund the research.

Even Dolly Parton announced she was a significant funder of the Moderna research for the vaccine.

Things aren’t quite back to normal yet, but it looks a lot less bleak because of the vaccines.

Especially for Moderna’s stock.

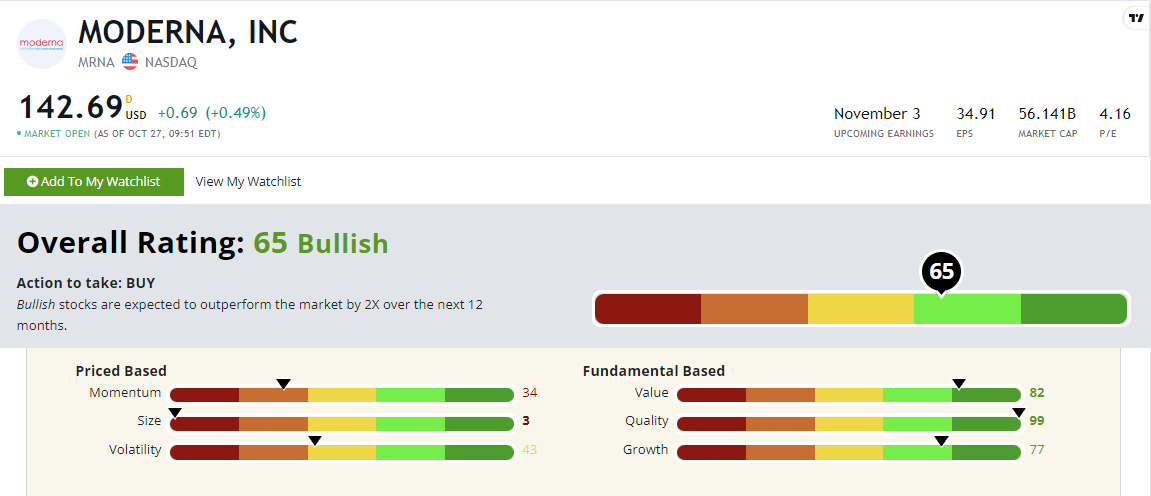

Moderna Inc. (Nasdaq: MRNA) rates a “Bullish” 65 out of 100 on our proprietary Stock Power Ratings system.

Moderna’s Future of Vaccines

While Pfizer plans to raise its prices as coronavirus vaccine demand slows down, Moderna is preparing for the next biological threat.

Moderna is close to finalizing a deal with the U.S. Department of Defense to produce vaccines to target diseases such as Ebola.

After the deadly virus spawned an outbreak in Uganda in September, Moderna didn’t waste a moment before getting into action.

Moderna targets the virus with the same mRNA (messenger ribonucleic acid) technology used to develop the COVID-19 vaccine.

However, multiple sources state that it is doubtful that an Ebola vaccine will be ready in time to address the cases in Uganda.

On top of its work on Ebola, company executives announced its commitment to advancing the clinical studies of 15 vaccine programs to target neglected infectious diseases by 2025.

Moderna’s future looks bright regarding finding vaccines for biological threats thrown our way.

But it has some shining moments now as a “Bullish” stock.

Let’s see how MRNA stock rates in our system.

Moderna Stock Power Ratings and Quality

Moderna has outstanding quality that I’ll dive into in just a second. But first, let’s look at its overall rating.

MRNA’s Stock Power Ratings in October 2022.

Moderna rates an overall 65 out of 100.

On three out of our six metrics, Moderna rates in the green, including solid value (82) and growth (77) factor scores.

The highest quality companies on our ratings system generate consistent positive earnings and cash flows.

We look at their returns on assets, equity and invested capital and more to generate our quality score.

By ensuring its debt ratios aren’t too large and its cash flow is intact, we can tell a stock is high quality.

Moderna has everything I’ve mentioned above, and what all of this means is that the stock is making money.

This all earns Moderna a 99 on our quality metric.

The Bottom Line

Moderna scores a “Bullish” 65 out of 100 on our Stock Power Ratings system.

We expect it to beat the broader market by 3X in the next 12 months!

But we have more in store.

To get one highly rated stock you should consider investing in, check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock to buy or avoid on our system and tells you why — for free!