You know me. I’m the “income guy.” While I like profitable stock trading, I love getting my dividend checks each quarter.

As a general rule, high-yielding dividend stocks aren’t known to rip higher. But Iron Mountain Inc. (NYSE: IRM), the secure document storage and shredding real estate investment trust (REIT), is doing exactly that. It’s a high-income stock with a dividend yield of 5.5%. But it’s also a high-momentum stock that’s up more than 55% in 2021.

My colleague and Money & Markets chief investment strategist Adam O’Dell specializes in momentum-based investing.

Adam likes to reference the great physicist Sir Isaac Newton’s first law, that Stocks that are trending higher attract the attention of investors, who then, in turn, push it higher, creating a virtuous cycle. It can persist a lot longer than you might think.

Why Iron Mountain Stock Is Going Up

So, what’s driving Iron Mountain’s momentum these days?

It’s a combination of a couple of things. The company has a high yield and a conservative business model. Its primary business is storing boxes of documents in warehouses, for crying out loud. With the economy looking a little rickety, the stability of this business model is wildly attractive.

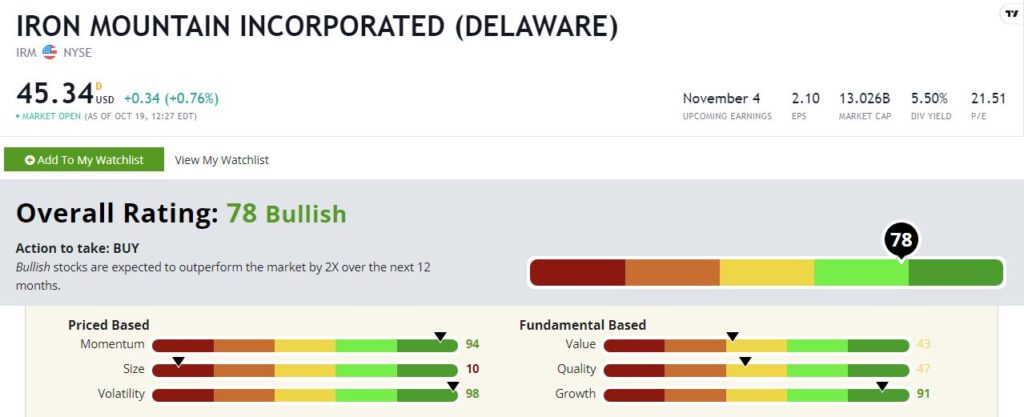

Iron Mountain rates a “Bullish” 78 on our Green Zone Ratings model.

Iron Mountain Inc.’s Green Zone Rating on October 20, 2021.

Let’s see how the individual factors stack up for IRM.

Dividend Stock With Low Volatility AND Momentum

Volatility — Iron Mountain’s business is about as steady as it gets. Once companies commit to document storage, the decision has been made. The documents won’t be going anywhere for years … even decades. They’re going to sit in a warehouse out of sight and out of mind until they’re needed. We shouldn’t expect to see a lot of revenue and earnings swings from quarter to quarter.

Not surprisingly, Iron Mountain’s stock is as low-vol as its underlying business. The company rates a 98 on our volatility factor, meaning it’s less volatile than 98% of the stocks in our universe. That’s the kind of stability I like to see in a dividend payer.

Momentum — Yet, lack of volatility does not mean lack of returns. Iron Mountain also rates in the highest tier on our momentum factor with a rating of 94. The shares are up by more than 50% this year, and this followed a strong recovery from the pandemic lows in 2020. We can’t predict the future, but given how starved investors are for yield these days, I wouldn’t be surprised to see IRM’s maximum momentum continuing for a while longer.

Growth — Iron Mountain rates a very nice 91 on growth. That’s fantastic for a low-vol stock with a sleep-at-night business model. The driver here is earnings per share. While revenue growth has been decent, it’s subfactor ratings on revenue growth place it in the middle of the pack at 57. But its earnings growth has been at the top of the charts with a subfactor rating over 99. Some of this is due to leverage, of course, and that takes us to the next factor.

Quality — Iron Mountain quality rating of 47 puts it in the middle of the pack. Remember, REITs tend to rate lower on this score. Our factor rating rewards low-debt companies with high profit margins, and most REITs come with high debt and profit margins skewed by the quirky accounting of the sector. Iron Mountain’s high debt in particular causes it to lose points here. That’s not a deal breaker. Given the predictability of its cash flows due to its long-term contracts with its customers, Iron Mountain should have no issue servicing those debts well into the future.

Value — REITs also tend to rate in the lower half on value for the same reasons they rate poorly on quality. When you compare the price to earnings (or other traditional metrics) REITs often look expensive because their earnings are artificially depressed by high depreciation and other non-cash expenses. Still, Iron Mountain’s 43 here isn’t terrible. It’s not far from average even with its handicap.

Size — Alas, Iron Mountain isn’t small. It’s a large $12 billion market cap REIT, and it rates a 10 on our size factor. While the REIT has a lot going for it, it’s a little too large to be undiscovered.

Bottom line: It’s rare to find a dividend payer with momentum pushing its stock price higher in a short amount of time. Iron Mountain stock fits that bill, and its business model lends itself to more growth in the future.

P.S. Live on November 4, my colleague Adam O’Dell will reveal how millions of new investors have accidentally opened a perfect trading window, and the system he designed to exploit this anomaly for massive gains. To sign up for the live event, go here.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.