Looking at official data, it appears that the economy has fully recovered from the shutdown. Gross Domestic Product (GDP), a broad measure of economic recovery, is at an all-time high.

Looking a little deeper, there are questions about whether or not the recovery is sustainable. The chart below shows that the economy would be faltering without government support.

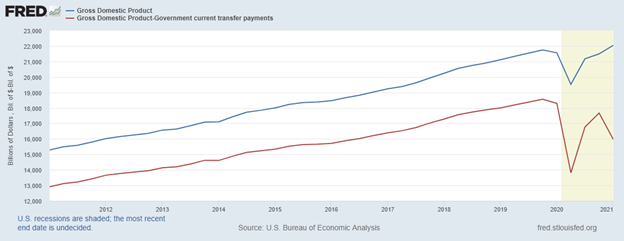

GDP Without Government Support Shows Money Velocity Problem

Velocity Suggests Economic Contraction Is Severe

In the chart, the blue line is GDP as reported. The red line subtracts government transfer payments from GDP.

Government transfer payments are defined as “payments for which no current services are performed and are a component of personal income.”

Transfer payments include Social Security retirement and disability benefits, unemployment compensation, along with other retirement checks and other payments.

There are always some government transfer payments moving through the economy. Stimulus payments and extended unemployment compensation significantly increased the dollar amount of transfer payments.

When transfer payments are removed from GDP, the data shows the economy contracted in the most recent quarter. This decline came even as the most recent stimulus payments were being pushed to consumers.

The chart above highlights the possibility that the economy recovered solely because of government payments.

This simple analysis understates the degree of the problem. Every dollar spent in the economy generally increases the value of GDP by more than a dollar. This is known as the velocity of money.

Velocity measures how many times each dollar of the money supply is spent. When velocity is considered, the contraction in economic activity without government support is even more severe.

Looking ahead, the economy might be forced to stand on its own. Prospects for additional stimulus are low. Many governors are withdrawing the extended unemployment compensation benefits to increase employment.

Without high levels of government transfer payments, growth will depend on private sector growth being able to offset the withdrawal of government support. Time will tell if that can happen.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.