Moody’s may be a little busier than usual as companies deal with a more bearish economic outlook. Does that bode well for Moody’s stock?

Founded in 1909, Moody’s Corp. (NYSE: MCO) is a global provider of credit ratings, research and risk analysis.

Over the past 113 years, the company has gone from strength to strength, becoming one of the most trusted sources of financial data in the world.

But what does the future hold for Moody’s stock?

In this blog post, we’ll take a look at where they are now and what investors can expect from the firm in 2023. We’ll also run MCO through our proprietary Stock Power Ratings system.

Moody’s Today

Moody’s is currently divided into two divisions:

- Moody’s Analytics provides software solutions and analytics to organizations around the world.

- Moody’s Investors Service issues ratings on bonds.

Both divisions grew through 2021, but that growth has slowed recently.

In the third quarter of 2022, Moody’s reported total revenue of $1.27 billion. That was lower than the previous quarter’s $1.38 billion — and a 16.45% decrease year over year.

We’ll see if that trend continues when Moody’s reports fourth-quarter numbers next week.

That reports should provide guidance for Moody’s stock throughout the rest of 2023.

Future Growth Strategies

In order to try to ramp up growth in 2023, Moody’s plans on investing heavily into new technologies such as artificial intelligence and machine learning.

This will allow it to better analyze data sets more quickly than ever before, giving it a competitive edge over other firms that are not investing in these technologies.

Moody’s also plans on expanding into new markets such as China where it can leverage its existing relationships with local government officials and financial organizations.

Lastly, it will continue its focus on developing innovative products that address customer needs while also staying ahead of regulatory changes in different countries around the world.

Is that enough to help Moody’s stock outperform in 2023?

Let’s see what our proprietary Stock Power Ratings system says.

Moody’s Stock Power Ratings

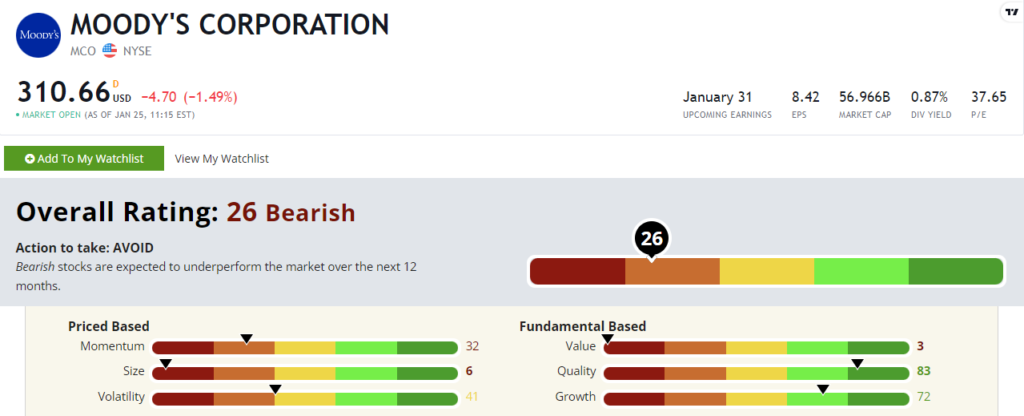

Moody’s stock rates a “Bearish” 26 out of 100. That means our system expects the stock to underperform the broader market over the next 12 months!

Moody’s total revenue was growing at a good clip through 2021. Between 2015 and 2021, it reported annual revenue growth between 3.44% in 2016 to a massive 15.77% in 2021.

Even with weaker revenue last year, Moody’s had established years of upward movement. That’s why it scores a 72 out of 100 on our growth factor.

You see, our system looks at various factors across many spans of time. Years of fantastic growth are enough to offset one bad year.

But this a big company with a market cap of almost $59 billion as I write. That’s why it scores a 6 on size. And that’s also why we shouldn’t expect a small-cap bump to its share price.

Bottom Line: Moody’s Corporation has been a stalwart of financial services since 1909 but it has never been more relevant than it is today.

But our Stock Power Ratings system says that Moody’s stock is one to avoid as it underperforms the broader market.