The U.S. economy is “deteriorating” amid renewed trade tensions between the U.S. and China, putting profits and economic growth at risk, Morgan Stanley warned Tuesday.

“Recent data points suggest U.S. earnings and economic risk is greater than most investors may think,” Morgan Stanley Chief U.S. Equity Strategist Michael Wilson wrote in a note to clients.

The note pointed to a recent survey by a financial data firm, IHS Markit, that shows manufacturing activity dipped to a nine-year low during May, and revealed a “notable slowdown” in the services sector, which is a key area for an economy highlighted by job gains in health care and business services.

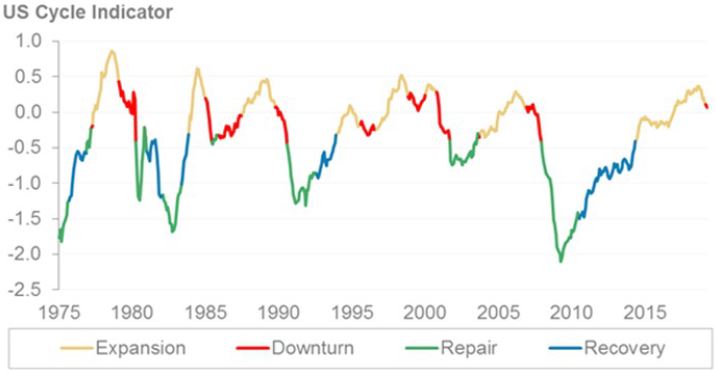

Morgan Stanley Cross Asset Research

The most recent reports reflect April’s data, “which means it weakened before the re-escalation of trade tensions,” Wilson added. “In addition, numerous leading companies may be starting to throw in the towel on the second half rebound — something we have been expecting but we believe many investors are not.”

Wilson was one of the more bearish strategists in 2018, defending his initial S&P 500 call of 2,750 by year’s end without adjusting it while the market roared to record highs in September before the fourth-quarter collapse that culminated in the worst December since 1931.

By the end of the year, his call was the most accurate of the year, according to CNBC.

His call for 2019 has been gloomy, often warning that we could be caught in a rolling bear market for the next several years. However, the S&P 500 is up nearly 12% on the year, and the Dow is up nearly nearly 9% as of the closing bell Tuesday.

However, many economists are predicting a slowdown for the second half of the year, and Morgan Stanley’s have lowered their second-quarter GDP forecast from 1% to just 0.6% a week after JPMorgan’s slashed their projection from 2.25% to just 1%.

“The April durable goods report was bad, particularly the details relating to capital goods orders and shipments. Coming on the heels of last week’s crummy April retail sales report, it suggests second quarter activity growth is sharply downshifting from the first quarter pace,” they wrote.

A number of companies like John Deere and Polaris Industries have warned the White House how the ongoing trade war with China will affect their bottom lines. While the number of companies that are publicly opposed the trade war is relatively small at this point, that number is sure to grow the long the trade war goes on.

“Regular readers are likely familiar with our view that the U.S. economy is vulnerable to a more significant slowdown due to overheating last year from the fiscal stimulus,” Wilson wrote. “This led to labor cost pressures for corporations, excessive inventories and an overzealous capex cycle that is now reverting to the mean, which means well below trend spending for several quarters.”

Market risks have been reflected in the bond market, Wilson said, pointing toward the inversion of the 10-year and 3-month Treasury yields, which is generally considered a sign of impending recession.

On Tuesday, the curve flattened further as the 3-month returns yielded 2.361% while the 10-year note yielded 2.266%.

Some point to the lingering effects of the Federal Reserve’s quantitative easing affecting the curve, but Morgan Stanley says the data reveals a “much different picture.”

Morgan Stanley says the curve inverted in November and has been negative ever since.

“The adjusted yield curve inverted last November and has remained in negative territory ever since, surpassing the minimum time required for a valid meaningful economic slowdown signal,” Wilson wrote. “It also suggests the ‘shot clock’ started 6 months ago, putting us ‘in the zone’ for a recession watch.”