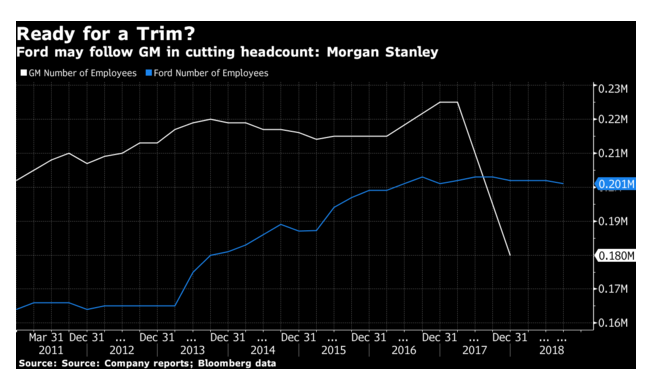

If you thought GM slashing 14,000 jobs and closing up to five plants in North America was bad, wait till you see what Ford does.

At least that’s what Morgan Stanley is saying in a prediction of sorts will happen when Ford Motor Co. finishes an $11 billion restructuring that could cost 25,000 employees their jobs.

Ford has yet to detail any of its plans, and the 25,000 figure is a prediction by Morgan Stanley analyst Adam Jonas.

Per Bloomberg:

“We estimate a large portion of Ford’s restructuring actions will be focused on Ford Europe, a business we currently value at negative $7 billion,” Jonas wrote. “But we also expect a significant restructuring effort in North America, involving significant numbers of both salaried and hourly UAW and CAW workers.”

Ford reportedly has told it’s 70,000 salaried employees they will face unspecified job losses by mid-2019 in what the company is calling an “organization redesign” aimed a creating a white-collar work workforce “designed for speed” says company spokeswoman Karen Hampton

It’s hard to type that sentence while simultaneously rolling your eyes. “Organization redesign” is simply a kinder way of saying “layoffs,” and anytime a company says they are restructuring to be more efficient, like “designed for speed,” it simply means there will be less people doing more work, hence more efficiency — and cost savings for the employer.

“These actions will come largely outside of North America,” Hampton said of Ford’s restructuring. “All of this work is ongoing and publishing a job-reduction figure at this point would be pure speculation.”

Ford also is cutting shifts at two U.S. plants in the spring and moving workers to plants that building SUVs and transmissions for pick-up trucks in moves the automaker says won’t result in job losses.

Jonas said other car companies will be forced to follow the lead of GM and Ford as the industry transforms by first jettisoning factories that build the slower-selling sedans to ultimately result in building more electric and autonomous cars.

“We believe existential business model risk will be prioritized over near-term profits and cash return,” Jonas wrote. “We still do not believe investor expectations have fully considered the near-term earnings risk.”