When someone brings up Goldman Sachs Group Inc. (NYSE: GS) or Morgan Stanley (NYSE: MS) I like to imagine a James Bond villain stroking a cat in a dark board room.

But what do these banks actually do? They are organized as commercial banks, but most of their revenue does not come from lending.

Today’s Investing With Charles lifts the veil on their business models, and, more importantly, helps you decide if these are stocks worth investing in.

Here are some highlights from my conversation with Money & Markets research analyst Matt Clark:

How Do Goldman Sachs and Morgan Stanley Keep the Lights On?

Charles: Morgan Stanley and Goldman Sachs are more transaction-based in the sense that they serve as a prime broker for hedge funds, mutual funds and big institutional investors. These investors that are dealing with huge sums of money don’t go to their E-Trade account or their TD Ameritrade account when they want to buy or sell something. They go to Goldman or Morgan Stanley to help them execute their trades.

Goldman and Morgan Stanley are also investment bankers that help bring stocks to the public. When a stock starts trading on the New York Stock Exchange or Nasdaq, an investment bank pushes it along that process and helps it go public through an initial public offering (IPO).

They also help companies issue bonds, and they have in-house wealth management and asset management arms.

That’s what these guys do. It’s quite a bit different than what Citi and Bank of America do.

Matt: Yeah. They don’t really issue credit cards, and you can’t get checks from them. These are very large financial institutions that act as intermediaries for institutional investors and venture capitalists in complex business transactions.

That’s a simplistic way of looking at it.

But I want to focus on Goldman and Morgan Stanley’s equity investment arms. These teams handle investing in equity for third parties, for big institutional investors, companies and even governments.

Charles: The big boys.

Matt: Yeah. And they make their money on these trades, based on fees they charge that are typically based on volume. For example, if Charles and I run a venture capital company and we want to invest $10 million in ticker ABC, we would go to Goldman Sachs or Morgan Stanley and we’d say: “Can you execute this deal for us?”

And then they will come back and say: “Yes, we can. We are going to charge you X percent of a fee.” And then that’s how they make revenue on this particular arm.

How Morgan Stanley and Goldman Sachs’ Investments Have Paid Off

Matt: Morgan Stanley has led for several of the last quarters when it comes to revenue based on their equity trading service. That was until this latest quarter when Goldman took the lead after it reported $3.1 billion in equity trading fees. Morgan Stanley reported $2.9 billion.

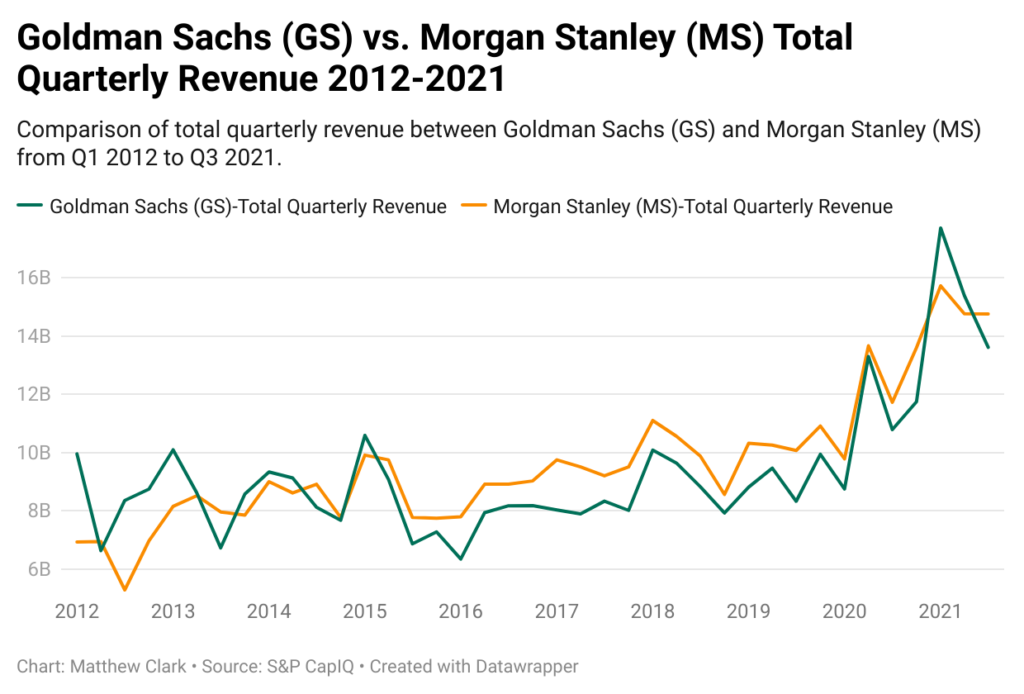

Looking at the last 10 years, there are instances where Goldman Sachs had higher quarterly revenue, but Morgan Stanley has led the pack slightly. You can see in the chart above that these two entities move in lockstep for the most part.

Should You Buy a Big Bank Stock?

Charles: Think about the market over the last several years. It’s been a raging bull market. So it does make sense that as more people want access to equities, that means you and I are putting our money in funds. Those funds are going to Goldman Sachs and Morgan Stanley. They’re going to them to execute their trades.

So, the more the collective public invests, the more demand it creates for the services of these banks. You and I aren’t doing business directly with them, generally speaking, but our interest in equities flows through to them.

Now, interestingly enough, the most volatile part of their business is investment banking. Investment banking is feast or famine. You’ll have a wave of IPOs, all at once, where fees are going nuts.

And that’s when the champagne corks fly, and that’s when these banks make some real money.

The IPO market has been hot, but it has bypassed the banks. Through investment vehicles like special purpose acquisition companies (SPACs).

The big banks find a way to make money, no matter what. These guys are good at anything. They get their little fingers into every deal and make a little bit of money. But going public via SPAC, or just staying private, has held back investment banking revenues to some extent. It’s one of the reasons they’ve gone heavier into equities.

How MS and GS Have Performed

Matt: Let’s look at the stock chart for both of these companies.

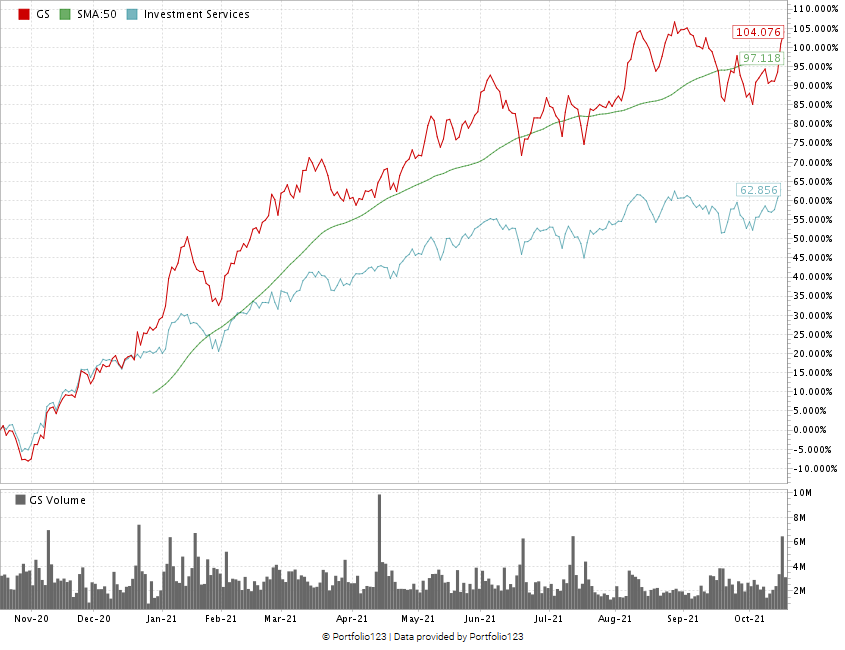

Goldman Has Had a Great 12 Months

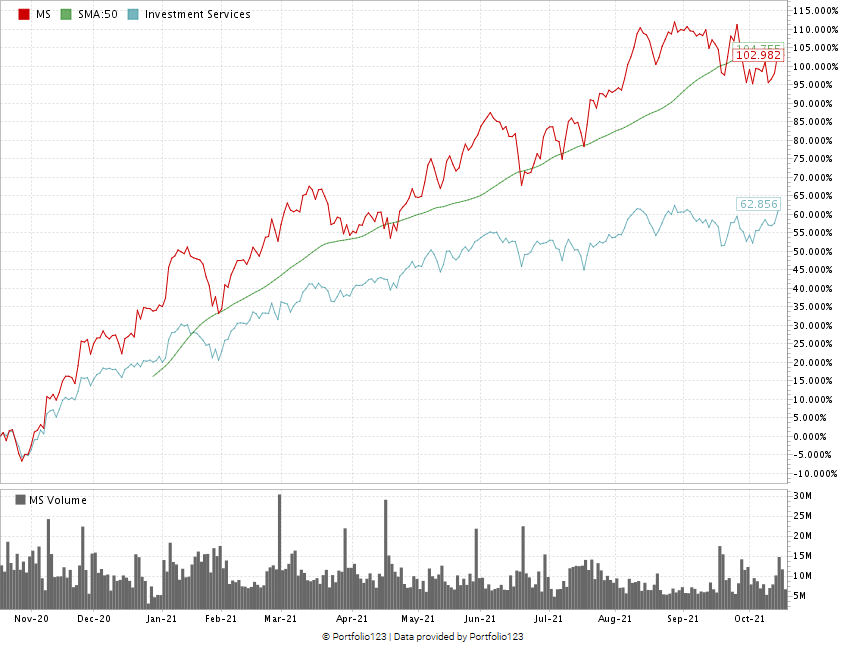

MS Is up More Than 100% as Well

First off, both of these stocks have seen a significant upward trajectory in the last 12 months. Goldman Sachs has gained about a 104% in its stock price from this time last year. It is trading at about 11% above its 50-day moving average. And it is nearly double what the investment services sector average gain is, which is around 60%.

Morgan Stanley is also up about 103%. So you’re only looking at about a 1% difference in terms of stock returns. Both of these stocks‘ movements are very similar.

Charles: And that makes sense. What’s good for one is generally good for the other. If macro conditions are good, if investors see a good environment for Goldman, they’re going to see a good environment for Morgan Stanley as well. So it does make sense that they move together.

There are subtle differences in their business compositions, though, but both of these banks are in the same lines of work. Their products and services overlap.

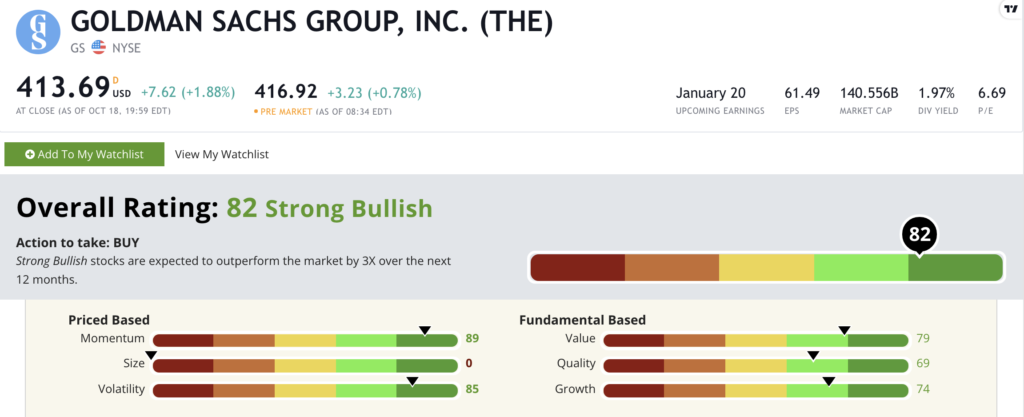

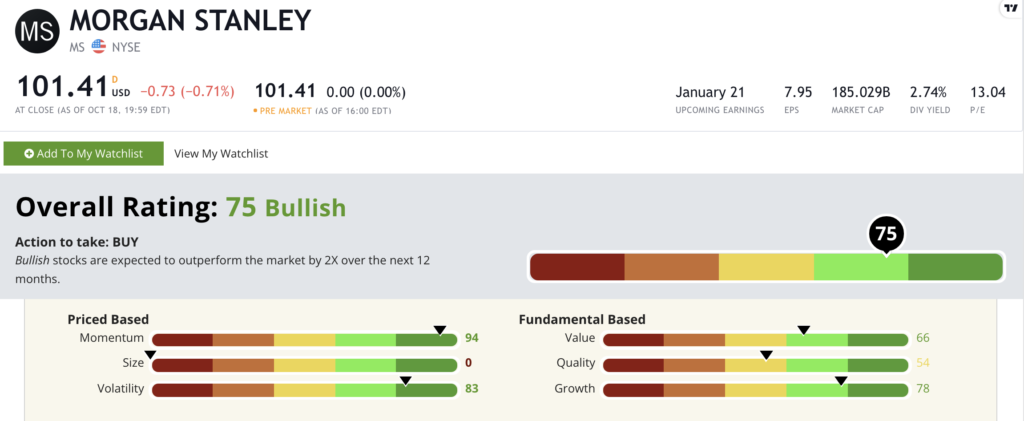

Green Zone Ratings for Morgan Stanley and Goldman Sachs

Matt: The last thing I want to look at is each stock’s Green Zone Rating, which anyone can access by going to MoneyandMarkets.com. We’ve got a little search bar towards the top of the homepage.

You just type in any ticker or company and find that stock’s Green Zone Ratings based on six factors. Charles, Adam and I use this system on a daily basis when we are looking at stocks.

Here’s how these two companies rate:

Goldman Sachs Group Inc.’s Green Zone Rating on October 20, 2021.

Morgan Stanley’s Green Zone Rating on October 20, 2021.

Charles: Both of these companies look solid based on Green Zone Ratings.

To find out more about each of these stock’s factor ratings, and see which big bank stock Matt and I think is a better buy right now, watch the rest of Investing With Charles here.

Where to Find Us

Coming up this week, Matt will have more on The Bull & The Bear podcast, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where chief investment strategist Adam O’Dell answers your questions.

You can also catch Matt every week on his Marijuana Market Update. If you are into cannabis investing, you don’t want to miss Matt’s weekly insights.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you! We may even feature your question or comment in a future edition of Investing With Charles.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.