In the latest Marijuana Market Update, I answer a viewer question about a cannabis stock we’ve discussed before: Green Thumb Industries Inc. (OTC: GTBIF).

Watch it below.

Green Thumb Cannabis Stock Sinks

Sally emailed us this question:

Hi, Matt! Thank you for the good Marijuana Market Updates! I look forward to them. Here’s a question: What is happening to Green Thumb at the moment? Is it being shorted? Do you see it remaining somewhat stable? Thanks so much. — Sally.

I appreciate the question, Sally!

Now, about Green Thumb…

Based in Illinois, Green Thumb Industries Inc. (OTC: GTBIF) produces cannabis flower along with processed and packaged products, including concentrates, edibles and topical solutions.

It offers products under the brands Rhythm, Dogwalkers, The Feel Collection, Dr. Solomons and Beboe.

The company has 55 retail stores in the United States and also distributes its products to third-party retailers.

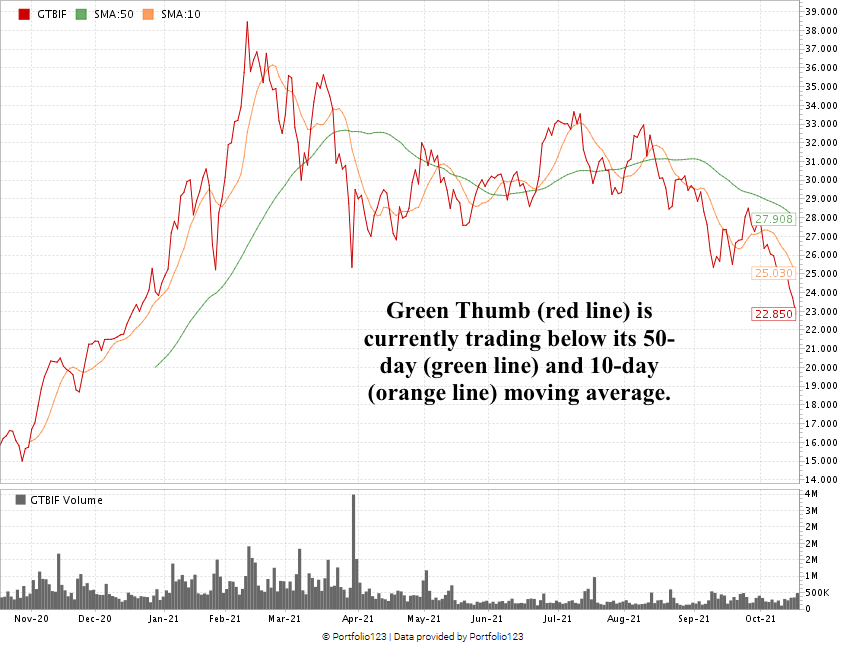

We can take a look at its stock chart first:

In mid-February, the stock hit a 52-week high of $38.45 per share. After that, shares started their downward movement.

By April, the stock lost 34% as it dipped below $26 per share.

Over the next few months, Green Thumb bounced between $27 and $33. The wild volatility wasn’t unique to Green Thumb. The broader cannabis market felt pressure as legalization discussion in the U.S. cooled along with broader banking reform.

After testing some resistance at the $33 level in August, the stock turned south in a hurry. It now trades around 40% below its 52-week high.

Green Thumb Earnings

What’s interesting is that Green Thumb’s stock suffered a 5% drop when it reported its quarterly earnings in August.

The company reported earnings per share of $0.10 on revenue of $221.87 million. Both numbers beat Wall Street expectations. Analysts projected earnings of $0.08 per share on revenue of around $206 million.

This was the 10th straight quarter in which Green Thumb beat expectations.

But the stock still fell.

This wasn’t the first time Green Thumb reported positive earnings but suffered a loss in stock price.

In its previous quarterly earnings report, the company beat revenue expectations by 4% after top-line revenue rose 90% year-over-year.

The stock fell more than 3% the next day.

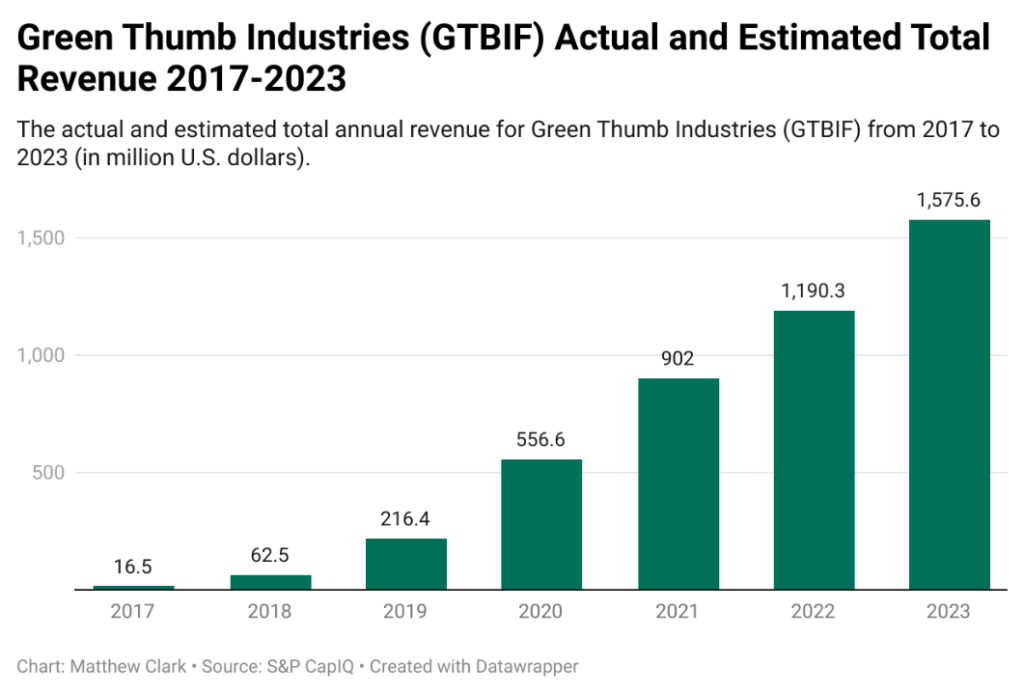

We can look at just revenue projections into the coming years and see that the future looks bright for Green Thumb.

In 2020, the company closed out the year with revenues of $556.6 million. That’s a 3,273% increase over its $16.5 million in revenue it reported in 2017.

But as you can see, the growth doesn’t stop there.

By 2023, Green Thumb expects its top-line revenue to hit $1.57 billion — a 183% jump from 2020 and 9,450% higher than 2017.

Those are massive growth numbers.

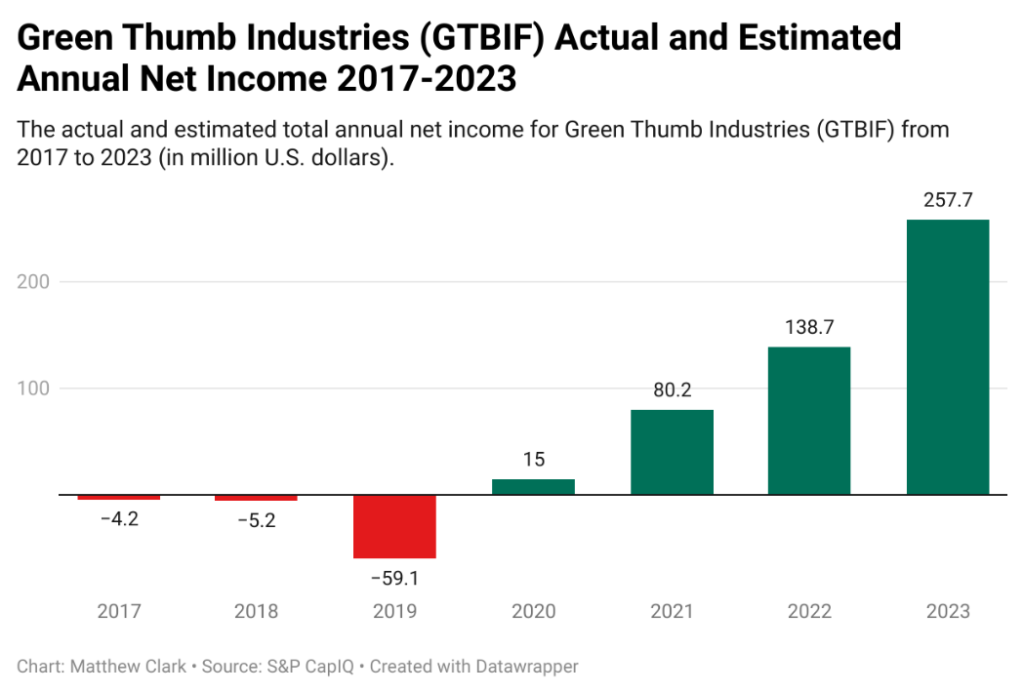

Its net income tells a similar story.

From 2017 to 2019, Green Thumb brought in more money but lost more net income.

Because cannabis companies don’t have access to the same capital that traditional businesses do — like revolving credit lines — expansion and operations for Green Thumb didn’t count toward those total revenues.

This is the primary reason cannabis companies lose money on a regular basis: They have to reinvest the money they make.

As you can see, in 2020, Green Thumb started to turn its net income positive. By the end of this year, it expects net income to grow to $80.2 million — a 435% jump from last year.

By 2023, Green Thumb expects a net income of more than $257 million — 1,618% higher than last year.

All of this suggests Green Thumb’s future is bright.

What Sank GTBIF Stock?

So why is the stock sinking?

For one, we have a value issue.

Even with the recent drop in price, Green Thumb stock trades with a price-to-sales ratio of 76.45. This is nearly three times higher than the 25.19 ratio average for the rest of the agriculture industry.

Its price-to-sales ratio for the next 12 months is 4.94, which is nearly double the 2.95 ratio for the industry.

Green Thumb trades with a price-to-cash flow ratio of 32.35 compared to the industry average of 24.87. Its price-to-book ratio is 4.19, while the agriculture industry average is 2.

So, Green Thumb is not just overvalued — it’s overvalued compared to its industry peers.

This creates sell pressure for investors.

Green Thumb Stock Rating

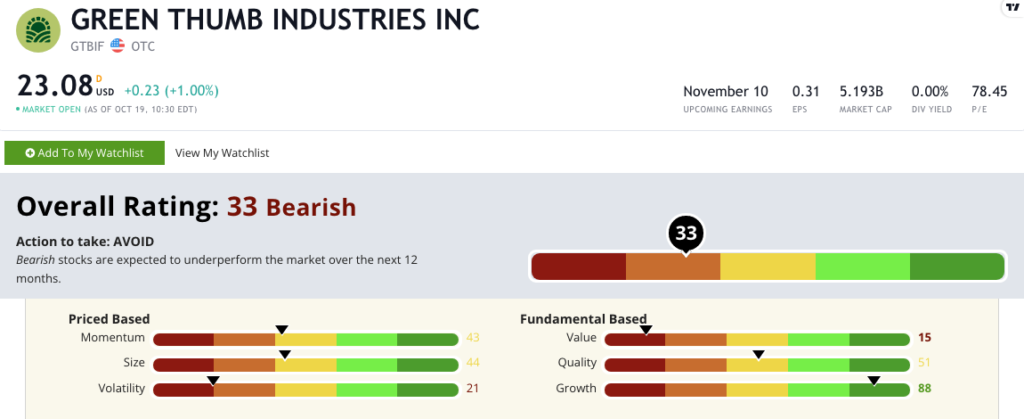

I ran Green Thumb’s stock through chief investment strategist Adam O’Dell’s proprietary Green Zone Ratings system.

He built this model to rate stocks on the six factors proven to drive market-beating returns.

Our team runs this model daily on a universe of more than 8,000 stocks and rank based on “Overall Rating.” These ratings range from 0 to 100, where 0 is “worst” and 100 is “best.”

You can see that GTBIF rates high on growth, at 88, but low in the other five factors, including value (15) and volatility (21).

Green Thumb Industries Inc.’s Green Zone Rating on October 19, 2021.

Now, remember that cannabis stock ratings are subjective because of the nature of their operations. However, this can give you a glimpse into how a stock might perform compared to the rest of the market.

You can access the Green Zone Ratings of any stock we rate for free on our homepage.

Sally also asked if Green Thumb cannabis stock was being shorted. Remember, short selling a stock is a bet that the price of the stock will go down.

In simple terms, an investor will borrow shares, sell them and then buy them back on the public market to return to the lender. If the stock goes down, the difference between the sell price and the buy price is the investor’s profit.

From what I can find, investors have sold about 259,000 shares of Green Thumb short as of September 30 — this is a 9.3% decline from 285,600 shares previously.

The decrease in short-sale volume suggests that Green Thumb’s stock isn’t dealing with a massive amount of shorting.

Cannabis Market Headwinds

Keep in mind that the broader cannabis market faces significant headwinds from Congress stalling on banking, legalization or decriminalization reform related to cannabis.

Cannabis stocks had a solid runup early in the year after Congress floated the idea of banking reform to help cannabis companies get access to traditional business banking services — as well as legalizing cannabis at the federal level.

Either or both would provide a boost to cannabis stocks while holding the status quo gives institutional investors no reason to think there will be a big price boost to cannabis stocks.

Under normal circumstances — legalization or giving cannabis companies access to lines of credit, for instance, Green Thumb Industries would be in a promising position.

However, couple the overvaluation of the stock price with the lack of serious legislation from Washington — and the fundamental outlook for cannabis companies like Green Thumb doesn’t matter much.

I hope that answers your question, Sally. Be on the lookout for an email from my team to get you hooked up with free Money & Markets gear.

If you have a question about a cannabis stock or the market, just email me at Feedback@MoneyandMarkets.com. Send us a question, we use it … and you’ll get free Money & Markets gear, like T-shirts, hats and sweatshirts.

P.S. Adam O’Dell is going LIVE on November 4 to reveal a once-in-a-lifetime opportunity accidentally created by the millions of new traders flooding the market. Why is now the best time in history to start trading? Find out all the details on November 4 by signing up for the event here.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

And check out our Ask Adam Anything video series, where we ask any question to chief investment strategist Adam O’Dell, as well as our Investing With Charles series, in which our expert Charles Sizemore and I discuss the trends you write in to ask about.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.