Another major U.S. coal mining company is seeking bankruptcy protection, joining a growing list of struggling coal operations as communities switch away from fossil fuels to less-polluting renewable energy or natural gas.

Ohio-based Murray Energy filed for Chapter 11 bankruptcy reorganization Tuesday.

Murray Energy was the country’s fourth largest coal producer in 2018, accounting for 6.1% of total production, according to the Energy Information Administration. Several other major coal producers have filed for bankruptcy protection this year, including Blackjewel Mining in West Virginia and Cloud Peak Energy in Wyoming.

Former Murray Energy CEO Robert Murray said the move was necessary to access liquidity and best position the company for long-term success.

The coal giant had signaled that it wasn’t immune to the industry’s downturn earlier this month when it announced it missed loan and interest payments to its lenders. Brian Lego, a research assistant professor at West Virginia University, said the bankruptcy of such a large company is a heavy blow to an already beleaguered sector.

“It doesn’t bode well as far as the overall state of the industry is concerned,” he said.

Government preference for gas and renewable energy to replace coal-fired power generation, combined with a recent severe reduction in coal exports, delivered a one-two punch that an over-extended Murray Energy could not withstand, said Cecil Roberts, president of United Mine Workers of America.

“Now comes the part where workers and their families pay the price for corporate decision-making and governmental actions,” Roberts said in a prepared statement. “But that does not mean we will sit idly by and let the company and the court dictate what happens to our members and our retirees. We have high-powered legal, financial and communications teams in place that will fight to protect our members’ interests in the bankruptcy court.”

West Virginia Senate President Mitch Carmichael said the bankruptcy filing was surprising even with the evident struggles in the coal business, adding that he’s concerned about pensions and worker protections for the business’ nearly 7,000 employees.

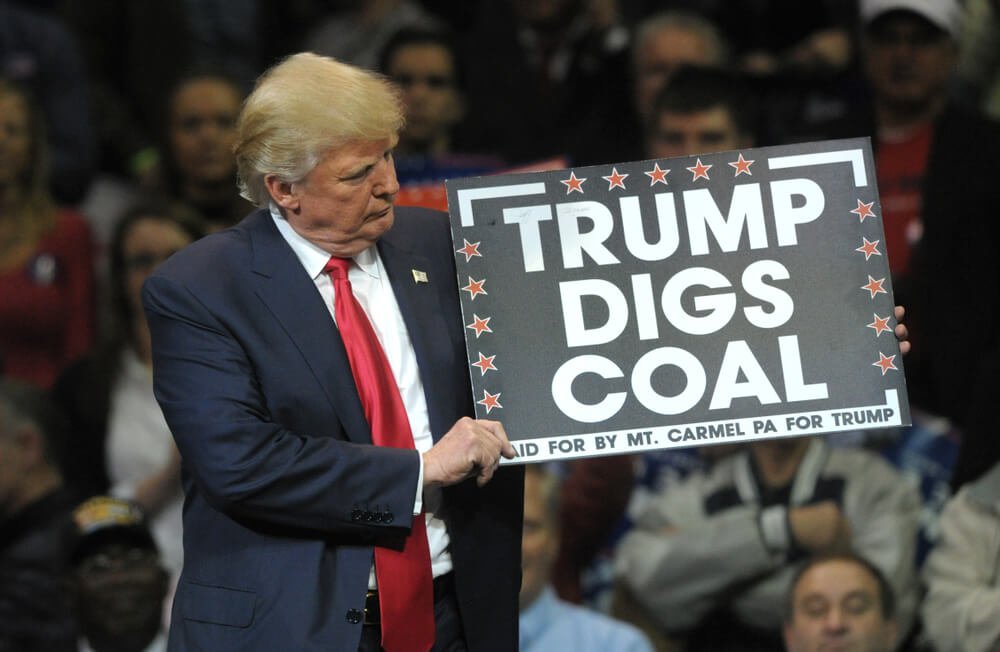

Murray, who on Tuesday was replaced as CEO by Robert Moore, has tied his fortunes to Trump. He hosted a fundraiser for the president in July, which had been expected to raise $2.5 million for a joint committee supporting Trump’s re-election campaign and the Republican National Committee. The coal-country crowd at the closed-door event included the governors of West Virginia, Kentucky and Ohio.

Murray, who has called climate change an “environmental hoax,” is also a proponent of Trump’s regulatory actions aimed at scaling back environmental protections put in place during Barack Obama’s presidency. He has flexed his influence at the local level as well, donating thousands of dollars to the 2020 campaign of West Virginia Gov. Jim Justice and successfully pushing for a tax cut on steam coal in the economically depressed Mountain State.

Trump’s gusto for “clean” and “beautiful” coal and coal miners helped to make Appalachian coal country one of Trump’s most fervent bases of support as he racked up big wins in West Virginia, Ohio, Kentucky and other states.

Trump has since lessened his call-outs for coal as the industry continues its decline despite his administration’s support.

“Murray Energy’s bankruptcy filing is another sign of the significant stress on the coal industry today,” said Benjamin Nelson, a Moody’s vice president and lead U.S. coal analyst. “While the demand for thermal coal has been declining for about a decade, healthy export prices helped the industry generate stronger cash flows in 2017 and 2018. A sharp reduction in export prices shines light on poor underlying demand fundamentals for thermal coal in the domestic market.”

Tyson Slocum, energy program director for Public Citizen, said there is little anyone can do to save coal.

“Even when coal companies get exactly the corporate welfare and license to pollute that they want, they still go bankrupt because renewable energy has been outcompeting coal in the market,” he said in a statement. “Instead of propping up the failing coal industry with taxpayer-funded bailouts, we should support the workers in transition and shut these mines down.”

© The Associated Press. All rights reserved.

Editor’s note: Should Trump — or any politician for that matter — work to save the coal industry, an industry whose best days are clearly in the past? Share your thoughts below.