Seattle is an interesting city.

From the Pike Street Market to the Space Needle, I found myself walking a ton over the course of my week on the West Coast.

A highlight of my trip was touring the Boeing Everett Production Facility, which sits on 1,000 acres about 22 miles north of Seattle.

I had the opportunity to see inside the largest building in the world, by volume … where Boeing produces its 777X and various other commercial jets.

I did not take pictures inside the facility, as that was strictly forbidden, but I can tell you that the six-building structure is massive.

This was as close as I could get for a picture. The production facility is the building with six blue doors.

Of course, during the tour, I kept thinking about Boeing Co. (BA) and its stock performance (odd, I know, but it’s just how my brain works).

When I got back home to South Florida, I dug into Boeing and the aerospace and defense industries. I found this piece I wrote back in July related to defense stock earnings.

I wondered about how this corner of the market has performed this year amid talk of defense spending increases in the U.S. and abroad.

What I found really surprised me…

Terminal Work Points To A Winner

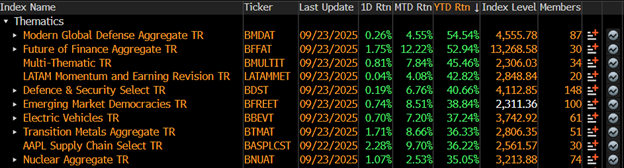

I dove into my Bloomberg Terminal and started analyzing thematic indexes that track companies from different sectors that are exposed to a long-term trend.

So, rather than industrial stocks, a thematic index might track stocks related to autonomous vehicles or circular materials.

Bloomberg has many thematic indexes, ranging from future finance to plant-based food (and even an obesity index).

When I went to sort all of their indexes by return, I found something exciting…

Modern Defense Leads Bloomberg Thematic Indexes

The index with the highest return in 2025 is the Modern Global Defense Aggregate Index, which is up 54.5% this year.

So, I dug deeper and found the index’s top five holdings:

- Palantir Technologies Inc. (PLTR).

- General Electric Co. (GE).

- RTX Corp. (RTX).

- The Boeing Co. (BA).

- Honeywell International Inc. (HON).

It also tracks companies like Lockheed Martin Corp. (LMT), Northrop Grumman Corp. (NOC) and General Dynamics Corp. (GD), along with international defense contractors like Italy’s Leonardo SpA, Sweden’s Saab AB and India’s Bharat Electronics Ltd.

The Modern Global Defense index has outperformed the benchmark by more than three-to-one compared to the S&P 500.

Modern Defense Beats S&P 500 By 3-to-1

With outperformance like that, I had to see how these stocks looked in our Green Zone Power Rating system…

Global Defense Stocks X-Ray

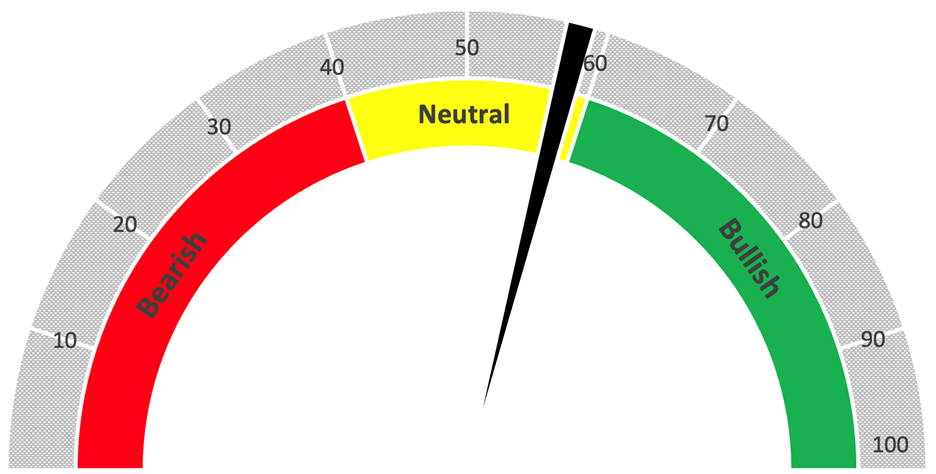

I started by X-raying all the stocks covered by the index. Then, I ran each stock through our system to find its individual and cumulative ratings.

Global Defense Index Near “Bullish”

As a whole, the Modern Global Defense index rated a “Neutral” 57 out of 100 on Adam’s system … very close to a “Bullish” rating.

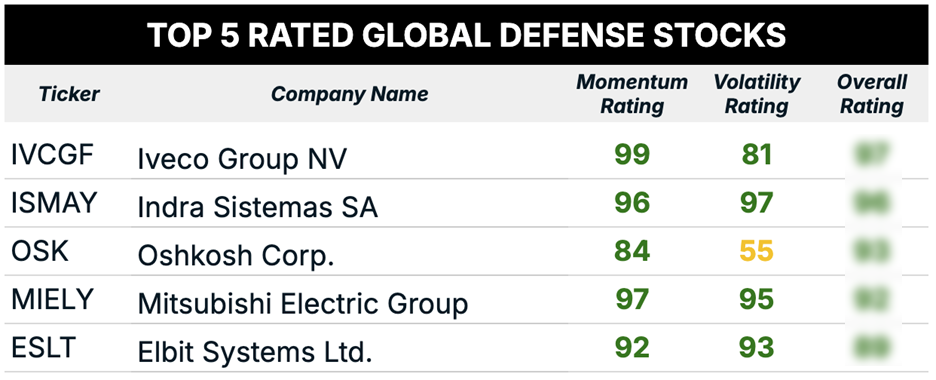

Since this index is only tracked within the Bloomberg terminal, I went ahead and pulled the top five-rated stocks as well as their Momentum and Volatility factor ratings:

With the exception of Oshkosh Corp. (OSK), all five rated “Strong Bullish” on both factors.

Side Note: All but one (not OSK) rated “Strong Bullish” on Growth, all but two were “Strong Bullish” on Quality and Value, and none rated above “Neutral” on Size due to larger market caps.

This analysis shows there is a lot of strength in the modern global defense market, and the Green Zone Power Rating system can help you sort out the wheat from the chaff and find the right place to invest in this trend.

If you want to see exactly how these stocks rate, click here to see how you can gain full access to our system with a Green Zone Fortunes subscription.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets