The Nasdaq is about to do something it’s never done before…

Starting next Monday, July 24, it’s reducing the weighting of the largest holdings in its widely followed Nasdaq 100 Index.

On the chopping block are stocks I’m sure you’ll recognize…

- Apple (AAPL).

- Microsoft (MSFT).

- NVIDIA (NVDA).

- Amazon.com (AMZN).

- Tesla (TSLA).

- Alphabet (GOOGL).

- And maybe even Meta Platforms (META).

We don’t yet know how big of a cut each stock will suffer … but the Nasdaq is expected to make the new weights known soon and will enact the changes before the open on Monday, July 24.

Details aside, one thing is certain: There will be forced selling of these stocks … and you could very well feel the impact in your portfolio.

I don’t say “forced” with creative license. I truly mean there will be forced selling of the names above. It’s just how stock market indexes, and the mutual funds and exchange-traded funds (ETFs) that track them, work.

If the index provider — in this case, the Nasdaq — determines that the Nasdaq 100 Index should hold a 12% allocation to Microsoft Corp. (Nasdaq: MSFT) shares … any ETF provider that has promised investors to track that index (such as QQQ) must invest 12% of its funds in Microsoft shares.

If then, a day later, the index adjusts its MSFT weighting to 10% … the ETF provider must reduce the size of its position, by selling shares of MSFT in the open market.

Now, that’s the “just the facts, ma’am” explainer on what to expect of the Nasdaq’s special rebalance.

The important thing to consider is, what does this mean for you?

Will the Big Tech Breakup Change Anything?

Understand, this event doesn’t spell the end of the “Big Tech” stocks.

It’s not like the Antitrust Division of the U.S. Department of Justice handed down orders to dismantle Apple or force the sell-off of any of Alphabet’s business units.

And judging by Microsoft’s win against the FTC, which tried to block its $69 billion acquisition of Activision Blizzard … the attempted “crackdown” on Big Tech isn’t going so well.

Regulators have proven to be ineffective in preventing the biggest U.S. corporations from getting bigger and bigger. But maybe “the market” will do that job for them…?

See, momentum works in both directions. The virtuous cycle of investor demand that pushed NVDA, AMZN and GOOGL above $1 trillion market caps … AAPL and MSFT above $2 trillion market caps … and each of them into a heavier share of the indexes … can run in reverse.

On the way up, investors bought Big Tech stocks … which pushed them up … which then increased their proportions in “cap-weighted” indexes like the Nasdaq 100 … rinse and repeat.

This caused the index to perform well, and the Big Tech stocks especially … but it created the problem of concentration.

See, a lot of folks think that when they’re buying a cap-weighted index, like the Nasdaq 100 or the S&P 500, they’re buying a passive position in the market.

In reality, they could just as fairly be called “momentum investors,” since the stocks that show the strongest price momentum become larger and larger chunks of the index.

Again, that virtuous cycle Big Tech stocks have enjoyed since the middle part of the last bull market could run in reverse. Decreased investor demand would lead to decreased buying activity … which would push the Big Tech stocks down … which then would decrease their share of cap-weighted indexes. We saw a bit of this in 2022, as Big Tech stocks took the brunt of the damage and dragged the whole market down.

In short, stocks can experience both virtuous (positive) and vicious (negative) cycles in cap-weighted indexes.

And frankly, those depend on nothing more than investor psychology.

So long as current and future GOOGL shareholders believe it’s the company to own … shares of GOOGL will trade higher, its market cap will grow and it will gobble up a larger share of indexes, mutual funds and ETFs.

If ever some GOOGL shareholders lose faith in the company, begin to feel the stock is too richly valued or simply find a more compelling use for the money they have in GOOGL … it will trade lower, its market cap will shrink and it will take a smaller and smaller share of indexes and funds.

Realize, this can happen even if Alphabet continues to dominate in its respective businesses and make monster operating profits. That alone won’t guarantee the stock’s share price will climb ever higher.

So…

What Should You Do About It?

Investor sentiment is notoriously fickle and tough to forecast.

“Irrational exuberance,” a term coined by former Federal Reserve Chair Alan Greenspan in 1996, can last far longer than sober-thinking skeptics expect.

So it’s possible that the investor sentiment which pushed the Nasdaq 100’s largest stocks to great heights … could indeed continue on for several more months, or even years. It could also turn on a dime.

Standing in front of the bullet train that is Big Tech’s market-leading rally is fraught with risk. At the same time, you’d be like an ostrich with your head in the sand if you didn’t at least consider the risks of such a highly concentrated rally.

The market has never been as concentrated in a handful of mega-cap stocks as it is today. Even at the height of the dot-com bubble in 2000, the 10 largest stocks in the Wilshire 5000 Index accounted for 20.3% of the market. Today, the 10 largest stocks make up nearly 26% of the entire market:

I wrote about this just over a month ago, as “AI fever” was at its peak.

And whether or not you believe the highly concentrated Nasdaq is a sign of trouble for the entire stock market … you’d be wise to at least consider your options for building a more diversified portfolio of stocks.

One option is to invest in equal-weight index funds, rather than cap-weighted funds.

An equal-weight fund will invest roughly the same dollar amount of capital in each of the stocks it owns. This not only reduces the net influence of the largest stocks in the fund, but also increases the influence of the smaller stocks.

For instance, if you want to invest in a diversified basket of technology stocks … I would recommend the SPDR S&P Software & Services ETF (NYSE: XSW) instead of the SPDR Technology Sector ETF (NYSE: XLK).

XSW uses a modified equal-weight portfolio construction method, where it invests about the same amount into each of the 150 software and IT services stocks it owns.

Meanwhile, XLK uses a modified cap-weighted method. It holds about half as many stocks as XSW, but 45% of its assets are concentrated in just two stocks — Apple (AAPL), with a 22.7% weighting, and Microsoft (MSFT), at 22.6%.

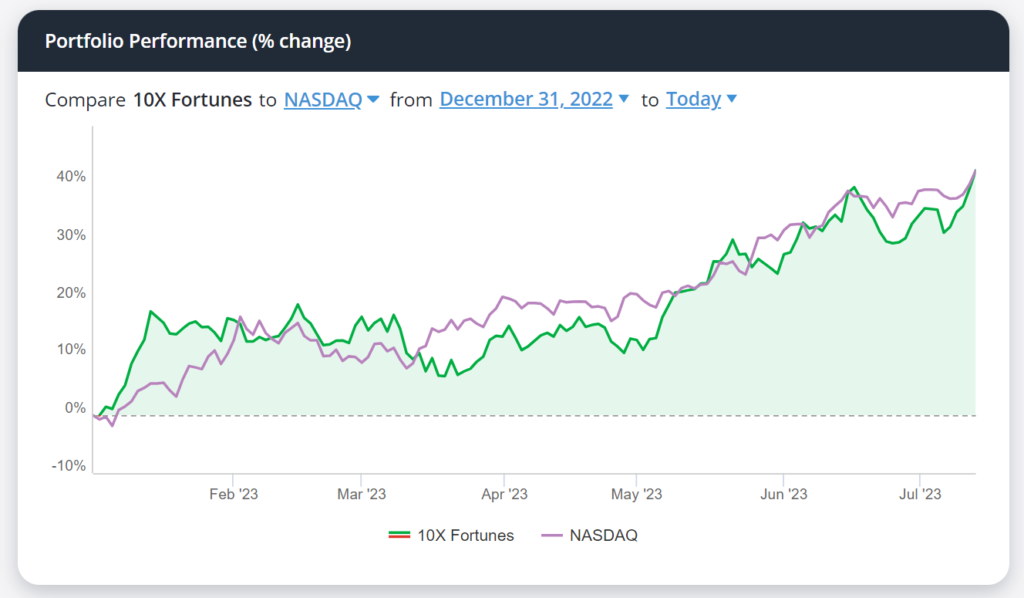

Otherwise, in my premium 10X Stocks research service, I’m building a portfolio of stocks that have the potential to return 10X or more over the course of a bull market.

I began building the portfolio last June and already we’ve had a number of positions return more than 100% … and one that’s now up more than 130%.

Our core model portfolio is keeping pace with the market-leading Nasdaq 100 this year. And according to the TradeSmith software we use to manage it, the portfolio is more diversified than the Nasdaq 100. Outlier stocks I recommended in the pharmaceutical and energy space have kept up just as well as tech:

A number of these stocks, unlike the eye-popping share prices of the Big Tech firms, are priced under $5 per share. (And hedge funds are champing at the bit for them to cross back above $5 — learn why here.)

Time will tell whether the Nasdaq’s first-ever special rebalance turns out to be a watershed moment for Big Tech, or a “nothingburger”…

The Nasdaq’s special rebalance will reduce the future impact of Big Tech on the index’s returns, but it can’t go back and undo the highly concentrated nature of this year’s rally.

Regardless, as an informed investor, you should know what you’re buying.

If you’re buying the Nasdaq 100 because you think you’re “diversified” across 100 individual stocks … the truth is that the majority of your returns — for better or worse — are driven by fewer stocks than I have fingers.

That’s great on the way up … but it could sting like hell on the way down.

Like I said, consider the equal-weighted ETFs if you’re looking for a more diversified exposure to tech or any other market. And better yet, check out the highly diversified portfolio I’m building in 10X Stocks for a lower-risk alternative to the Nasdaq 100.

To good profits,

Editor, Stock Power Daily