It’s official.

The Nasdaq 100, which includes many of the biggest names in technology, is now in correction territory. The index is 14% off its 52-week highs.

The financial press loves precise definitions. A “correction” is a drop of at least 10% from recent highs, whereas a “bear market” is a drop of at least 20%.

Now, I’m not a huge stickler for terminology. It’s not important to my analysis whether this is “officially” a correction.

The bigger takeaway for me here is that the market has lost its momentum. We no longer have that rising tide lifting all boats. So, we need to be careful.

But little setbacks like these also present us with opportunities. This is the time to put together a list of stocks to buy once the dust has settled. And we have a system for that, of course.

Why the Nasdaq Is in a Correction

Before I get into what we should do next, I want to quickly break down what’s going on.

The market correction hasn’t been kind to any market sector, though it’s been particularly rough for tech stocks.

There’s a reason for that.

While it’s a mistake to read too much into the reasons for a decline — stocks don’t need a “reason” to move — the fear today centers around the Federal Reserve’s planned tightening.

As the Fed scales back its bond purchases, a major source of buying pressure will disappear, explaining why bond prices are falling. And lower bond prices mean rising bond yields.

All of this has an outsized impact on tech valuations.

You don’t buy tech stocks for today’s profits. You buy them for the expected profits years — or even decades — in the future. The higher market interest rates go, the less valuable those future earnings are when discounted to today’s prices.

Put These Nasdaq 100 Stocks on Your Radar

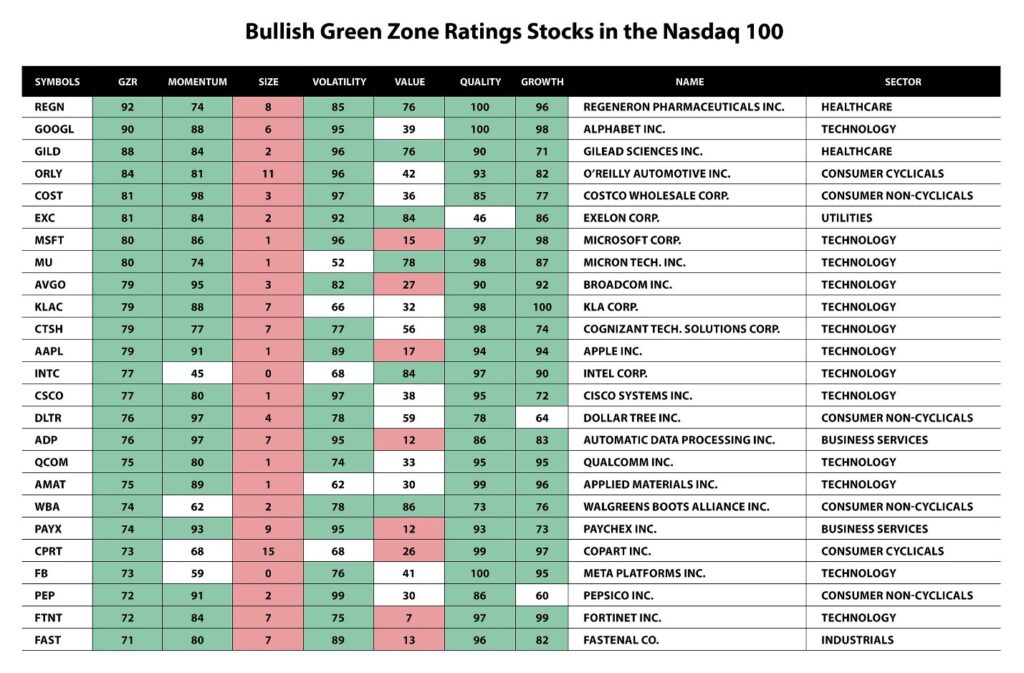

My proprietary Green Zone Ratings system gives us a way to objectively rank stocks by six factors that have proven to outperform over time: momentum, growth, value, quality, volatility and size.

I ran a screen of the Nasdaq 100 to see what, after the recent volatility, still ranked as “Bullish” in Green Zone Ratings.

The list is pretty short!

But there are some takeaways.

The list is heavy with mega-cap tech names that generate massive cash flows today. That makes sense given the situation with rising bond yields.

Ideally, you want a stock that is generating massive sums of cash today but also has major growth projects in the pipeline that the market is ignoring for now. And that’s the subject of my January issue of Green Zone Fortunes, by the way!

What’s Next

I’m a trader, not a forecaster. I’m not going to tell you when or at what exact price the market finds a bottom. That’s a fool’s errand.

But I’ve been doing this long enough to know that the change can happen in the blink of an eye. All it takes is an offhand comment by a Fed official to lead to an onslaught of short covering, which then snowballs into a tradable rally.

We don’t know when that day will come, but we want to be ready for it when it does!

And one of the best ways to prepare is to join my premium stock research service Green Zone Fortunes today.

You may be wary of buying any stocks right now. I get it.

But we are still following some of the biggest stock mega trends in the Green Zone Fortunes model portfolio. And based on my research, I believe the brightest days for these stocks are still in the years ahead.

To see why I have such a high conviction in mega trends like the genomics revolution, click here to watch my “Imperium” presentation now.

To good profits,

Adam O’Dell

Chief Investment Strategist