The terrorist attacks of September 11, 2001, changed everything.

On the national defense side, the attacks exposed the importance of actionable intelligence … especially in cyberspace.

From monitoring websites to examining mounds and mounds of data, governments are investing billions in intelligence-gathering operations.

Using Adam O’Dell’s six-factor Green Zone Ratings system, I found a company helping governments improve data analysis in order to find potential threats before they become a reality.

Its stock has jumped 14% in the month of October. And I think it will only go higher.

We are “Strong Bullish” on this stock, which means it is poised to outperform the broader market by at least three times over the next 12 months.

Let’s see why investors should act quickly to capitalize.

National Security Spending Reaches New Highs

According to Defense News, global spending on military forces — including intelligence gathering — reached a staggering $1.98 trillion in 2020.

That’s the highest figure since tracking of military spending started in 1988.

The United States spends the most on its military. It shelled out a whopping $778 billion, or 39% of global spending.

Here’s who rounds out the top 5:

- China ($252 billion).

- India ($72.9 billion).

- Russia ($61.7 billion).

- The United Kingdom ($59.2 billion).

When it comes to intelligence spending, the U.S. spent $85.8 billion on national and military intelligence in 2020 (the most in history). That’s more than the U.K., Russia and India spent on their entire defense.

Governments don’t undertake intelligence gathering and analysis by themselves. They rely on companies with the equipment and expertise to decipher data and find solutions to global issues.

Spending is on the rise, and the reliance on intelligence is only getting bigger.

Investors can find big profits in this growing demand.

A Major Intelligence Player: CACI International Inc.

CACI International Inc. (NYSE: CACI) provides expertise and technology for governments and businesses. It develops services to help with a wide range of activities:

- Command and control.

- Cybersecurity.

- Information technology.

- Intelligence.

- Communications.

- Business services.

The Reston, Virginia-based company works with U.S. and international governments and businesses.

In intelligence gathering, CACI develops technology to process internet, signals and computer vision data that allows intelligence operatives to quickly process potential threats that human analysts may miss.

Intelligence has been good business for CACI International.

In 2017, the company reported total revenue of $4.35 billion.

That revenue jumped to $6.04 billion in 2021 — an increase in top-line income of 39%.

By the end of 2024, CACI International is projected to report total revenue of more than $6.8 billion — a 58% jump over its revenue in 2017.

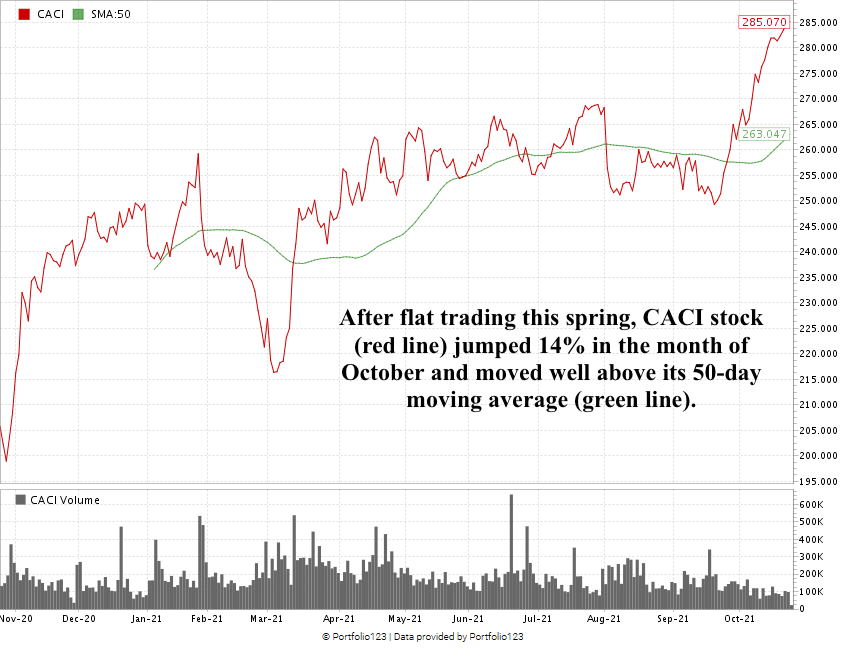

CACI International Stock Reaches New High

CACI started 2021 strong but faced a 17.3% downturn from February to March.

After rebounding, the stock traded between $250 and $265 before leaping up 14% to a new 52-week high in October.

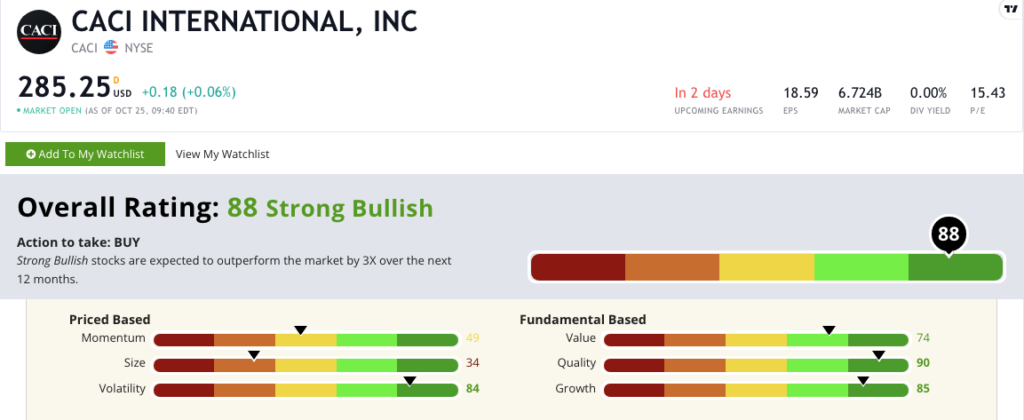

CACI International’s Stock Rating

Using Adam’s six-factor Green Zone Ratings system, CACI International scores an 88 overall. That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times in the next 12 months.

CACI International’s Green Zone Rating on Oct. 25, 2021.

CACI International stock rates in the green in four of our six factors:

- Quality — The company’s returns on assets, equity and investments all exceed the business services industry average — including a 17.2% return on equity compared to the industry average of 8%. CACI earns a 90 on quality.

- Growth — The company has a three-year annual sales growth rate of 10.6% and a one-year earnings per share growth rate of 45.1%! CACI earns an 85 on growth.

- Volatility — CACI’s stock has either moved sideways or up — with very little downward movement. It earns an 84 on this metric.

- Value — CACI trades with a price-to-earnings ratio of 15.3 compared to the industry average of 30.6. Its price-to-sales ratio is 1.1 while its industry peers are averaging 2.7. CACI earns a 74 on value.

CACI scores a 49 on momentum, which is neutral, but its recent run to a new 52-week high suggests it’s starting a run for “maximum momentum.”

The company scores a 34 on size due to a $6.72 billion market cap.

Bottom line: Cyber threats are not going away.

Hackers, terrorist organizations and even foreign powers are using the internet to disrupt our everyday lives.

As governments pour billions into threat analysis and deterrents, companies providing tools to seek out these threats are going to prosper.

That’s why CACI International Inc. is a stock worth considering for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.