Stranger Things, Lost in Space and The Umbrella Academy are just a few of Netflix’s sci-fi successes over the last few years.

My personal favorite is Black Mirror.

I am still one of the many fans holding on to hope for another season.

Netflix helped people move away from basic cable.

For a while, Netflix looked untouchable in the streaming space.

But with the company cracking down on subscription sharing and developing a new ad-supported tier in an attempt to woo new subscribers, the future of Netflix isn’t as shiny as it once appeared.

Netflix Inc.’s (Nasdaq: NFLX) sharp stock drop earlier this year was reminiscent of a scene straight out of a cosmic horror movie.

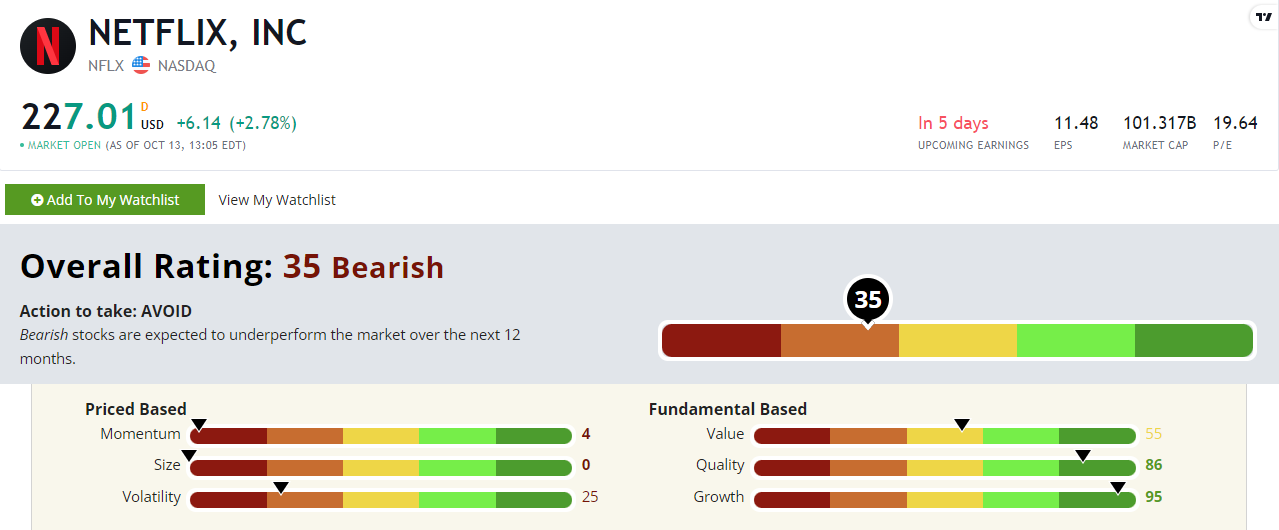

Let’s take a closer look at why Netflix rates a “Bearish” 35 out of 100 on our proprietary Stock Power Ratings system.

Netflix’s 2022 Stock Free Fall

Netflix isn’t having the best year.

After a disastrous second quarter, Netflix reported a loss in subscribers for the first time in over a decade.

As investors feared the worst for the company’s future, shares dropped more than 35%, cutting $50 billion off its market cap.

Netflix executives claim several headwinds affected the company’s performance, such as increased competition in the streaming industry and the lift of pandemic restrictions.

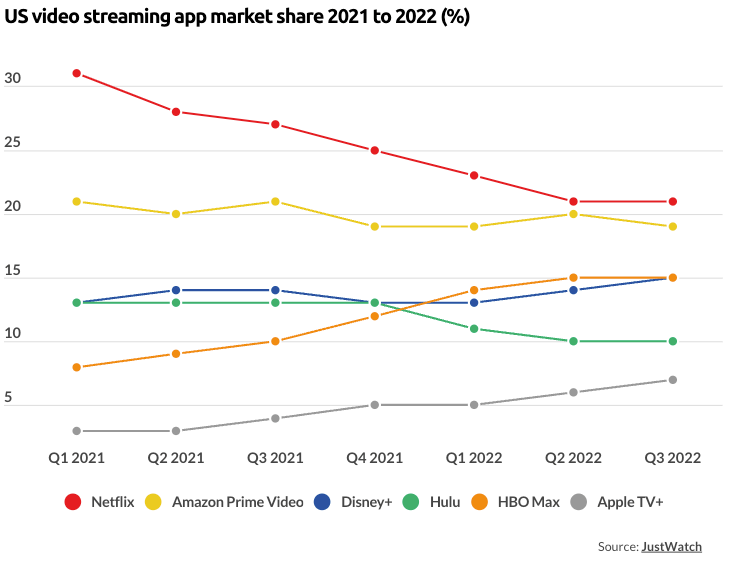

Source: JustWatch.

The image above shows that the industry is full of big names.

JustWatch projects Netflix’s market share to continue its downward trend.

Another considerable factor: subscription password sharing.

The company estimated that 100 million households share their subscriptions with friends and family.

This is what brought the latest move to fruition for Netflix.

A cheaper alternative to a standard Netflix subscription with one small change: advertising.

This is a rather interesting move for the company that once vehemently rejected the idea of ads.

But even company officials are aware it won’t feel the benefits of this change until 2024.

Let’s look at Netflix’s breakdown to see where it stands after a shaky summer.

Netflix Stock Power Ratings Breakdown and Momentum

Netflix rates a “Bearish” 35 out of 100 on our Stock Power Ratings system.

NFLX’s Stock Power Ratings in October 2022.

For bearish stocks, I like to focus on the lowest scores.

Netflix’s market cap is $101.9 billion.

Netflix is a massive company and earns a 0 on our size factor.

Now let’s zoom in closer on momentum to see how badly Netflix’s stock performed compared to its peers.

Source: TradingView.

Source: TradingView.

A shaky market and inflation worsened broader market pressures over the last 52 weeks and pushed Netflix down.

Compared to its industry peers, Netflix (shown in red) is down 63.4%.

Over the last 52 weeks, industry peers aren’t faring much better, at a 46% loss.

These numbers earn Netflix a 4 on our momentum factor.

The Bottom Line

Netflix scores a “Bearish” 35 out of 100 on our Stock Power Ratings system.

However, “Strong Bullish” stocks are no anomaly.

We expect those stocks to beat the broader market by 3X in the next 12 months!

To get one highly rated stock you should consider investing in, check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock that scores 80 or above on our system and tells you why you should add it to your portfolio — for free!