Four years ago, I was having a beer with a buddy of mine, and I asked him a hypothetical question: If you could only choose one entertainment medium — cable TV or Netflix— which would you choose, assuming the cost was the same?

I expected him to ponder it for a moment before answering. But I barely finished my sentence when he replied with: “Netflix. No question, Netflix.”

Stop and think about that. A standard Netflix subscription costs about $14. The typical cable bill can exceed $200 per month. When you consider cost, choosing Netflix is a no-brainer.

But even if offered at the same price, he would choose Netflix.

So would I. It’s more high-quality content than I’ll ever be able to watch in 100 lifetimes … on-demand … with no commercials.

Netflix changed the way we watch TV. Every other major media company — including the big boys like The Walt Disney Co. (NYSE: DIS) and AT&T Inc.’s (NYSE: T) HBO — has made it their mission to copy them.

But while Netflix Inc. (Nasdaq: NFLX) is a transformational company, is it a good stock? Let’s give it a look using Adam O’Dell’s Green Zone Ratings system.

Netflix Stock’s Green Zone Rating

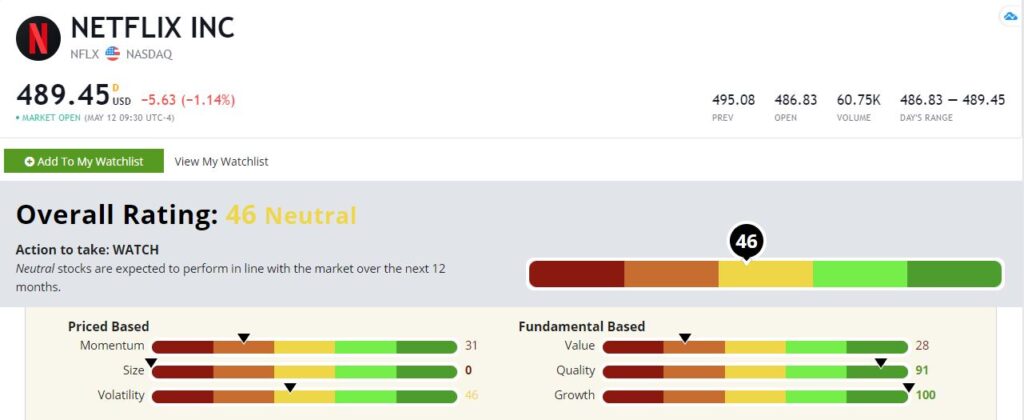

NFLX’s rating is subpar at just 43. Let’s do a deeper dive.

Netflix Inc.’s Green Zone Rating on May 12, 2021.

Growth — Netflix isn’t a complete slouch. It rates a 100 on growth. It is literally in the top fraction of 1% of all companies in our universe. This is a company that, in a little over a decade, transformed itself from a DVD-rental-by-mail service to the world’s first commercially-viable streaming company. In 2007, when Netflix started streaming, almost no one knew what “streaming video” meant. Today, Netflix has over 200 million paying subscribers. That’s growth.

Quality — Netflix also scores well on quality, with a rating of 91. The company sports healthy margins and competitive returns on investment, assets and equity. And NFLX is enjoying a virtuous cycle in which a larger subscriber base allows it to spend more on quality programming. That keeps subscribers coming back. There’s a lot to like here.

Volatility — But Netflix’s ratings drop off after that. It rates a 46 on volatility, meaning the company is more volatile than 61% of the stocks in our universe. It’s not unusual for a high-growth company to also have a lot of volatility.

Momentum — Netflix has enjoyed a phenomenal run. Its shares have risen by more than 100 times since 2009. Unfortunately, that blistering momentum has leveled off of late. Shares have traded in a range over the past year, giving Netflix a momentum rating of just 31.

You can see NFLX’s momentum and volatility at play in its stock chart below.

NFLX Has Traded Sideways Since July 2020

Value — Netflix also rates low based on value, with a score of 28. It’s not at all strange for a high-growth, high-quality company to rate low based on value. Investors pay up for growth. So, a low score here isn’t a deal breaker. But it’s a worry when paired with flat stock movement.

Size — As one of the FAANGs, Netflix is one of the largest and most widely recognized stocks out there today. It rates a 0 here.

Bottom line: Netflix is one of the great success stories of our generation.

It changed the way we watch media and massively lowered the cost of high-quality content. But at current prices, the stock isn’t a compelling buy.

Pro tip: Don’t forget that you can use Adam O’Dell’s proprietary Green Zone Ratings system to look up the stocks you’re thinking about buying! You’ll see the stock’s overall score, as well as how it rates on all six factors. If you aren’t sure how to look up stocks on our homepage, check out our research analyst Matt Clark’s four-minute video below.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.