As I wrote yesterday, technology stocks are on fire.

Between the seemingly unstoppable enthusiasm for AI, rumblings that quantum computers may finally be making their way out of the laboratories and into the real world and the fact that the Federal Reserve is expected to cut rates again tomorrow, investors can’t seem to get enough tech exposure.

It makes sense.

Outside of the tech sector, growth is pretty hard to come by. Consumers have been showing signs of being tapped out for months, and we’re starting to see “cockroaches” appear in the form of bad loans in the banking sector.

Meanwhile, Big Tech is investing hundreds of billions of dollars annually into AI infrastructure, leading to record profits for many of America’s small to mid-sized tech-adjacent names. Why wouldn’t you want to invest alongside them and ride that wave of hyper-growth?

And yet, disciplined investors face a conundrum…

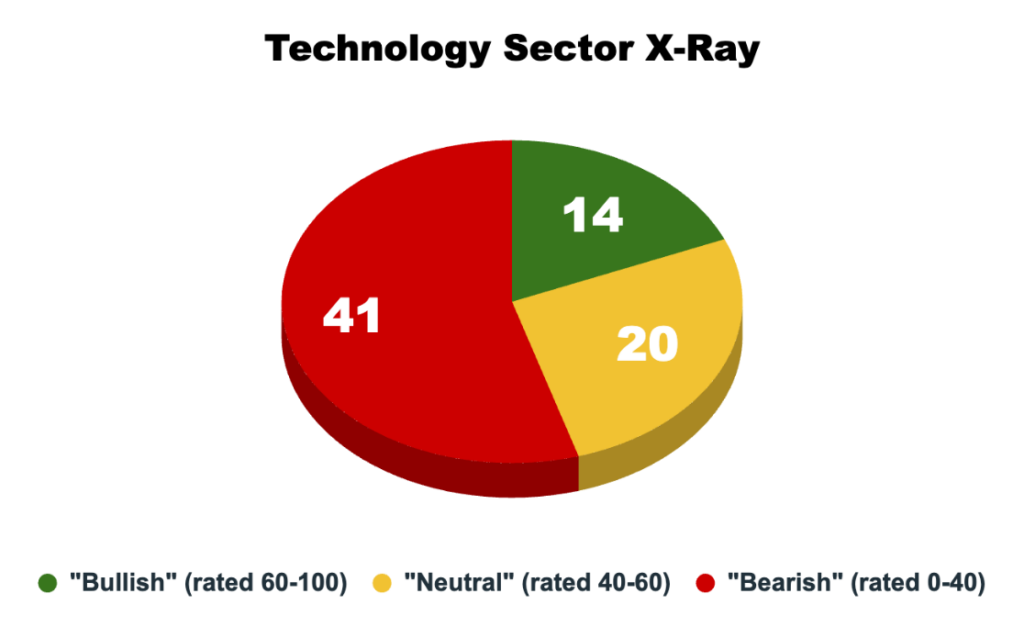

The majority of tech stocks in the S&P 500 actually rate as bearish on my Green Zone Power Ratings system. 41 out of 75 rate bearish, and another 20 rate neutral. Only 14 rate as bullish…

So, how do we explain this disconnect?

How is it that so few companies rate as bullish considering the massive outperformance of the sector as a whole?

Let’s do a proper sector “X-ray” to see what’s happening under the surface.

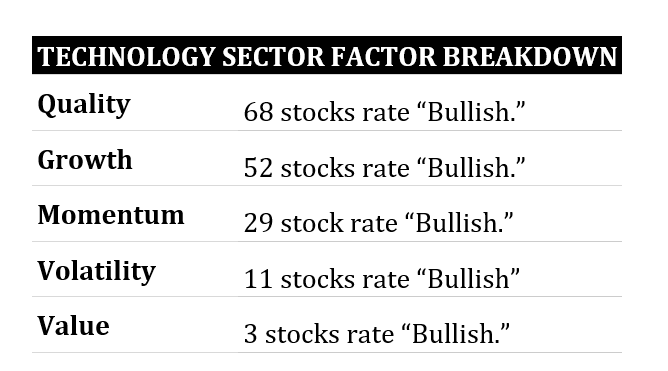

Factor Breakdown of 75-Stock Sector

A couple things jump right off the page.

The tech sector scores “points” on my rating system due to the high quality and growth factors of its underlying companies. In fact, a whopping 68 out of 75 rate as “Bullish” on the quality factor, meaning they score a 60 or higher. And 52 rate as “Bullish” on the growth factor.

Growth is easy enough to understand. I rate companies based on a proprietary blend of revenue, earnings and net income growth metrics. Companies that have rising sales and profits rate higher. It really is that simple – as it should be.

Quality requires a little more explanation. I measure a company’s quality by rating its profitability, the strength of its balance sheet and its capital efficiency, among other factors. The ideal high-quality company would boast fat profit margins, low debt and would be “capital light.”

That is a perfect description of knowledge-based businesses in the tech sector like software. They generate massive profits with only a modest amount of capital invested.

Unlike an old-school industrial stock or utility, they don’t require constant investment in property, plant and equipment. (This is changing somewhat due to the massive spending on AI infrastructure, but relative to other sectors it remains true.)

Unfortunately for newcomers, the high-quality nature of Big Tech’s best businesses is no secret. Wall Street is very well aware that they are profit machines and values them accordingly. Tech stocks are often expensive, and that is particularly true today. As you can see above, only three stocks out of 75 rate as bullish on my value factor.

With FOMO in full effect, we’ve also seen a lot of volatility in tech shares, even in megacap names. Last month, Oracle shot up 37% in one trading day, its biggest daily move since 1992.

No one minds when they see upside volatility, of course. But it really isn’t normal and its indicative of the kind of high-volatility seen in a FOMO market. And remember, any stock that rises that far that fast can also fall by as much or more just as quickly.

Finally, size is also a factor in the S&P 500 tech sector’s poor overall ratings.

My Green Zone Power Ratings system gives preference to smaller companies, as the data shows that they tend to outperform their larger peers over time. In a sector where multi-trillion-dollar valuations have become normal, tech stocks are penalized for their size, which then works to bias their overall ratings lower than they would be otherwise.

Where to Find Bullish Tech Stocks in a Frothy FOMO Market

There’s nothing wrong with trading high-volatility stocks. I do it all the time in more aggressive trading services. But the key word here is “trading.” Buying and holding them in your retirement account is a different story. That’s the sort of thing that will give you an ulcer.

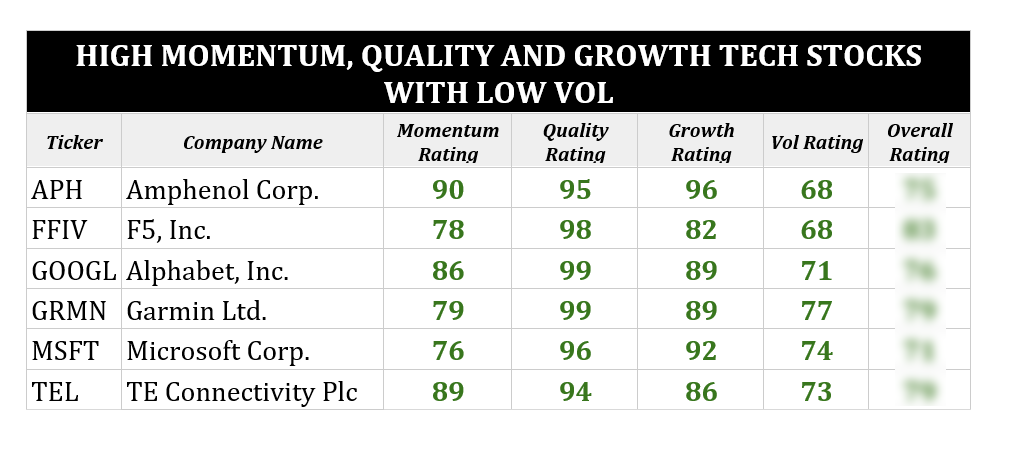

So, with that in mind, I drilled deeper into the data to screen for low-volatility tech stocks (Volatility factor score of 60 or higher) that also rated “Bullish” on their momentum, quality and growth factors. I wanted only the best of the best, and my screen produced six names:

Some of these names really need no explanation. Alphabet (GOOGL) and Microsoft (MSFT) are two of the largest and best-known tech companies in the world, and both are leaders in both cloud computing and AI.

Of course, if you own an S&P 500 index fund or ETF, you already have ample exposure to both. They each represent 5% – 6% of the index.

The rest of the names are a little more under the radar. Amphenol (APH) and TE Connectivity (TE) both create components used in AI infrastructure. F5, Inc (FFIV) provides security and cloud management applications. And Garmin (GRMN) is a leading maker of smartwatches and fitness trackers.

If you’re wanting to ride the tech boom higher with a little less risk of getting whipsawed by excessive volatility, this list will give you a good start. And if you’d like to do a deeper dive on your own, join us in Green Zone Fortunes today!

My team and I are putting together the finishing touches of our latest monthly issue, meaning now is a perfect time to join us.

This month’s recommendation is a rock-solid company with strong ties to automation and powering the next phase of the AI mega trend.

Click here to find out how to subscribe now and be one of the first to receive my latest guidance later this week.

To good profits,

Editor, What My System Says Today