Quick! Can someone go wake up 2023’s rally?

With stocks faltering out the gate to kick off 2024, let’s have some fun with this Friday edition of Stock Power Daily.

It’s a new year, and everyone’s talking goals and resolutions.

Gyms are packed, healthy food is flying off shelves and your Facebook feed is flooded with promises to cut down on this or that.

As I mentioned on Monday, I’m working toward running the Peachtree Road Race on July 4 and contributing an extra $5,000 to my 401(k). There’s a laundry list of other goals, but those are the big two. Wish me luck!

Now, I realize New Year’s resolutions won’t make the chart of top investable mega trends of 2024.

But this is an idea we can run with in Adam O’Dell’s Green Zone Power Ratings system.

That’s because you can get a snapshot of a stock’s potential in seconds.

Just look for the search bar at the top of this page, type in a ticker or company name, and BOOM! You’ll know if a stock is set to outperform the broader market throughout 2024.

Let’s put it into practice with a couple of New Year’s resolution stocks.

New Year’s Resolution Stock No. 1: Packed Gym ≠ Stock Outperformance

Full disclosure: I am joining Planet Fitness or a similar budget gym once the January craziness dies down.

But that doesn’t mean I have to buy Planet Fitness Inc. (NYSE: PLNT) stock!

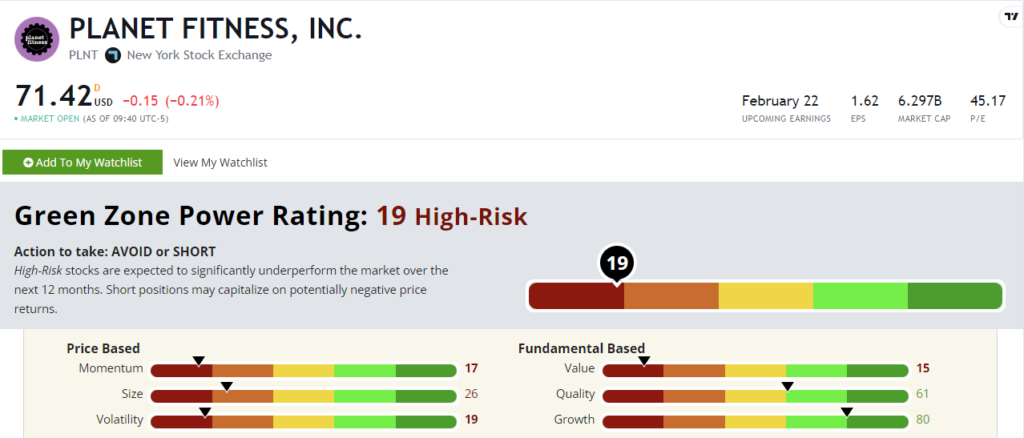

PLNT rates a “High-Risk” 19 out of 100 in Green Zone Power Ratings. High-risk stocks are set to vastly underperform the broader market over the next year.

The last year was incredible for major U.S. indexes. The Nasdaq Composite, S&P 500 and Dow Jones Industrial Average all recorded double-digit gains.

But Planet Fitness investors didn’t get the memo. Shares of PLNT sank -8.6% since this date a year ago, showing why it rates a 17 on Momentum.

This is also a swingy stock with a Volatility rating of 19. That means this stock is more volatile than 81% of the 6,000 stocks Adam’s system rates.

Growth does look solid at 80 out of 100. Back in November, the company posted a solid earnings beat. In the third quarter, it increased revenue by 13.6% year over year to $277.6 million.

But with that higher volatility and weak momentum compared to the broader market, Green Zone Power Ratings says there are better places to put your hard-earned money.

The Athleisure Co. That Started It All…

Forbes Health/OnePoll asked 1,000 U.S. adults about setting resolutions in a recent poll. Almost half (48%) said improving their fitness topped their list of goals. And I bet a full 100% (maybe 95%) want to look good while doing it!

That led me to Lululemon Athletica Inc. (Nasdaq: LULU)…

I think it’s safe to say at this point that Lululemon has changed the way we dress. It brought athleisure into the mainstream, and now we’re all running around town in our gym clothes — not that I’m complaining.

It turns out, selling premium clothes that make you look good and feel good is a solid business model. And that’s reflected in LULU’s Green Zone Power Ratings.

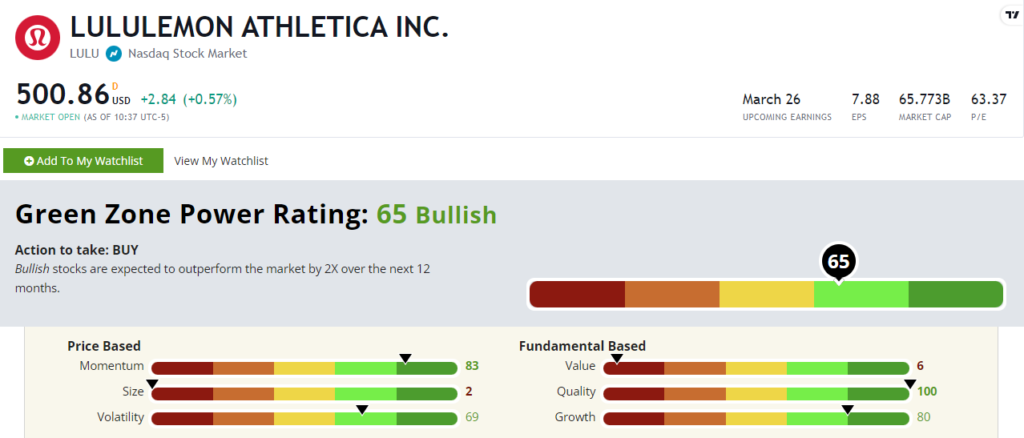

Lululemon stock rates a “Bullish” 65 out of 100 in Adam’s system. Over the next year, it’s set to beat the broader S&P 500 by 2X.

Looking closer, LULU has all the trappings of a booming tech stock. It sports solid Growth (80) and Momentum (83), while rating low on Size (2) and Value (6).

Put another way, investors jumped into LULU chasing growth and pushing its market cap to $65 billion … and now the stock is trading at exorbitant valuations. Its price-to-earnings ratio of 63.3 is more than double the S&P 500’s P/E of 25 and triple the apparel and accessory industry average as I write.

I realize we’re in the middle of a mini tech sell-off to start 2024, but Green Zone Power Ratings shows LULU is set to weather the storm.

I’m more of a Vuori guy, but I’m definitely adding Lululemon stock to my shortlist.

Like I said up top, I know New Year’s resolutions aren’t going to be a top mega trend of 2024. (If you’re looking for ways to invest in those, I highly encourage you to check out Adam’s Green Zone Fortunes.)

But that’s what’s so great about Green Zone Power Ratings. You can run with any investing idea you have. Just plug a stock into the search bar here, and you’re off!

I hope you have a fantastic start to 2024.

Until next time,

Chad Stone

Managing Editor, Money & Markets