You know my shtick. I love a high dividend. But ultimately, dividend growth is more important over time. Without consistent dividend growth, you’re losing ground to inflation year after year.

Over a short time horizon, you might not notice. But your retirement could last 20 years or more. If your payouts lag inflation by even a single percent, your purchasing power will erode by a significant amount over time.

Inflation compounds just like interest, and 1% erosion over 20 years means your dividend payments will be worth 22% less by the end.

That’s why I harp on dividend growth so much. A consistent, growing dividend hedges against inflation, while a high-yielding stock runs the risk of cuts below the inflation rate.

Gold is one the best inflation hedges over time. It’s been a store of value for millennia and will likely still be a store of value millennia from now.

So, why not include a blue-chip dividend-paying gold miner in your income portfolio?

A Top Inflation Hedge

This brings me to Newmont Corp. (NYSE: NEM). Newmont is one of the world’s leading miners with proven gold reserves of 94.2 million ounces. It has a sprawling global operation, including mines in: the United States, Canada, Mexico, Dominican Republic, Peru, Suriname, Argentina, Chile, Australia and Ghana. Apart from its gold mining operations, the company also produces significant amounts of copper, silver, zinc and lead.

Newmont yields 3.6% at current prices. That’s a very competitive yield in this environment.

The company’s profitability is dependent on the price of gold, and thus so is its dividend. When gold prices are stable or rising, Newmont tends to raise its dividend. When gold prices are trending lower, Newmont lowers its dividend.

For example, the 2013-2014 stretch was difficult for gold miners. Newmont lowered its dividend during those years. But it’s been steadily hiking the dividend since 2017. It has more than doubled its payout in the past year alone.

I don’t know where inflation goes from here. We’re in uncharted territory. But I do know that the Federal Reserve has expanded its balance sheet by trillions of dollars over the past year. And Chairman Powell isn’t slowing down. The Fed may or may not get this right. Only time will tell. But it only makes sense to have a little dollar insurance in the portfolio, just in case. Gold and gold miners like Newmont provide that insurance.

Newmont’s Green Zone Rating

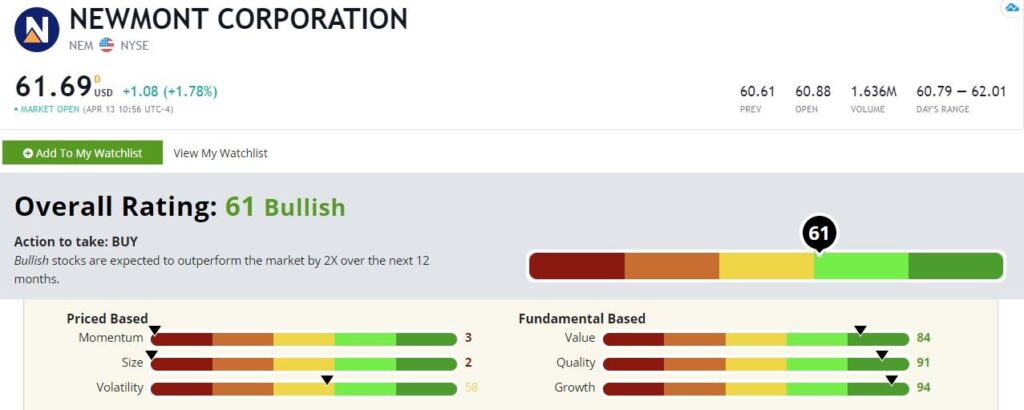

Let’s see how Newmont stacks up on Adam O’Dell’s six-factor Green Zone Ratings model. Overall, it rates a 61, making the cut as a “Bullish” stock in our model. Bullish stocks are expected to outperform the market by two times over the following 12 months.

Newmont Corp.’s Green Zone Rating on April 13, 2021.

Let’s do a deeper dive.

Growth — Newmont rates highest on growth at 94. This is impressive given that we measure growth over relatively long timelines as the gold market struggled for most of the last decade. Growth only picked up in the past couple of years. If inflation rears its ugly head, Newmont’s growth surge could be just the beginning.

Quality — Newmont also carries a high-quality rating of 91. Mining is a tough business. Expenses don’t change much, but revenues can vary wildly based on commodity market prices. When prices are exploding higher, miners make out like bandits. But when prices fall, cost control becomes critical. Smart debt management is key to survive down markets. And Newmont has proved itself.

Value — Stocks that rate well based on growth rate poorly on value in most cases. Newmont is an exception with an 84 value rating. Commodity-oriented stocks haven’t performed well over the past decade. Investors have preferred glitzier growth names, primarily in tech. But that’s changing. Value stocks have been enjoying a strong 2021 so far. If cyclical value stocks continue to outperform, Newmont is a great candidate to ride that wave higher.

Volatility — Newmont is more or less in the middle-of-the-pack based on volatility with a rating of 58. Given the boom-or-bust nature of the business, that’s actually a good testament to Newmont’s quality in this space.

Momentum — Newmont’s momentum score isn’t so hot at 3 out of 100. After a strong 2020, shares have trended lower this year. It looks like the recent stock downtrend bottomed out in February. If you want to be cautious, you could wait for Newmont to establish a new uptrend before buying shares.

Size — This is a large company with a market cap of $61 billion. Newmont size rating is 1 because of that.

Bottom line: Newmont is a competitive yielder with built-in inflation protection. But if you want to play it safe, you could average in spending a set amount in intervals. Or you could wait a few weeks to see if the stock develops a new uptrend before buying.

All told, Newmont should be on your dividend radar.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.