I was talking to my neighbor Danny the other day.

You might remember Danny … he asked me about investing in a new cryptocurrency some years back.

This time around, we were talking about trips to the grocery store.

He told me he spent more than $200 on groceries that might last a week, maybe two … and it’s just him, his daughter and his grandson.

Needless to say, he was beyond frustrated at the cost … and that’s without frivolities or extras.

And he isn’t alone. We’re all looking for ways to make our dollar go further amid inflation-fueled high prices.

The expectation for the near future is more pain at the checkout line… whether it’s for groceries, clothes or even household furnishings.

And that’s putting a dent in consumer confidence…

Consumer Confidence Is Not High… Repeat… Confidence Is Not High

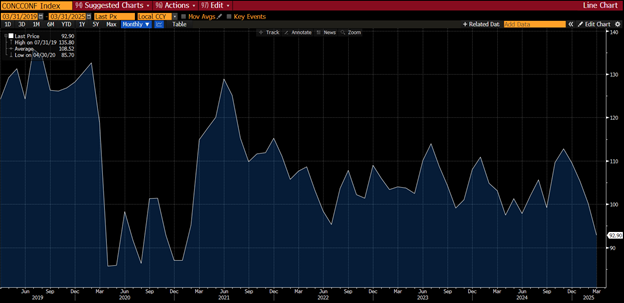

Every month, the Conference Board releases a survey of how Americans feel about everything from the economy to grocery store prices.

And the latest reading of consumer confidence is extremely telling…

Consumer Confidence Hits Low

In March, the gauge of consumer confidence dropped 7.2 points to 92.9 — well below economists’ estimates of 94.

It is the lowest reading of the index in four years.

What’s more, expectations for the next six months dropped 10 points to 65.2 — the lowest reading in more than a decade.

The biggest driver of these worries is the belief that we aren’t out of the woods on inflation and that new tariffs will make the situation worse.

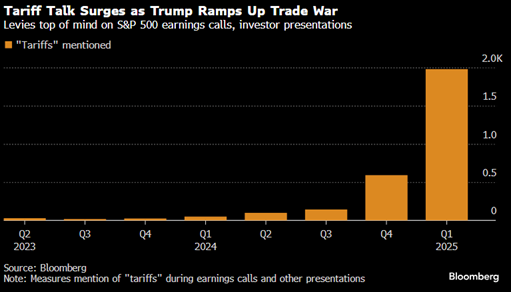

Companies have been sounding tariff alarm bells as well.

In the first quarter of this year, S&P 500 companies mentioned the word “tariff” nearly 2,000 times on their earnings calls and presentations.

That is a nearly 4X increase in mentions from the previous quarter.

So there is cause for concern as both businesses and consumers are considerably worried about the state of the U.S. economy and, perhaps more pressing, the price of goods we buy at the store.

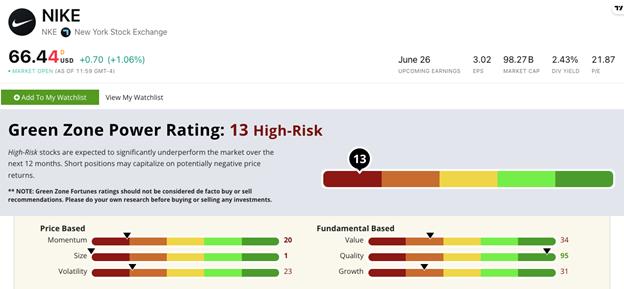

Using the Green Zone On Struggling Retailers

One of the biggest companies that has been affected by ongoing trade wars, tariffs and inflation is Nike Inc. (NKE).

The company imports 18% of its branded footwear from China, where the Trump Administration has levied an additional 20% tariff.

Nike also makes products in Mexico and other countries, and they are expecting tariff hikes in April.

In its earnings report last week, Nike predicted further revenue and profitability declines due to current and future tariffs.

But our Green Zone Power Ratings system has already flashed a warning sign…

NKE rates 13 out of 100 on Adam O’Dell’s proprietary system.

Nike’s recent earnings report dropped the stock more than 9% the day after its release. In the last month, it is down nearly 17%.

That’s why it scores a 20 out of 100 on Momentum.

The stock is also paying the price for that weak earnings report, as its Growth factor rating (31 out of 100) indicates.

The bottom line is that we can’t predict where prices will go. But, if you’re like Danny and I, you know they are already too high.

We also don’t know the overarching impact of current and future tariffs levied by the Trump Administration.

What we do know is that companies like Nike Inc. are taking a hit, and it’s even more important to find these knee-capped stocks now before making an unwise investment.

Green Zone Power Ratings helps us achieve that goal.

That’s all from me today. Have a great weekend.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets