Traditionally, when a company issued strong earnings, its stock would push higher.

Conversely, if earnings were down, the stock would follow suit.

However, something changed at the turn of the century.

In the 1970s, the Securities and Exchange Commission promoted the idea of companies releasing their financial forecasts during quarterly reports. The practice didn’t actually take hold until the 2000s.

Now, guidance can impact a company’s post-earnings stock movement more than the actual earnings themselves.

A company can report gangbuster quarterly numbers, but withdraw or lower their guidance, and the stock falls. Likewise, reaffirmation or strengthening of guidance can make a stock rise, even paired with lackluster earnings.

The reason for withdrawing or lowering guidance is typically related to economic uncertainty for the future.

In 2020, S&P 500 companies were more likely to pull their guidance or offer none at all because of uncertainty surrounding COVID-19 lockdowns.

Today’s uncertainty revolves around global trade and the reciprocal tariffs announced by the Trump administration.

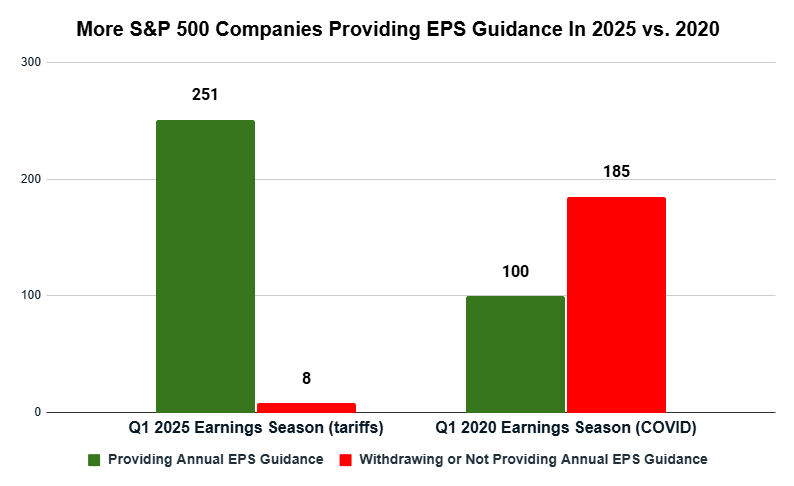

The interesting thing is that today’s uncertainty isn’t causing S&P 500 companies to shy away from offering guidance:

Of the S&P 500 companies reporting quarterly earnings in the first quarter this year, 251 have provided annual guidance, despite the uncertainty surrounding global trade.

Compare that to just 100 companies that provided guidance in the first quarter of 2020 amid COVID-19.

Of the 251 offering guidance, 139 maintained their previous EPS guidance, 64 raised their guidance, and 37 lowered it.

On the other hand, we aren’t seeing nearly as many companies withdrawing their annual EPS guidance in 2025 as we did during the early days of the pandemic. Only eight companies have withdrawn compared to 185 in 2020.

Earlier last month, we noted this potential for a trend after Delta Airlines (DAL) withdrew its future guidance. But it’s clear that, after looking at the aggregate data, this wasn’t as prevalent an issue.

Let’s shift gears a bit and see which companies could face a bullish earnings swing next week.

Look for “Bullish” Earning Guidance on 3 Stocks

For this part of our Earnings Friday analysis, we focus on companies expected to beat their previous quarter’s earnings and, thus, potentially trade higher if those expectations are met … or even exceeded.

For this screen, stocks must meet four criteria:

- The stock is covered by 10 or more analysts.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

Here are three important companies set to report this week:

These three companies all have the potential to surpass their previous quarter’s earnings per share.

The biggest thing that jumps out to me here is Dollar Tree Inc. (DLTR).

Dollar Tree’s last quarter was pretty rough with a $17.18 loss per share in earnings, so I dug a little deeper.

The company’s biggest issue during the last quarter was the sale of its Family Dollar business to Brigade and Macellum for $1 billion.

However, its same-store net sales were just 2% higher year over year, and its traffic was only 0.7% higher.

Its quarterly expenses were higher, but its operating income was lower.

I expect its first quarter numbers to show significant improvement as discount retailers like Dollar Tree stand to benefit from continued higher inflation and economic uncertainty.

I’ll be looking for the company’s guidance for the following quarter and the rest of the year in its quarterly report.

Now, let’s peek into companies that could face bearish earnings next week…

“Bearish” Earnings to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

Our screen brought back three companies:

Lululemon Athletica being on the list isn’t too surprising considering the state of consumer confidence and inflation still staying in the game.

When your paycheck doesn’t go as far as it used to, most households start cutting back on discretionary expenses.

In this case, Lululemon is hampered by its brand quality and higher price point for its apparel.

Just like with Ulta Beauty (see last week), if discretionary spending continues downward, sales will follow at Lululemon.

This could adversely impact LULU’s “Neutral” rating on Adam’s Green Zone Power Rating system. Strong factor ratings on Quality and Growth buoy that rating.

However, if the company’s earnings per share drop as estimated, those factor ratings will fall … along with LULU’s overall rating.

That’s all from me today. I hope you all have a great weekend.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets