It’s only happened one other time since starting What My System Says Today back in March…

My Green Zone Power Rating “New Bulls” screen came up with zero stocks from the S&P 500.

If you’re only interested in buying into stocks from the world’s most popular large-cap index, you’re likely a little bummed out by that fact.

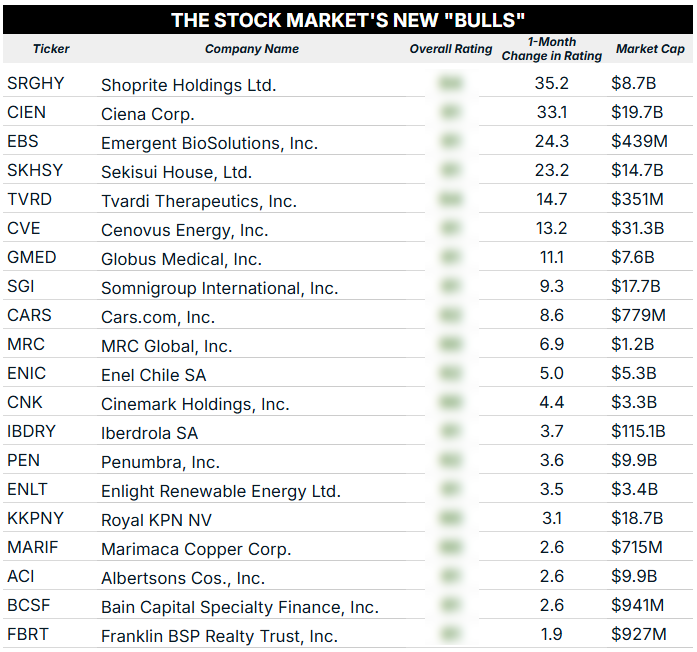

But if you know that outsized, market-beating gains can also come from the right selection of smaller, lesser-known stocks … you’ll be happy to know that 20 stocks outside the S&P 500 entered the “Bullish” zone since last week — and thus are positioned for outperformance from here.

Looking at this week’s “New Bulls” list, you’ll also notice that there’s a lean to the larger side of the market-cap spectrum. So even if these stocks aren’t in the S&P 500, they’re still a healthy size if you’re looking for a potentially steadier play than a small- or micro-cap stock.

With all that said, let’s see what this week’s screen revealed…

20 “New Bulls” Outside the S&P 500

One crucial thing to remember when using my Green Zone Power Rating system is that investors make the market, and thus, help determine the overall rating of stocks in my system.

Sure, a business might have a rock-solid balance sheet driving its Quality rating up, or its Growth rating is incredible due to massive (and growing) revenues pouring in.

However, we also have to consider a stock’s actual price action. It’s why I’ve developed my system with six factors in mind. Who wants to buy into a business with incredibly strong financials if no one else is buying at the same time? That’s a recipe for frustration in your portfolio.

As I shared above, I am happy to report that we have 20 stocks that passed my “New Bulls” screen this week that aren’t currently on the S&P 500 index. That means they just hit a rating of at least “Bullish” (60+) after being rated lower for at least the last month.

These are the stocks with incredible potential as investors branch out from the largest U.S. companies:

Once again, seven stocks have improved by double-digits in my Green Zone Power Rating system over the last four weeks.

Here’s how the list looks broken out by market cap:

- 2 Micro-cap stocks (<$500 million).

- 5 Small-cap stocks ($500 million to $2 billion).

- 7 Mid-cap stocks ($2 billion to $10 billion).

- 6 Large-cap stocks (>$10 billion).

With 13 of 20 stocks (65%) carrying market caps north of $2 billion, you have a lot of options if you’re looking for outperformance within the large-cap market.

Of course, I also encourage you to consider those stocks on the smaller side. With the Fed’s latest rate-cutting cycle now in motion, smaller companies will have a chance to turn cheaper financing into rocket fuel for their stocks as investors anticipate new growth opportunities.

This 20-stock list is a fantastic starting point if you’ve been wanting to give my Green Zone Power Rating system a spin. Click here to see how you can join my flagship investing service, which includes full access to the system.

Once you’re in, you can click this button on our homepage to start searching for these or thousands of other tickers.

To good profits,

Editor, What My System Says Today