In the small town of West Mineral, Kansas, you can see an exhibit called “Big Brutus.”

Once the world’s largest electric shovel at 160 feet tall, Big Brutus was used to excavate coal in the mines of southeastern Kansas.

What was a rare colossus is now the norm.

The average height of a truck hauling dirt from mines is more than 22 feet — or four of me standing on top of one another!

Companies use this larger equipment because it’s faster and more efficient.

And as excavation for oil, gold and other precious metals continues to rise, the need for this kind of heavy machinery will grow.

Revenue from heavy machinery used in agriculture, construction and mining dropped to $68 billion in the U.S. during the COVID-19 pandemic.

As you can see in the chart above, by 2024, estimates show that revenue will reach $75.4 billion — a 10% jump — hitting levels we haven’t seen since before the coronavirus crash.

Today’s Power Stock is North American Construction Group Ltd. (NYSE: NOA).

The Canada-based company provides heavy equipment, maintenance and mining services in both Canada and the U.S.

NOA scores a “Strong Bullish” 99 out of 100 on our Stock Power Rating system, and we expect it to crush the broader market by 3X in the next 12 months.

NOA Stock: High Value + High Growth

Two items stood out to me in my research:

- Its stock is undervalued compared to its peers. Its price-to-earnings ratio is a low 10.3, compared to the industry average of 22. NOA’s price-to-sales is an even 1 — its peers’ average is 1.39.

- According to its most recent annual presentation, the company has five long-term contracts on mines with 30+ years of remaining life. The need for NOA’s machinery isn’t going away anytime soon.

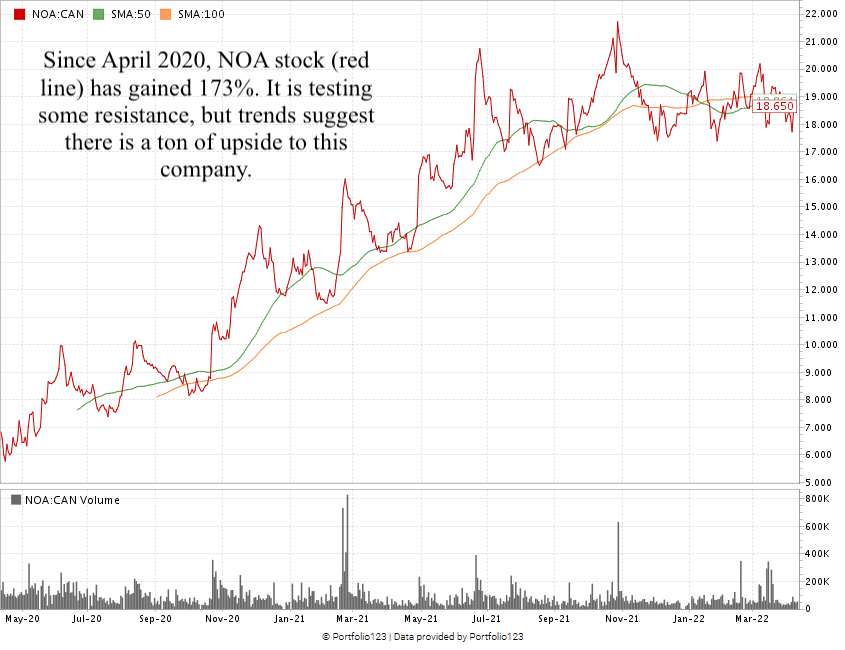

Since April 2020, NOA has climbed 173%. It hit a 52-week high in November 2021.

Some of those gains have pared back, but we see it testing resistance at the $15 mark with a potential breakthrough in the near future.

North American Construction Group Ltd. stock scores a 99 overall — it’s in the top 1% of all stocks we rate.

That also means we’re “Strong Bullish” on NOA and expect it to beat the broader market by at least three times in the next 12 months.

In terms of value and growth, you get the best of both worlds with this stock. NOA rates in the top 6% of all stocks we rate in both categories — which is a rarity.

The stock also comes with a forward dividend yield of 1.72%, or $0.26 per share … so you get paid just to hold it in your account.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Ratings and stock chart updated on April 12, 2022.