When it comes to department stores, I tend to avoid Nordstrom.

Not because I don’t like its products or the designers it carries — there are some beautiful choices.

But I’m more comfortable shopping at Macy’s or Dillard’s — maybe even Kohl’s if I have some extra Kohl’s Cash lying around.

Now, this could be my insecurity.

Or it could be because Nordstrom has gained notoriety for appealing to the upper class as a high-end department store.

But with inflation hitting Nordstrom as much as its industry peers, it’s seeing middle-class customers tighten their spending.

Now Nordstrom is struggling to hit its sales goals.

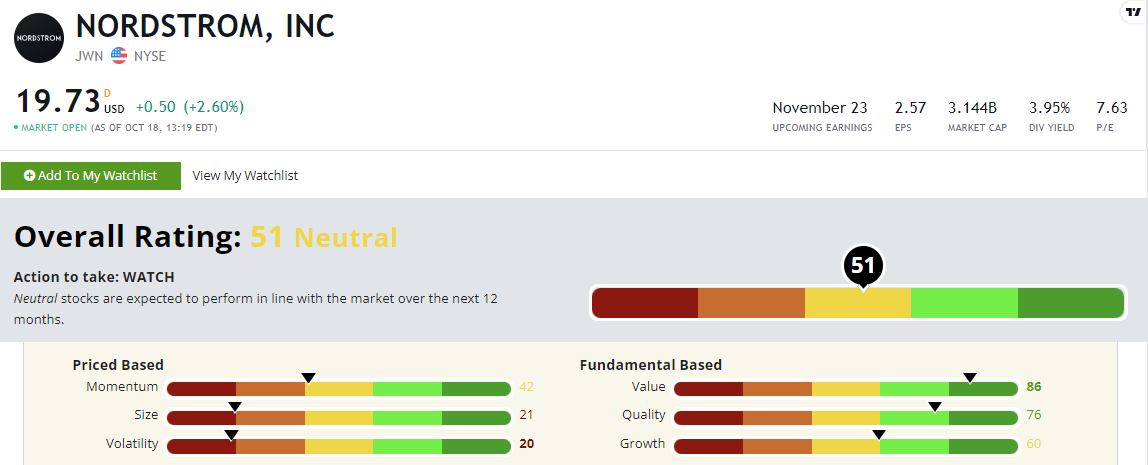

Nordstrom Inc. (NYSE: JWN) rates a “Neutral” 51 out of 100 on our proprietary Stock Power Ratings system.

As the holiday season approaches, Nordstrom is going all-out to gain consumers.

Let’s take a look at a few of these plans.

Nordstrom’s Holiday Plans

Nordstrom and Nordstrom Rack are preparing for the holiday season with exciting promotions. Some of these include:

- In-store gifting stations with a curated set of products perfect for stocking stuffers.

- Grab-and-go boxed gifts priced at $25, $50 and $100.

- In-store and virtual holiday-based events featuring special guests like influencers, interior designers and more.

These promotions seem like Nordstrom is set for a promising holiday season.

But Nordstrom is also one of the retailers that cut seasonal employee hiring from 28,600 in 2021 to 20,000 in 2022.

This shows that Nordstrom is still in trouble despite all these exciting plans.

These promotions appear to be an attempt to offset a stark drop that occurred in September for Nordstrom’s stock.

I’ll get into that in a bit when I zoom in on the company’s momentum.

Time will tell how Nordstrom’s promotions will affect its sales during the holiday season.

Until then, let’s take a closer look at its Stock Power Ratings to see how it is expected to perform over the next 12 months.

JWN’s Stock Power Ratings and Momentum

Nordstrom stock rates a “Neutral” 51 out of 100 on our proprietary system.

JWN’s Stock Power Ratings in October 2022.

As we focused on Macy’s momentum, I also want to look closer at Nordstrom’s to see how it stands.

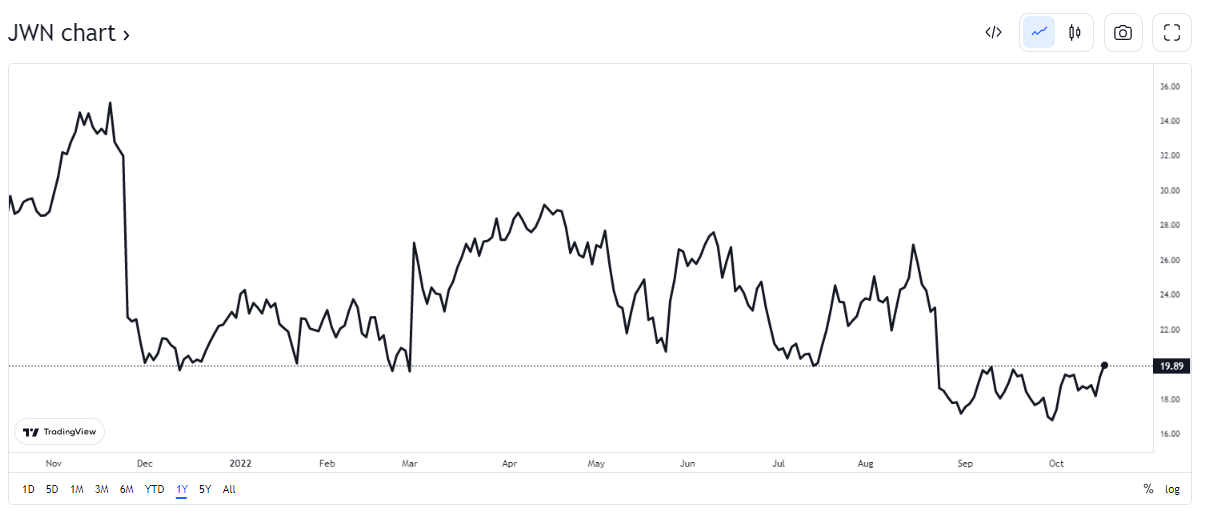

Here’s how Nordstrom stock performed over the last 52 weeks:

Something to note: When we look at momentum we consider a stock’s short-, medium- and longer-term trends.

For a high momentum score, we want to see all trends on the upside.

This isn’t the case for Nordstrom.

JWN (red line) stock plummeted to a 52-week low of $16.14 on September 30.

This shows a short-term downward trajectory for the stock.

Nordstrom earns a “Neutral” 42 on our momentum factor.

The Bottom Line

Nordstrom scores a “Neutral” 51 out of 100 on our Stock Power Ratings system.

Stay tuned: I will discuss Dillard’s, which earns a “Strong Bullish” rating, tomorrow.

“Strong Bullish” stocks are no anomaly.

We expect those stocks to beat the broader market by 3X in the next 12 months!

To get one highly rated stock you should consider investing in, check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock to buy or avoid on our system and tells you why — for free!