Yesterday was a bloody day for tech stocks, and particularly some of the biggest names in AI.

Meta Platforms (META) was down close to 3%, Oracle (ORCL) was down close to 4%, and Tesla (TSLA) and Amazon (AMZN) both dropped about 2%, to name a few.

As for the “why,” it’s simple. Folks are finally starting to look through the hype and ask critical questions.

For instance, when OpenAI CEO Sam Altman says that he plans to spend $1.4 trillion building data centers, investors are asking where exactly he plans to find that kind of money given that it has no clear path to profitability and currently loses billions per year.

If OpenAI must scale back ahead, “right-sizing” its ambitions and promises, the entire AI economy that has grown and intertwined with it starts to look suspect really quickly.

So, are we in the early stages of a major market rotation out of tech and into “old economy” stocks?

That’s what my system says today …

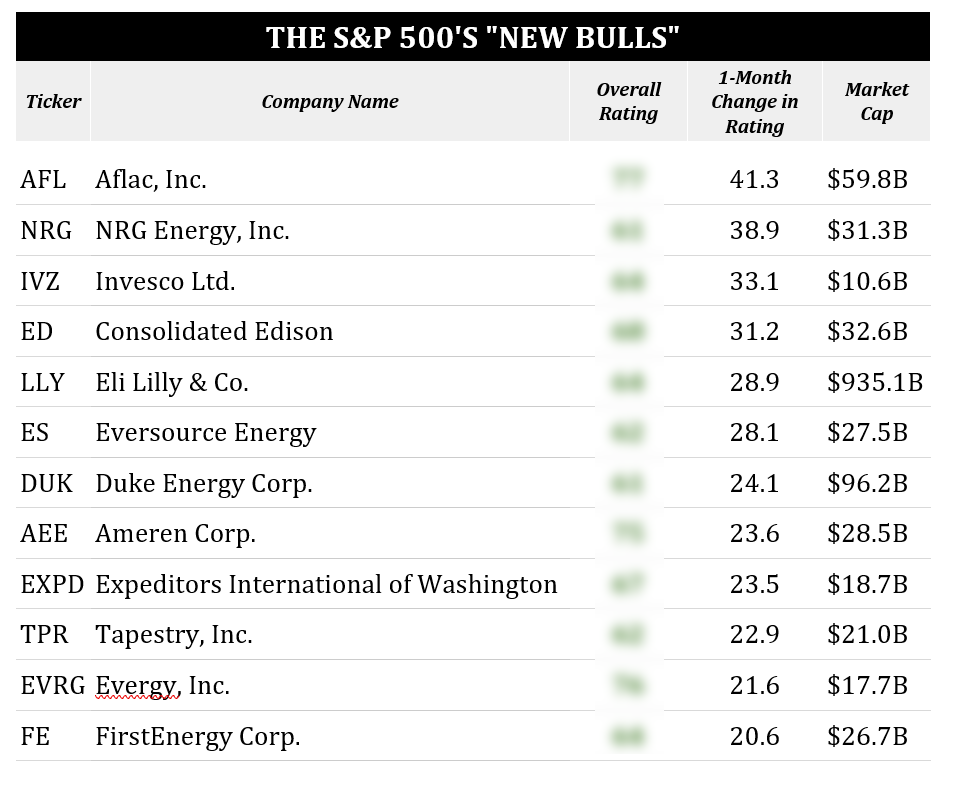

This week we’re seeing a major surge of old-economy stocks showing up as newly “Bullish” on my Green Zone Power Ratings system.

In fact, the list of new S&P 500 stocks was so long, I had to reduce it to newly “Bullish” stocks that also saw a jump of at least 20 points on their rating… and I still got 11 fresh names (none of them strictly “tech”).

To me, a couple things jump off the page.

For one, utilities are highly represented. NRG Energy (NRG), Consolidated Edison (ED), Eversource Energy (ES), Duke Energy (DUK), Evergy (EVRG) and FirstEnergy (FE) are all American electrical utility companies. That’s more than half the list.

And here’s where it gets interesting…

Utilities have traditionally been thought of as defensive dividend stocks for “widows and orphans.” My own grandmother is one of them (a widow, not an orphan). At 96 years old, she’s still sharp as a tack, but spends more time talking about her glory days as an executive at the local telephone company, and her dividend stocks, than she does talking about Nvidia CEO Jensen Huang’s next move.

Well, as the sayings goes, today’s utilities stocks “aren’t my grandmother’s utilities stocks!”

Just consider that NRG rates an 82 on my system’s growth factor … a utility rating better than 82% of all companies, on growth!

In fact, all six of the utilities listed above rate as either “Bullish” or “Strong Bullish” on the growth factor, and most rate higher on growth than they do on value.

We know why this is…

The AI boom has created massive new demand for electricity, and for the first time since the mass electrification of the country a century ago, utilities can be considered growth stocks.

Paid-up Green Zone Fortunes members know well of this underappreciated, “picks and shovels” way to play the AI mega trend. I recommended buying NRG Energy (NRG) last August and we’ve already doubled our money in the play.

As a solid, cash-generating business I saw NRG as a safer way to put money to work in the AI mega trend, and still earn fantastic returns. But I’ve also warned subscribers to view this more as an “AI” position than a traditional dividend-paying utility.

As more folks jump on the bandwagon, NRG’s valuation is getting stretched to the upside … and, naturally, it could re-price (lower) if folks begin to see the AI capex boom slowing.

Of course, you don’t have to limit yourself to the S&P 500 to find new highly-rated stocks …

Major Jumps in Some Unexpected Places

My outside-the-S&P “New Bulls” screen produced an exceptionally long list this week, so I limited it to stocks that had seen their score jump at least 30 points over the previous month. I still got 28 names.

As was the case with the newly “Bullish” stocks within the S&P 500, it’s a list of mostly non-tech companies.

There are exceptions, of course. The stock that mounted the largest jump in its overall rating (55.5 points!) is Skywater Technology (SKYT), a small and budding American chip foundry … and a stock my 10X Stocks subscribers have recently doubled their money on.

But outside of Skywater, the “New Bulls” list above is light on pure-play “tech” names.

One interesting addition is Vestas Wind Systems (VWDRY), the Danish maker of wind turbines.

If there was ever a company that would seem to be at odds with the Trump administration’s agenda, Vestas would be it. Trump has made no secret of his disdain for wind energy and has shown a strong preference for traditional fossil fuels.

And yet, Vestas has enjoyed a fantastic winning streak this year. The American-traded ADR shares have more than doubled off their March lows.

Vestas rates a “Strong Bullish” 90 on my Green Zone Power Ratings system. Based on historical data, stocks with Strong Bullish rating are expected to outperform the market by 3X over the following 12 months.

Vestas rates exceptionally well on its growth factor with a score of 92. And it rates well on its momentum, value and volatility factors as well with factor ratings of 86, 77 and 75.

All told, consistent monitoring of our “New Bulls” lists is critical to, as the saying goes, skating to where the puck is going, not where it’s been. This is ever more important as we anticipate a jarring shift away from bloated “Big Tech” names, making room for fresh opportunities in lesser known (and far less hyped) ones.

To good profits,

Editor, What My System Says Today