From our cars to our kitchen knives, steel is everywhere.

The biggest use of the metal is in construction: The industry makes up over half of the world’s steel demand.

High-rise buildings, industrial sheds, bridges, parking garages and houses all need steel.

Steel is prominent because it’s a durable metal that can withstand a lot of weight.

In 2021, the world produced a record 1.95 billion metric tons of crude steel, as you can see above.

Of that, the U.S. consumed 98 million. That’s an 18% increase in steel consumption compared with the same period the previous year.

The trends are clear: The world is consuming and producing more steel than ever before.

That brings me to the Power Stock I think you need to consider today: Nucor Corp. (NYSE: NUE).

Based in North Carolina, Nucor makes products used in building construction: sheet and plate steel, steel rebar, beams and planks.

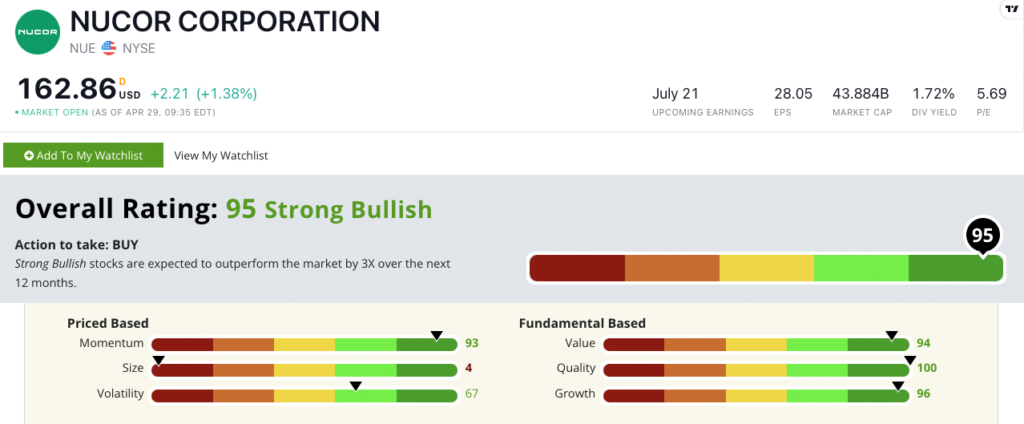

NUE scores a “Strong Bullish” 95 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

NUE Stock: Max Quality + Strong Growth, Value and Momentum

Two items stood out about NUE when I dug into the company:

- Last year’s net sales were $36.5 billion — up 81% over 2020’s sales of $20.1 billion. That is a monster of a year.

- The company demolished its record for earnings per share (EPS). In 2021, EPS were $23.16, crushing its 2018 record of $7.42.

The first thing to point out about NUE is that it’s a high-quality stock. It earns a perfect 100 on the metric, as you can see above in its Stock Power Rating!

Its returns on assets, equity and investments are impressive — between 32% and 60%. The metal products industry averages are just 3% to 11%.

NUE’s massive 2021 jump in sales puts it in the top 4% of all stocks we rate on growth (it scores a 96).

Raising sales by 81% and earnings per share by 879.5% shows enormous growth potential for Nucor.

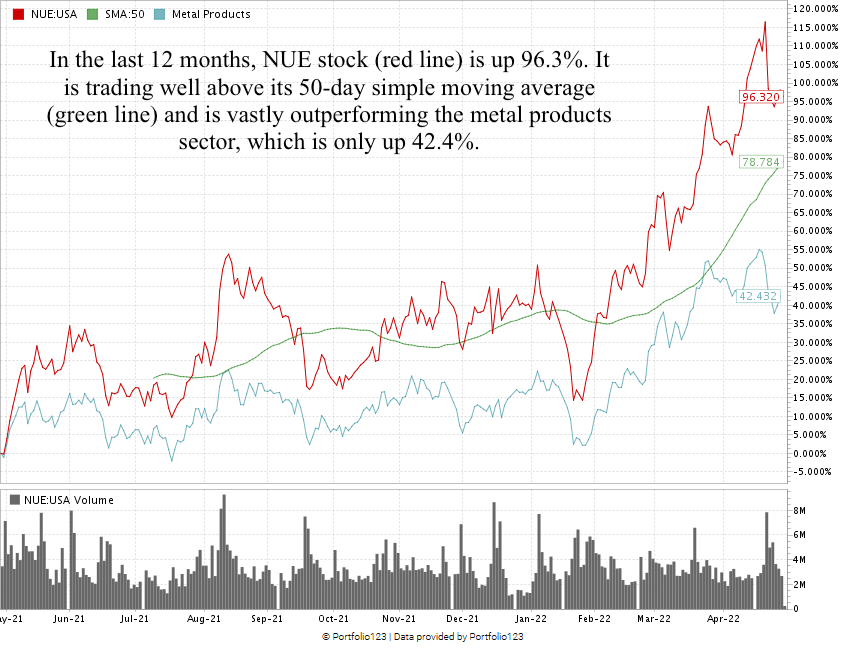

On April 21, 2022, NUE notched a new 52-week high of $175.

A pullback in the broader market pared those gains, but NUE is still up 96.3% over the last 12 months — more than doubling the performance of its peers, who average a 42.4% gain in the last 12 months.

It still trades about $13 above its 50-day moving average, which is a strong bullish sign for the stock.

Nucor Corp. stock scores a 95 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The company went gangbusters in 2021, and I expect the same in 2022 and beyond.

Stay Tuned: Data Storage Stock Crushes Market

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on one tech company that’s beating the pants off its competition!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets