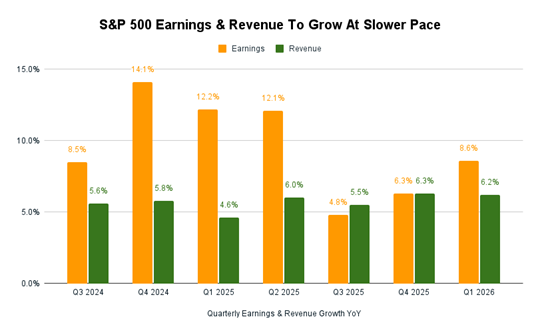

S&P 500 companies have seen earnings go through the roof over the last several quarters.

In the fourth quarter of 2024, earnings grew 14.1%.

That was followed by 12.2% earnings growth in the first quarter of 2025.

Growth is expected to hold steady this quarter, but projections show a significant slowdown through the rest of the year.

Revenue will be steady to higher, but increased tariff costs and inflation will nibble away at earnings per share for S&P 500 companies.

Projections for the third quarter show earnings increasing only 4.8% — the lowest rate since the third quarter of 2024.

Certainly not horrible news, but definitely something to keep our eyes on.

Today, I’ll revisit a projection I made myself last week. Then, I’ll analyze “bullish” and “bearish” earnings potentials for next week.

Let’s get after it…

Sometimes Cheaper Is Better

Last week, I highlighted earnings for TJX Cos. Inc. (TJX) and said I believed it would not only outperform expectations for the quarter but also report resiliency for the rest of the year.

That’s because these discount stores have become increasingly popular as Americans try to stretch their spending dollars amid higher inflation.

TJX Cos. Inc. is the parent company of TJ Maxx, Marshalls and HomeGoods — retailers that specialize in selling cheaper name-brand clothes, accessories and other household items.

Analysts expected TJX to beat the previous quarter’s earnings, but I suggested it would go even farther than that.

It did.

The company reported EPS of $1.10 (vs. $1.01 expected) on revenue of $14.4 billion (vs. $14.1 expected).

Even when inflation is rising, we still need things like clothes, bathroom towels and other products, and we look for the best deals on those items.

Judging by its impressive increase in quarterly revenue and earnings, customers are choosing stores run by TJX Cos. Inc.

In addition to blockbuster quarterly earnings, the company raised its full-year earnings guidance to $4.52-$4.57 per share, up from $4.34-$4.43.

Not only did the company outperform this quarter, but it expects its sales and foot traffic to continue growing through the end of 2025.

As a result, TJX shares touched an all-time high on Wednesday. However, they pared back some of those gains on Thursday… likely due to the broader market decline.

TJX is still rated “Bearish” in our Green Zone Power Rating system, but I believe this strong earnings report and subsequent price action will move its rating higher.

Pro tip: To see where TJX stands, click here to see how you can gain full access to Adam’s system with a Green Zone Fortunes subscription.

Now, let’s analyze potentially “bullish” earnings for next week.

These stocks are expected to beat their previous quarter’s EPS, and thus, if those expectations are met or exceeded, they could potentially trade higher.

“Bullish” Earnings to Watch

For this screen, stocks must meet four criteria:

- 10 or more analysts cover the stock.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

Here are the eight companies that made the list:

It might be the most anticipated earnings announcement of the quarter … only because it’s been the most anticipated of the previous four quarters.

Nvidia Corp. (NVDA) has been at the forefront of the conversation relating to all things tech, but more specifically, artificial intelligence.

Analysts are betting that the on-again, off-again ban on H20 processors being sold to China will have minimal impact on Nvidia’s bottom line this quarter.

Instead, continued growth in AI data center spending will increase the company’s bottom line.

I agree.

NVDA continues to tear up the market…

NVDA Up 27% In 2025

The stock is up 27.2% year to date, compared to the S&P 500’s 7.7% gain.

Despite a recent sell-off in the tech sector due to questionable valuations, Nvidia remains alone on an island when it comes to providing components necessary for data centers to process complex AI systems.

In fact, I can see Nvidia beating expectations… not by a huge amount, but beating nonetheless.

The question becomes whether these consistent rises in earnings and revenues continue through the rest of the year.

Now, let’s pivot and look at potentially “bearish” earnings for next week…

“Bearish” Earnings to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

Here are the three S&P 500 companies that passed this screen:

All good things must come to an end.

For Ulta Beauty Inc. (ULTA), its partnership to sell its products inside Target stores will end in August 2026… a partnership that began in 2021.

This break-up has nothing to do with Ulta’s earnings this quarter, but it may impact earnings later next year.

As for this upcoming quarterly call, the key will be to see how Ulta navigated through tariff costs.

Recently, cosmetics giant Estee Lauder reported a 12% decline in sales due to tariff costs. Those costs are projected to impact Estee Lauder’s profitability by $100 million through 2026.

One thing Ulta has going for it is its domestically sourced ecosystem, which helps it get around tariffs.

It does not, however, have much protection from rising prices.

That will be the most significant impact on Ulta … bottom-line sales falling due to higher prices.

Not making a call on this one, but an earnings miss could negatively affect ULTA’s “Bullish” rating on Adam’s Green Zone Power Rating system.

We’ll wait and see.

Have a great weekend, everyone.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets