Money & Markets Week Ahead for February 21, 2021: Nvidia Corp. (Nasdaq: NVDA) reports earnings and another SPAC is set to launch.

Last week was relatively quiet for investors — aside from GameStop and Robinhood’s hearing in Congress.

Then there was bitcoin hitting the $50,000 mark.

Looking ahead to this week: Earnings continue to wind down, and a tentative SPAC IPO is on the horizon.

Here’s what to look for in the week ahead on Wall Street:

On the IPO Front

There is only one initial public offering (IPO) on the calendar this week.

MCAP Acquisition has tentatively scheduled its IPO for Tuesday. It plans to trade on the Nasdaq under the symbol MACQU.

What it is: MCAP Acquisition is a special purpose acquisition company (SPAC). These kinds of companies are also known as “blank check” companies.

It was formed by Monroe Capital Corp. (Nasdaq: MRCC) with the intent of targeting private technology companies for reverse merger and public listing.

MCAP Acquisition is led by heads of Monroe Capital:

- CEO and Chairman Theodore Koenig.

- Co-Presidents Zia Uddin and Mark Solovy.

- CFO Scott Marienau.

As of September 30, 2020, Monroe Capital had more than $9.1 billion in assets under management.

The offering: The Chicago-based company intends on raising $250 million by offering 25 million units at a price of $10 per.

According to Renaissance Capital, one unit represents one share of common stock and one-third of a warrant, exercisable at $11.50.

If all things go to plan, MCAP Acquisition would have a market value of around $313 million.

Cowan is the only bookrunner on the deal.

Deeper Dive: NVIDIA Corp. (NVDA) Earnings

Earnings may have slowed down this quarter, but there are still some large, well-known companies yet to report.

One big one this week is NVIDIA Corp. (Nasdaq: NVDA). The company will report its quarterly earnings on Wednesday.

The company focuses on personal computer graphics, graphics processing units and artificial intelligence.

Its stock has been on fire coming off March 2020 coronavirus crash lows.

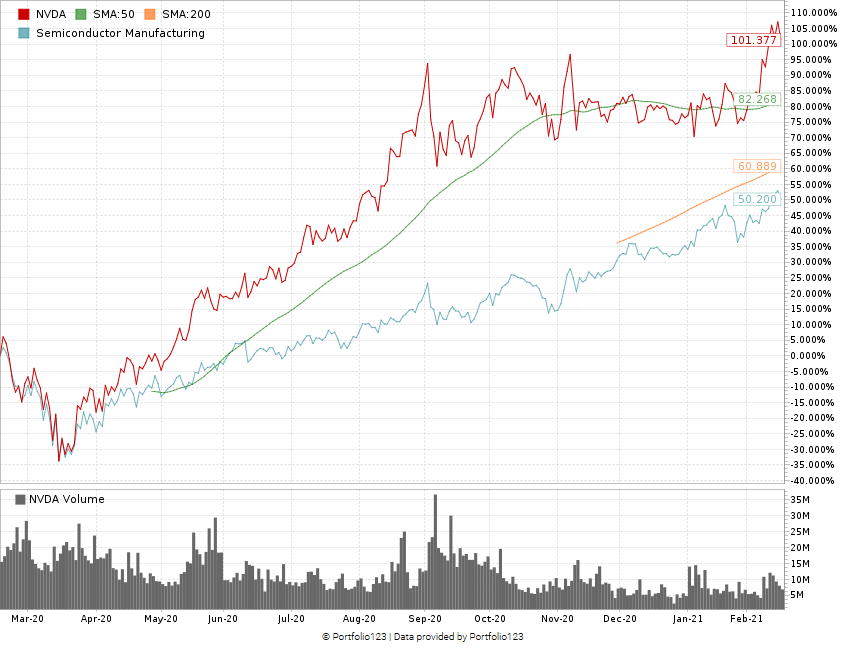

NVDA Stock Jumps 199% Off March 2020 Lows

In the last 12 months, NVIDIA stock has climbed more than 100% compared to the broader semiconductor manufacturing industry — which has only risen 50%.

NVIDIA’s balance sheet weathered 2020 nicely, the company reported a 49% increase in its revenues for the 39 weeks ending October 25, 2020.

Its net income jumped 56% to $2.88 billion over the same period.

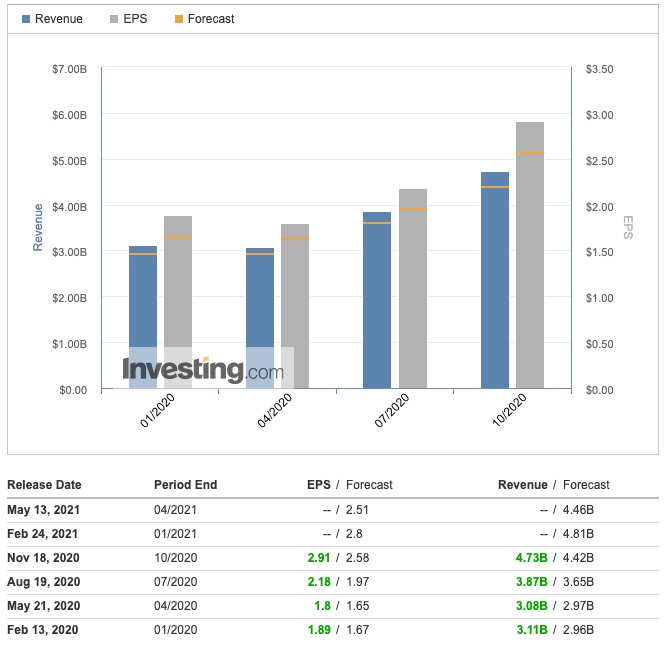

The company has consistently improved its earnings per share and revenue in each of the last four quarters.

NVDA EPS Climbs Near $3

Forecasts for Wednesday’s earnings are for earnings per share of $2.80 on revenue of $4.81 billion.

I like the estimate, but I think NVIDIA can beat it. I can realistically see closer to $3 per share of earnings on $4.85 billion in revenue.

Regardless, NVIDIA stock continues to rise, and I don’t see that stopping any time soon.

Pro tip: Nvidia ranks 68 overall on Adam’s Green Zone Ratings system. It rates 99 on both quality and growth and 73 on momentum and volatility. See more here.

Money & Markets Week Ahead: Data Dump

On Thursday, the Commerce Department will reveal real consumer spending for the month of February.

The report measures the inflation-adjusted amount of money spent by households in the U.S. economy. This report covers both durable and non-durable goods.

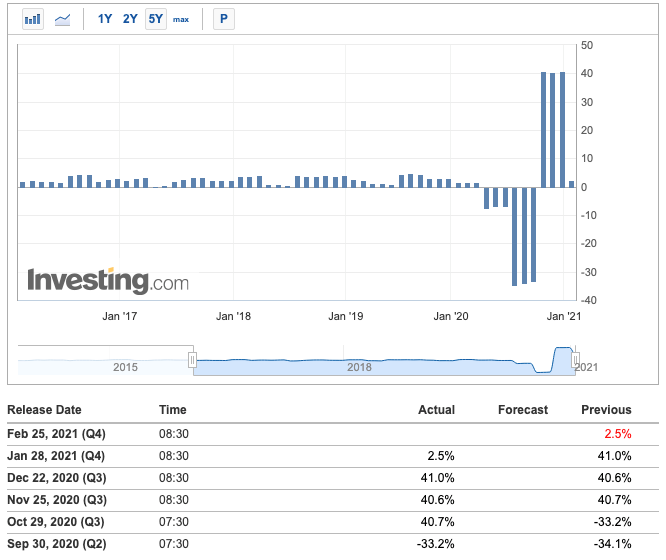

Consumer spending saw its biggest dips in five years during the months of June, July and August of 2020.

Spending in each of those months dropped more than 30%, preceded by 7-8% reductions in spending from April to May — the height of the COVID-19 pandemic.

Consumer Spending Rebounds in Late 2020

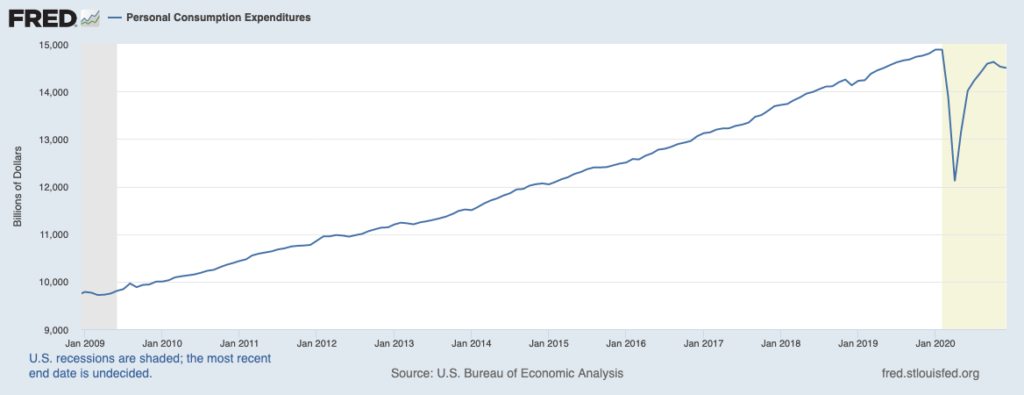

To look at the numbers another way, there is the Federal Reserve’s Personal Consumption Expenditures report.

This is a measure of the prices consumers in the U.S. pay for goods and services.

Personal Expenditures Rebound at the End of 2020

Source: Federal Reserve.

From 2009 to just before the COVID-19 pandemic in 2020, the rate of personal spending was steadily increasing.

It dropped from a high of $14.8 trillion in February 2020 to $12.1 trillion in April.

Personal expenditures rebounded to around $14.4 trillion in December 2020.

Expectations for consumer spending are for a 2.5% drop off.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out this week:

Monday

Berkshire Hathaway Inc. (NYSE: BRK.B)

Palo Alto Networks Inc. (NYSE: PANW)

Diamondback Energy Inc. (Nasdaq: FANG)

Tuesday

Home Depot Inc. (NYSE: HD)

Square Inc. (NYSE: SQ)

American Water Works Co. Inc. (NYSE: AWK)

Wednesday

Nvidia Corp. (Nasdaq: NVDA)

Lowe’s Companies Inc. (NYSE: LOW)

Rent-A-Center Inc. (Nasdaq: RCII)

Thursday

Salesforce.com Inc. (NYSE: CRM)

Moderna Inc. (Nasdaq: MRNA)

American Tower Corp. (NYSE: AMT)

NetEase Inc. (Nasdaq: NTES)

Friday

DraftKings Inc. (Nasdaq: DKNG)

Foot Locker Inc. (NYSE: FL)

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.