When I was a kid, if an advertiser wanted to get your attention, they used either television, radio or newspapers.

Those days are long gone as marketers have shifted to digital means to reach customers. (Think of the ubiquitous ads on websites and mobile apps.)

Spending on digital advertising continues to break records, as you can see in the bar chart below:

Spending on digital ads jumped 15% during the COVID-19 pandemic as marketers took advantage of reaching out to people who were staying home.

But the trend isn’t stopping — quite the opposite! Analysts project that U.S. digital ad spending will reach $278.5 billion by 2024 — an 82% increase over 2020.

Meanwhile, global spending on digital ads will reach $526.1 billion. This means the U.S. will account for 53% of global digital advertising.

Companies with a strong digital presence will see massive numbers in the years ahead … and smart investors will see big profits.

Today’s Power Stock is Nexstar Media Group Inc. (Nasdaq: NXST).

Nexstar provides sales, programming and other services to 37 television stations. It owns and operates another 198. It also offers advertising platforms through its own and third-party websites and apps.

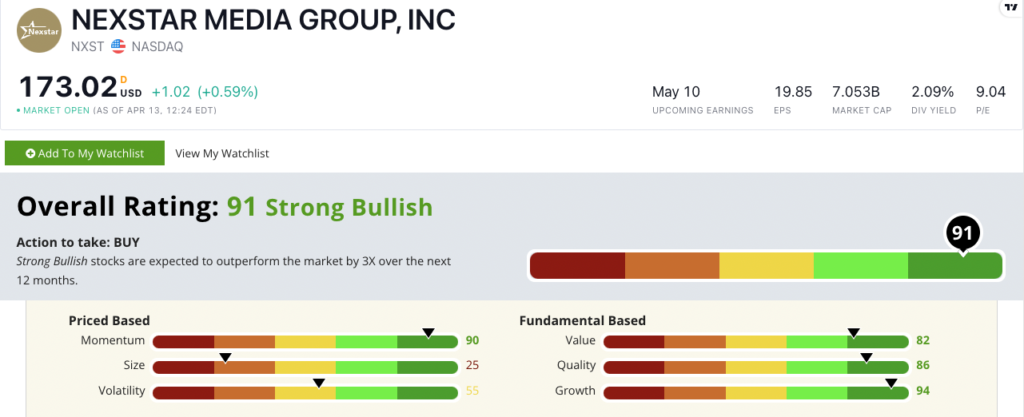

NXST scores a “Strong Bullish” 91 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

NXST Stock: Strong Momentum and Growth in Online Ad Space

In my research on NXST, two points impressed me:

- In January 2022, NXST’s digital arm increased its year-over-year unique visitor count by 45%. Its websites and apps now reach 48% of the U.S. digital audience.

- Those users generated 820 million page views across all platforms.

It’s easy to think of NXST as a television company and nothing more, but frankly, that’s short-sighted.

I see it as a digital advertiser — one with superb growth. Its three-year sales growth rate is 19%, and its earnings-per-share growth rate over three years is 32.2%.

In the competitive world of digital advertising, NXST capitalizes on its expanding online and app presence by monetizing users.

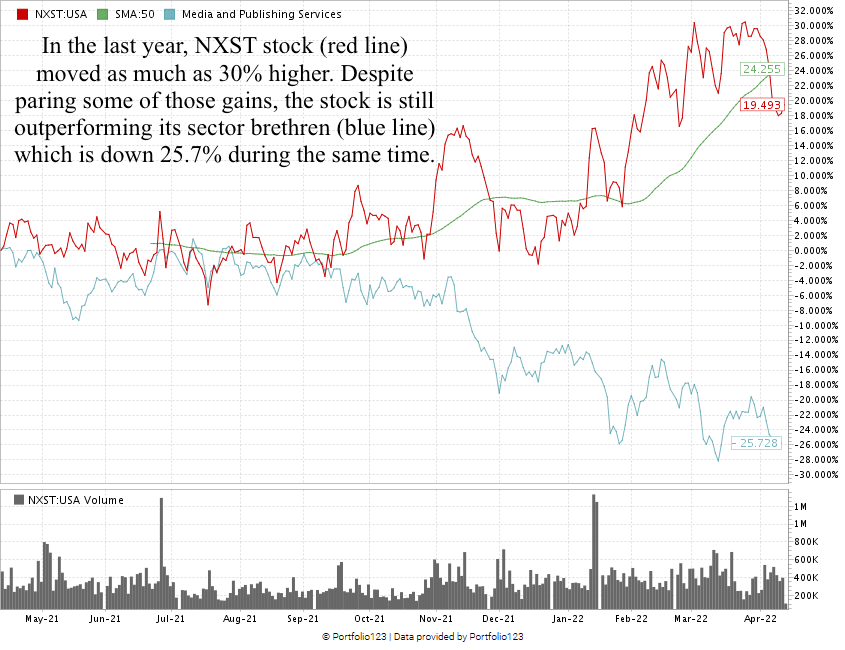

You can see in the stock chart above that NXST jumped 30% in the past year. Though it pulled back, it’s still beating the pants off its media and publishing services peers.

I’m not concerned with the recent downward movement of the stock. We can attribute that to broader market headwinds.

Nexstar stock scores a 91 overall.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The stock tops all but 6% of the stocks we rate in growth. Its impressive monetization of unique and current users of its websites drives its growth score of 94.

Bonus: On top of strong momentum and growth, NXST includes a 2.09% forward dividend yield. This means the company will pay you $3.60 per share annually — just to hold the stock.

Stay tuned: Top Fertilizer Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a fertilizer stock that I think you need to own.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets