I recently filled up my car with gas and, boy, was I surprised.

Mind you, I don’t drive a big SUV or truck…

And it was still $58 to fill up my four-door sedan’s tiny tank.

I watched in horror as the price went past $30 … then $40 … and finally past $50, and I couldn’t help but think about how I didn’t have any other choice.

I still have to drive everywhere and my car only takes gas.

What amazed me, even more, was the line at the gas station that was about two cars deep … per pump.

Today, I’m going to dive into our growing demand for gas and oil. Then, I’ll use Adam O’Dell’s proprietary Green Zone Power Ratings system to locate a stock capitalizing on our thirst for black gold.

Demand for Crude Oil Surpasses Pre-Pandemic Highs

In the thick of the COVID-19 pandemic, our need for oil took a collective nosedive.

We weren’t going anywhere, so demand evaporated.

To put it in perspective, in 2019, the global demand for crude oil was just over 100 million barrels of oil per day.

In 2020, demand fell to around 91 million barrels — a 9% decline worldwide.

Remember how easy (and cheap) it was to get around town?

But what happened after the pandemic subsided was even more surprising.

Despite the global push toward renewable energy and the increasing demand for electric vehicles, our consumption of crude oil isn’t weakening — it’s doing the opposite:

Global demand went from a low not seen since 2013 to what will be an all-time high of 101.9 million barrels per day by the end of this year.

Using our Green Zone Power Ratings system, I’ve found a little-known stock that is poised to take full advantage of this trend.

DHT Holdings Helps Meet Oil Demand Crunch

Started in 2005, DHT Holdings Inc. (NYSE: DHT) operates a fleet of crude oil tankers responsible for moving this critical resource around the world.

It has management offices in Monaco, Singapore and Oslo, Norway. It started with a fleet of seven large tankers and has grown to 24 ships based globally.

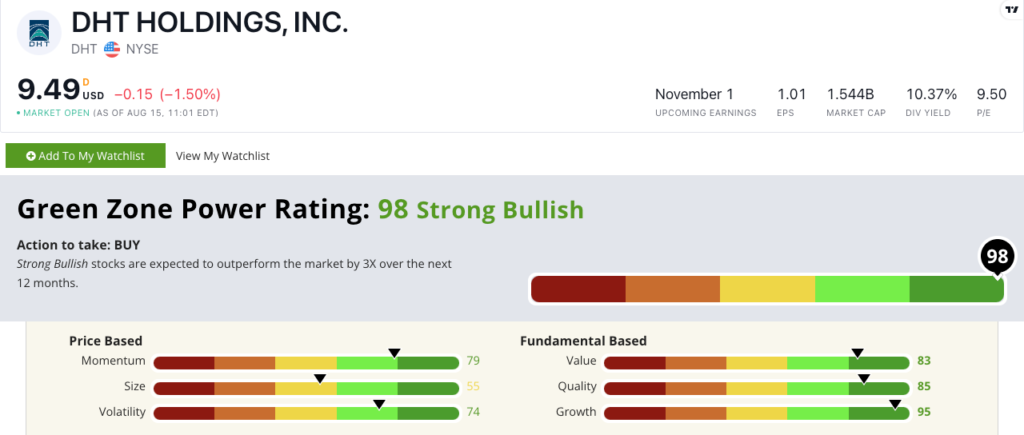

And that growth is reflected in its “Strong Bullish” Green Zone Power Ratings.

DHT rates 98 out of 100, which means we expect it to outperform the broader market by 3X over the next 12 months.

The stock rates a 95 on our Growth factor. That’s because its one-year sales growth rate is 52.2% and its earnings-per-share growth rate is a massive 648.5%!

This is also a good Quality stock — it rates an 85 on that factor. Its return on assets is more than double the average of the support activities for the oil and gas operations industry.

What’s more, DHT has a gross margin — the cost of goods minus net sales — of 54.3%. The industry average is just 36.2%. In fact, DHT’s net and operating margins are also stronger than its peer averages.

Bonus: DHT comes with a forward dividend yield of 14.5%. That means shareholders collect $1.40 per share per year in dividends.

Bottom line: The global demand for crude oil isn’t diminishing anytime soon. In fact, despite the push for renewable energy, our thirst for crude oil is only getting stronger.

That means it’s more important than ever for oil to get from the drill to the gas pump.

With a global fleet of large crude oil tankers bringing in outstanding profit margins, DHT is a compelling stock for your investment portfolio.

Of course, today’s Power Stock has a lot of potential as oil demand continues its march higher, but if you want the best ways to follow what our chief investment strategist, Adam O’Dell, is calling the “Oil Super Bull,” you need to check out his presentation.

This is a broad mega trend that is going to last for years (if not decades), and Adam is targeting energy stocks with 10X profit potential in a matter of years for his premium subscribers.

Click here to see how you can join him in 10X Stocks and start investing in his high-conviction recommendations now.

Stay Tuned: How Stable Are Big Bank Stocks?

Tomorrow, Chad is going to explore the state of the finance sector as we continue to contend with higher interest rates.

And he’ll show you how investable some of the biggest banks are, according to Green Zone Power Ratings.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets