Well, how’s that for a comeback?

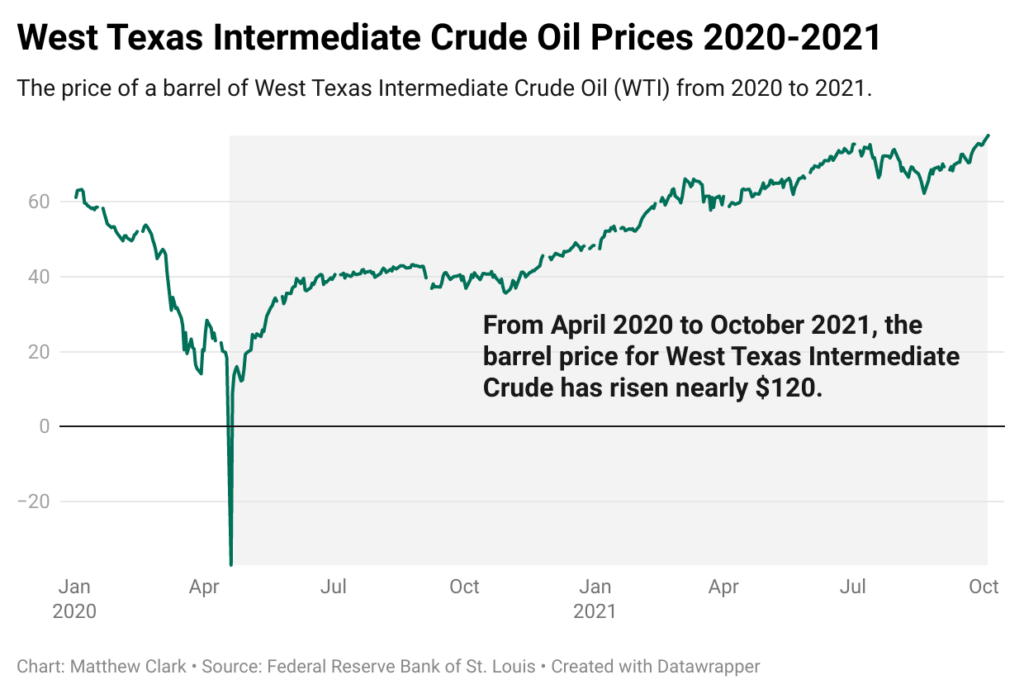

West Texas Intermediate crude oil is now trading for around $80 per barrel, touching levels not seen since 2014.

Just a year and a half ago, you literally couldn’t give it away. Oil prices went to negative $37.63 in April 2020, as you might remember, meaning that rather than pay for oil, you would have been paid to cart it away. We’ve gone from oil having a value of less than zero to having it trade at multi-year highs.

So, is energy back?

Our Approach to the Energy Sector

Before I answer that, remember that I’m not necessarily an “energy guy.” I look for opportunities wherever they might be, and ideally, I like to see durable long-term mega trends in place before we act on them.

In energy, that mega trend is in renewables. Virtually every government in the world is pushing to get a higher percentage of their energy from renewable sources like solar, wind or hydroelectric. This is a durable trend, and it’s one I’ve been following in Green Zone Fortunes.

But we’ve also been looking for shorter-term opportunities in traditional energy. Our readers have already enjoyed returns of 54% in one of my highest-conviction traditional energy plays.

Back to my question concerning the future of energy…

Why Is the Oil Price Surging?

Let’s take a look at some of the factors pushing energy prices, and specifically the oil price, higher.

We’ll start with demand. Demand for energy fell off a cliff during the pandemic. We weren’t going anywhere, so we weren’t gassing up our cars. And the places we weren’t going — hotels, malls, offices, etc. — weren’t using as much energy either.

As the world has returned to something approaching normal, demand for energy has rebounded a lot faster than most energy executives expected. When you add to that a colder-than-usual winter and hotter-than-normal summer in much of North America and Europe, demand for energy has enjoyed a fantastic recovery.

You’ve heard “supply chain issues” being blamed for everything from the shortage of cars to rising food prices.

It’s also an issue in the energy market.

Producers slowed output to a crawl in the early months of the pandemic. The Organization of the Petroleum Exporting Countries (OPEC), Russia, the American frackers… everyone with any real presence in energy reduced output in an attempt to stabilize prices.

What’s Next for Oil

Bringing supply back online takes time. The producers also have to be confident that the rise in oil and gas prices is going to last long enough for their investment to pay off.

Bringing supply back online takes time. The producers also have to be confident that the rise in oil and gas prices is going to last long enough for their investment to pay off.

OPEC has said that they consider a $70 oil price per barrel to be ideal. So, we can expect increased output so long as prices are well above that.

But any pumping they do now won’t have any impact on prices for a while, and the supply crunch will likely get worse before it gets better. The International Energy Agency believes that there will be a deficit of about 700,000 barrels per day through the rest of this year, which means that existing inventories will have to be depleted to make up for this shortfall while we wait.

We’ll see how it plays out.

I don’t forecast crude oil prices. But I do track the fundamentals and technicals of energy companies using my Green Zone Ratings system. And I’m seeing fantastic trading opportunities today.

We have multiple stock recommendations within the Green Zone Fortunes model portfolio pertaining to energy. We are covering all the bases with stocks focused on the current demand for fossil fuels and stocks focused on our renewable energy future.

Our top-performing “old energy” recommendation is up 54% since recommending it in March, and I think it has room to run 50% higher over the next year and a half.

To find out how you can gain access to all of these stock recommendations, along with guidance on the best times to buy and sell, click here.

To good profits,

Adam O’Dell

Chief Investment Strategist