We’re seeing some shakiness in U.S. markets as President Donald Trump brings tariffs back into the fore — the latest threat being a 50% levy against Brazil and a 50% tariff on copper imports set to begin on August 1.

While Trump’s tariffs are a bit of a “wildcard” in this market, there are clearly plenty of bullish opportunities out there as major indexes trade near all-time highs.

And with a system like Green Zone Power Ratings, we can stay focused on identifying stocks well-positioned for what’s to come, tariff tumult or not.

Let’s do just that by examining our latest set of “New Bulls”…

A Recognizable Name on the “New Bulls” List

Even with tariff uncertainty cropping up, the S&P 500 is sitting around the 6,300-point level after climbing roughly 3.7% over the last month alone.

Every week, new S&P 500 stocks hit “Bullish” or “Strong Bullish” status in my Green Zone Power Rating system. Stocks in these categories should outperform ahead by 2X or 3X, respectively.

And my “New Bulls” screen, which we run every Thursday, helps us find those very stocks. For a refresher, here are the parameters of this screen:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”) in my Green Zone Power Rating system.

- The stock must have been rated less than 60 for each of the last four weeks.

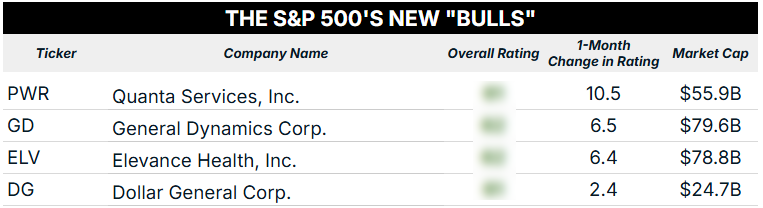

We have four new S&P 500 stocks to analyze this week:

My Green Zone Fortunes subscribers should recognize the stock that tops this list. Back in June 2021, I recommended Quanta Services Inc. (PWR) as a picks-and-shovels play on the renewable energy infrastructure buildout. It’s “Strong Bullish” 90 out of 100 overall rating at that time played a big role in making the recommendation.

And while there’s a lot of buzz around oil & gas amid massive deregulation efforts, as part of Trump’s “Big Beautiful Bill,” Quanta Services has positioned itself well as an “all sides” energy play. No matter the source, companies need solid infrastructure to transmit power and avoid service interruptions.

With the onset of AI and the massive (and growing) energy requirements needed to power data centers, smart investors are looking for the companies that can help make that happen.

Quanta’s standing in my Green Zone Power Rating system took a hit earlier this year as shares trended lower into March. But investors have regained confidence in this stock, pushing PWR’s share price almost 60% higher since early April — and back into “Bullish” status.

We’re sitting on an open gain of 320% on the remaining 50% of our open position in the Green Zone Fortunes model portfolio, currently. And while this stock is outside of my official “buy zone,” PWR’s incredible outperformance shows you what can happen when we target the right highly-rated “Green Zone” stocks in the right mega trends.

If you want to join up and see how you can kick off your Green Zone journey, now is a perfect time to do so. My latest monthly issue serves as an ideal “starting point” with eight stocks that I’ve reconfirmed as solid plays for this market. Click here for more information on how you can join now.

Now let’s see what my “New Bulls” screen came up with outside of the S&P 500…

17 “New Bulls” Outside the S&P 500

The S&P 500 consists of 500 of the largest publicly traded companies, but it’s still only 500 out of thousands of tradable stocks.

Here are the 17 stocks from outside the index that passed my screen this week:

I will note that this list includes a large number of companies based outside the U.S. It’s easy to fall into a “home bias” when looking for new stocks to add to your portfolio, and that’s totally fine.

But U.S. markets aren’t the only game in town. Other markets, especially in Europe, are also trading around record highs. It’s why I didn’t limit my Green Zone Power Ratings system to only focus on American stocks when originally designing it.

What’s more, with market caps between $500 million and $28 billion, the 17 stocks above show you opportunities within the “small-cap,” “mid-cap” and smaller “large-cap” spaces … if you’re so inclined to look beyond the handful of popular “mega-cap” stocks that tend to dominate the headlines.

To good profits,

Editor, What My System Says Today