Well, it was bound to happen eventually…

Between President Trump’s broad tariff plan going into effect and a much weaker-than-expected jobs report on Friday, investors took the opportunity to take some money off the table.

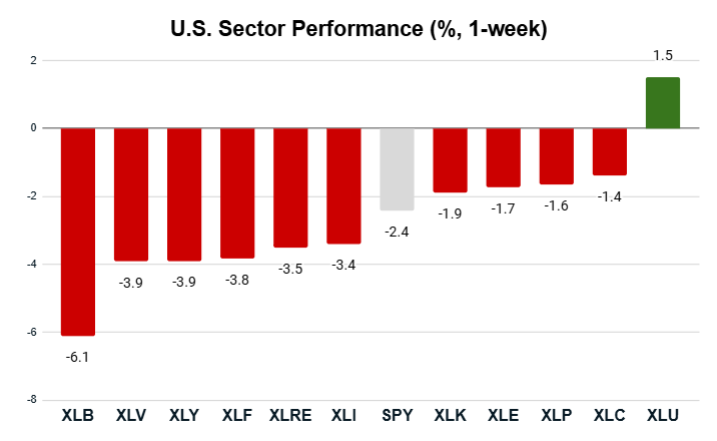

As you’ll see below, utilities (XLU) was the only S&P 500 sector to weather the storm and finish in the green:

Key Insights:

- The S&P 500 (SPY) finished the week 2.4% lower.

- 10 of 11 major sectors closed in the red, with six doing worse than the S&P 500.

- XLU was the only positive, with a 1.5% gain.

- The materials sector (XLB) fell the most at -6.1%!

The aftermath saw President Trump continue his attack on the Federal Reserve and Fed Chair Jerome Powell for not lowering interest rates earlier in the week.

He also fired Erika McEntarfer, the commissioner of the Bureau of Labor Statistics, after the agency reported that the U.S. only added 73,000 in July and revised down May and June numbers to just 19,000 and 14,000, respectively.

Was it a one-day move lower? Early trading this morning says “yes” as investors are pushing all major indexes higher again…

But Friday’s economy-driven shock tells me to brace for a more reactive market ahead.

Luckily, with my Green Zone Power Rating system in hand, we can still find stocks poised to outperform and avoid the ones that aren’t!

Let’s start by looking at the one sector that managed a gain amid the madness…

Utilities Sector: All Alone at the Top

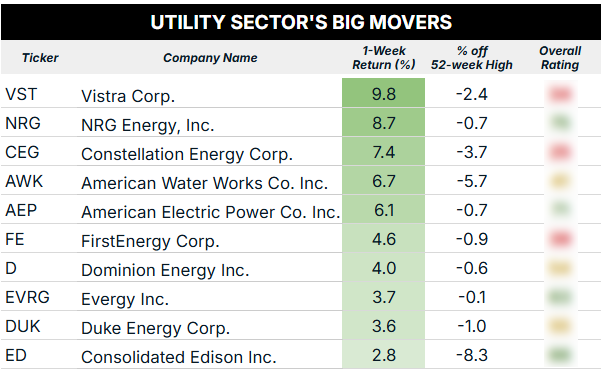

To finish 1.5% higher while the rest of the market dropped sharply is impressive. I can’t say that will continue for the utilities sector, but looking at the companies that led the pack, there’s a trend to pay attention to.

Below, you’ll find the Top 10 utilities sector stocks that closed last week within 10% of their 52-week highs:

By my count, nine of the companies on this list are involved directly in American power generation, through both stalwart energy sources such as coal and gas, as well as renewables such as solar, wind and nuclear.

President Trump has made it clear that onshoring American energy is a chief goal of his second term. These are some of the companies that will benefit from that plan while also providing critical services to a power grid that will only need more energy in the years ahead.

Add in the onset of power-hungry artificial intelligence (AI) data centers, and you can see why XLU is trading at an all-time high.

With that said, only four stocks on the list above currently rate “Bullish” or “Strong Bullish” in my Green Zone Power Rating system. I even recommended one of them to my Green Zone Fortunes subscribers in August 2024, and we’re currently sitting on a 107% open gain in that model portfolio.

While that stock just passed my recommended buy-up-to last week, its strong standing in my rating system points to more outperformance from here.

If you’d like to see where it stands, as well as look up the ratings on any of these other tickers (or thousands of others), click here to see how you can join Green Zone Fortunes today.

Now, let’s switch gears and look at last week’s worst-performing sector…

Materials Sector Down Sharply in Market Crash

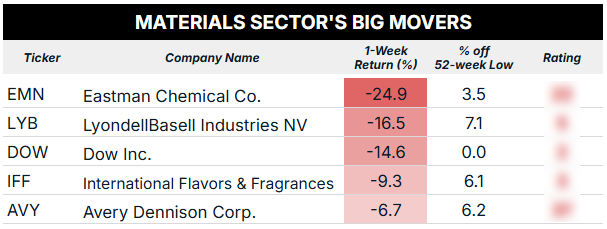

The materials sector (XLB) didn’t take Friday’s news so well, finishing the week a hefty 6.1% lower.

Here’s a look at the materials sector stocks that closed the week within 10% of their 52-week lows:

Talk about bad timing for Eastman Chemical Co. (EMN)…

The American company specializing in recycling materials reported a miss on second-quarter projections during its Friday earnings call, extending its five-day losing streak and closing the day 19% lower.

Eastman, which relies heavily on business in the building and construction and automotive OEM production industries, cited tariffs as a major ongoing concern. It reported a 39% drop in attributable net income from the same quarter in 2024, and sales dipped 3% to $2.29 billion in the same period.

Of course, my Green Zone Power Rating system was already flashing a “Bearish” warning on this stock. In fact, all five materials stock on the list above currently rate “Bearish” — or even worse, “High-Risk” — in my system.

This tells me to tread lightly if you’re looking for new materials stocks to buy. We’re still in the early days of Trump’s tariff world, and this sector will feel the impacts more than others.

To good profits,

Editor, What My System Says Today