Inflation has hit everyone right in the wallet.

Everything is more expensive today than it was a year ago.

But one thing that has actually dropped in price over the last 12 months? Gasoline.

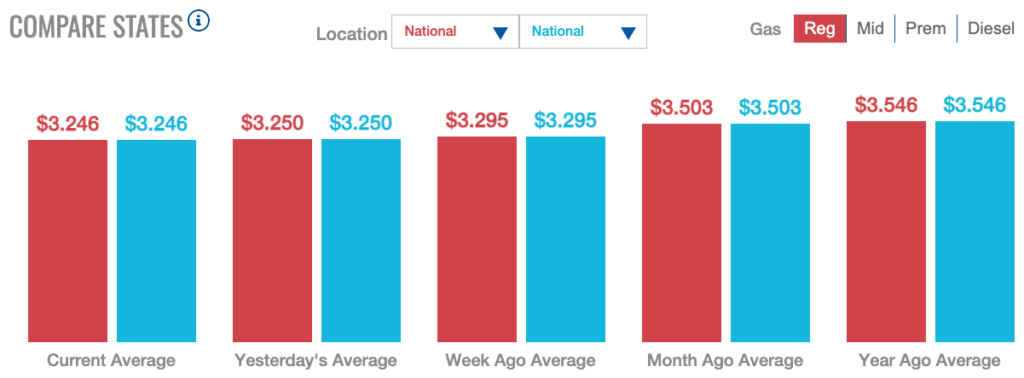

Last year, after Thanksgiving, the price of a regular gallon of gas was $3.54 nationwide. Today, that average is just $3.24 — a $0.30 drop.

Even here in South Florida, gas prices fell below $3 a gallon just after the holiday.

Gas prices have steadily sunk lower for more than 60 straight days — just in time for the holiday shopping season.

But the excitement may be short-lived due to one event happening today.

Let me explain…

The Crude Oil Conundrum

The price of gas is closely correlated to the cost of a barrel of oil.

While gas isn’t the only byproduct of a barrel, each barrel is good for around 19 to 20 gallons of gas.

So the higher the price of oil, the higher the price of gas.

As I write, the barrel price of West Texas Intermediate crude is just under $75. A year ago, it was more than $77.

Today’s price is 20% lower than the 52-week high of more than $93 a barrel in September earlier this year — when gas was nearly $4 a gallon, on average.

But it’s not that simple.

Oil prices fluctuate based on supply, demand and speculation. While market makers play a big role in setting that price, oil-producing nations can directly impact it.

Saudi Arabia is one of the world’s largest oil producers. But it doesn’t just pump an endless supply of oil to put on the market. That would create a glut of supply and drive prices into the ground.

Instead, they help control the price of oil by controlling how much they sell on the open market. If demand is low, oil prices typically fall because there is more oil on the market than is needed. The opposite is true if demand is high… Oil prices rise because there isn’t as much of it.

It all boils down to simple supply and demand.

Sometimes, these oil-producing countries will take matters into their own hands if the price of oil is too low — because that means profits are too low. They will voluntarily cut production to create higher demand.

That’s what could be happening today…

OPEC+ and Oil Price Control

Saudi Arabia is part of a conglomerate of oil-producing states called the Organization of Petroleum Exporting Countries (OPEC). It’s a core group of mostly Middle Eastern and some African nations.

An extension of that is OPEC+ — the 13 members of OPEC and 10 other countries that work with the organization but aren’t members.

This group plays a massive role in determining oil prices.

Today, the group is meeting to discuss even deeper oil supply cuts than those already in place — some members of OPEC+ have enacted cuts of about 5 million barrels per day, or 5% of daily global demand in 2022.

The reason is simple: Oil prices are too low … at least for OPEC’s liking.

This is due to tensions in the Middle East, available oil supply from non-OPEC countries and prolonged weaker demand in countries like the U.S. and China.

In order to buoy oil prices higher, these nations have to cut back on the amount of oil they put on the market … remember supply and demand.

This meeting was supposed to take place over the Thanksgiving weekend, but some African nations balked at production cuts. So in order to get some kind of consensus, the meeting was postponed to today.

If OPEC+ follows through with further cuts into 2024, it will erode the surplus of oil already on the market and … more importantly to OPEC … settle oil prices and send them higher again.

Analyst’s estimates suggest that the move would see oil prices between $80 and $100 a barrel for the foreseeable future.

If you were enjoying those low gas prices, don’t get used to it.

But as an energy investor, today’s OPEC event is set to be a catalyst for the next bullish move in oil. If you’re wondering how you can take advantage of that move, my colleague Adam O’Dell has you covered.

He’s found a tiny $20 oil stock that’s set to become a leader in this growing $10 trillion industry.

If you want details on how to access his No. 1 oil stock recommendation today, click here.

Until next time...

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets