The timing could not have been worse…

Just two weeks ago, things started to pick up.

The Federal Reserve softened its language about future interest rate hikes … signaling we may have reached the peak of inflation.

Stocks rallied to close out the first quarter … signaling optimism in the markets.

But just when things looked like they were turning around, we got hit with a body blow.

Four nations within OPEC decided to scale back oil production by around 1 million barrels per day.

This means less oil on the market, driving up prices, including the price of a gallon of gas.

This isn’t great news for inflation … or our pocketbooks.

But it’s shaping up into a profitable situation for investors.

I’m going to share what this terrible timing means for us. I’ll also dive into our Stock Power Ratings system to point you in the direction of strong investments to capitalize.

But first…

OPEC’s Bad Timing for Summer Gas

The first reason why the timing of this oil production cut is bad is because of summer gas. Senior Technical Analyst Mike Carr hit on this point yesterday in Stock Power Daily.

Refineries produce two main types of gasoline: summer blend and winter blend.

The main difference between the two is the rate of evaporation.

In the summer, higher temperatures increase evaporation. So refiners produce gas with lower pressure, reducing the amount lost in hotter months.

Winter blends are just the opposite, with higher pressure which helps your vehicle start in cold temperatures.

But what matters to us as consumers is the price.

Summer blended fuel comes with higher octane. That increases the cost of a gallon of gas by as much as $0.15 over winter blends.

Refiners are now transitioning to summer blend fuel. Because of the switch, there are lower fuel inventories at refineries … and lower supply means increased costs.

As you can see from the chart above, the price of oil was already on the rise heading into April … before OPEC decided to strangle production.

And the U.S. specifically has another problem…

Limited Options to Replenish Depleted Oil Reserves

Here is why the U.S. is in a pickle.

In March 2022, President Joe Biden authorized an emergency drawdown of 180 million barrels of oil from the Strategic Petroleum Reserve.

This reserve was created at the height of the oil crisis in the 1970s to ensure America would still have oil … even if foreign producers turned off the spigot.

Biden achieved his goal when the drawdown led to lower gas prices.

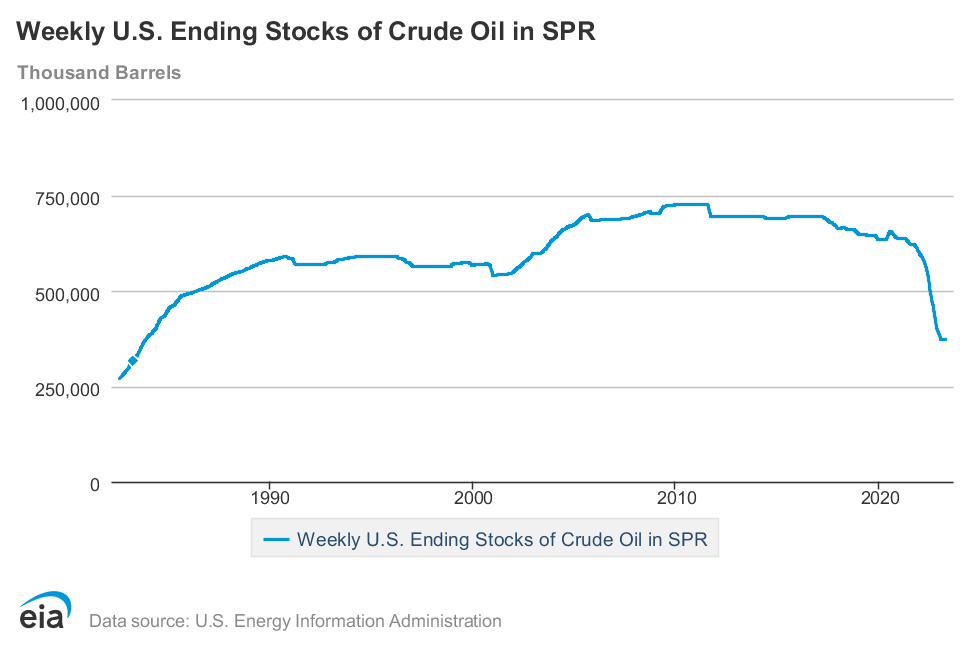

However, the reserve is now at its lowest point in more than 40 years:

What this means is that our insurance policy against future oil supply issues is depleted.

On top of what Biden siphoned off, Congress voted to sell 147 million barrels out of the reserve to fund unrelated legislative issues.

That’s not even the biggest problem.

The government is mandated to refill the reserve through direct purchases of oil on the market or collecting oil owed by operators who have leases on federal land.

With the price of oil on the rise because of the blend switch and OPEC cutting supply, the only two options for the government are:

- Buy oil to replenish reserves at a higher price, costing us, the taxpayer, more.

- Continue to wait until the price goes lower … risking further depletion of reserves if the situation gets worse.

That leads to…

How to Profit From This OPEC Timing

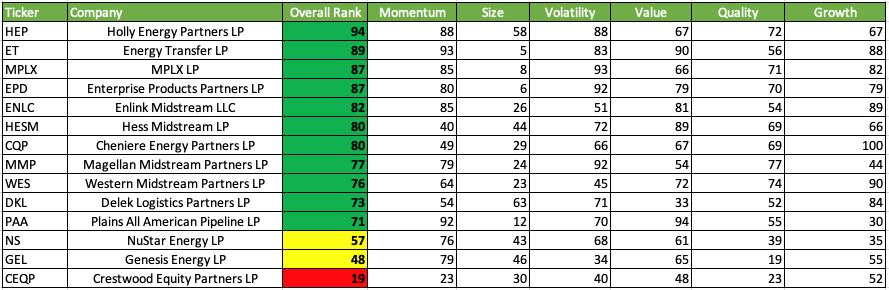

I zeroed in on oil stocks using our Stock Power Ratings system.

My focus was on midstream oil and gas companies — these are companies that transport, store and market crude oil.

They don’t explore for it and they don’t sell it at the pump. These are the oil middlemen.

I examined the Alerian MLP ETF (NYSE: AMLP) — an exchange-traded fund that holds 14 of the biggest midstream oil and gas companies in the U.S.

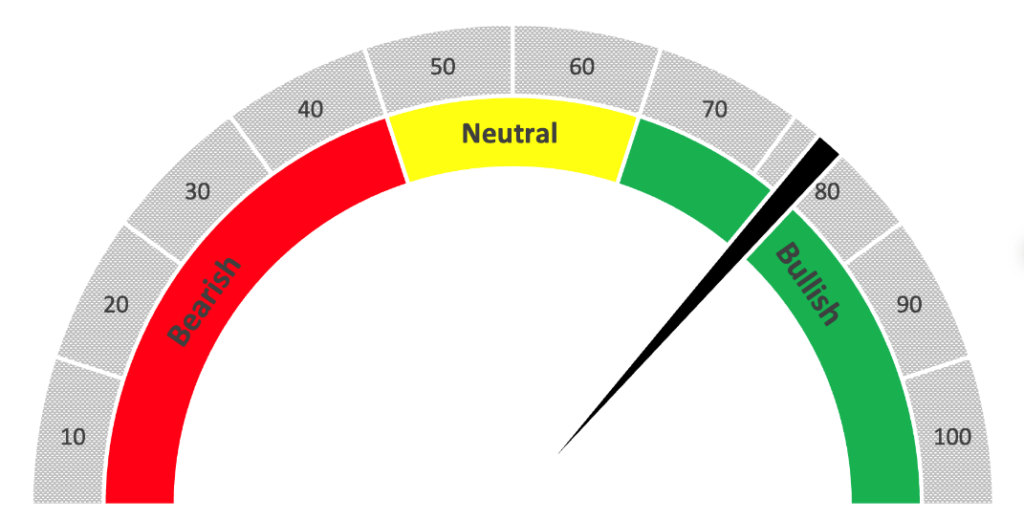

Midstream Oil Stocks Average “Bullish” Stock Power Ratings

The average overall score of stocks I examined was 73 out of 100. This indicates our system is “Bullish” on these companies.

Eleven of the 14 holdings scored 71 or above, while just one was rated “Bearish.”

Bottom line: Oil prices are going up thanks to this OPEC production cut.

Our Strategic Petroleum Reserves are already depleted, leaving open the risk of not being able to sustain another run on oil.

This may lead to some pain at the pump, but as an investor, you can profit from trends in the market like this.

Our Stock Power Ratings system shows us that these midstream oil companies have strong profit potential in the wake of this latest oil crisis.

Of course, our chief investment strategist, Adam O’Dell, is on top of this trend. But, as he mentioned on Tuesday in Stock Power Daily, both sides of the Energy War are set to profit over the coming years.

He’s following what he calls the “Oil Super Bull” closely with high-conviction stock recommendations within oil and the broader energy sector.

To see how you can follow Adam’s guidance during this oil bull market, click here to watch his presentation now.

Stay Tuned: My Top “Strong Bullish” Stock From AMLP

I highlighted AMLP above as a “Bullish” play on the broader midstream oil market above, but tomorrow I’m going to show you why one company stands out to me as oil prices climb higher.

Stay tuned…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets