Editor’s Note: There’s still time to sign up to Adam O’Dell’s Wednesday Windfalls live event. To sign up, click here. On Thursday at 4 p.m. Eastern time, Adam will finally reveal the details of his new strategy that’s beat the market by 51 times … don’t miss it.

While the stock market is pulling back, it’s an ideal time to look at fundamentals. It doesn’t mean it’s time to look at the price-to-earnings ratio or other widely used measures. It means we need to look at how the companies in the major indexes are performing financially.

A widely used measure of financial performance is the operating margin.

The operating margin is the amount of profit a company makes on a dollar of sales. In general, higher ratios are better since that indicates the company’s costs are low and profits are high. The trend in the margin is also important. Rising trends indicate the company is focused on costs and working to sustain its profits.

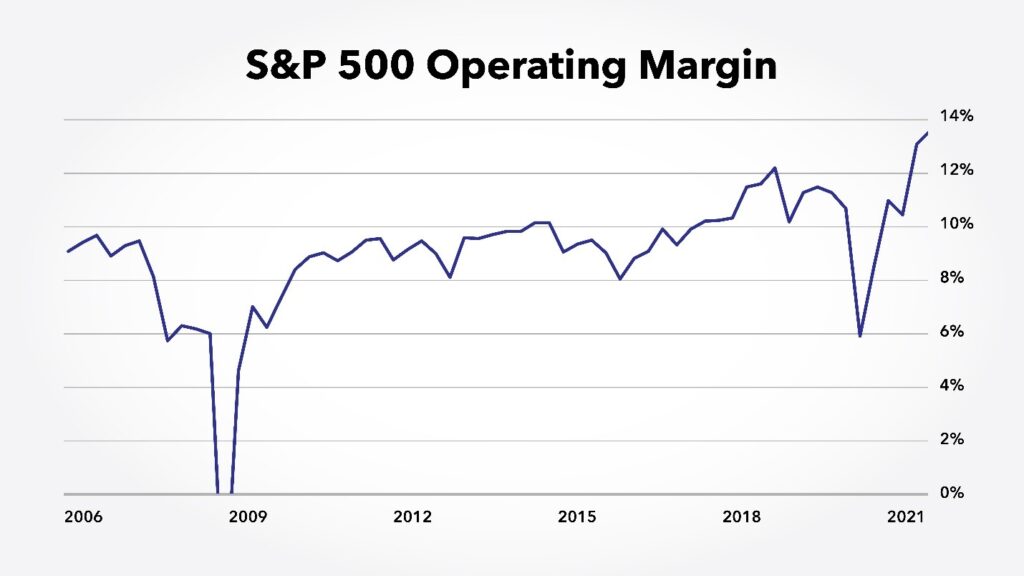

For the companies in the S&P 500, the operating margins are at a record high and projected to go even higher.

Source: Standard & Poor’s.

What Higher Operating Margin Means for Stocks

In the second quarter of this year, the operating margin was 13.5%. Since 2006, the average margin has been 9%. Once in the past 15 years the margin was negative, in the fourth quarter of 2008.

Operating margins were consistently between 8% and 10% until 2017, when they broke above 10% and remained there until the pandemic. In the first quarter of 2020, the margin fell to 5.9% but quickly recovered and reached new records this year.

This tells us that large-cap companies have strong pricing power and have thus far been able to pass higher costs onto consumers. In fact, companies are raising prices faster than costs are rising.

It is possible companies are stockpiling cash in case inflation continues so that they will remain profitable as margins contract. However, that seems unlikely. Companies are raising prices and sales are rising. This is the best possible scenario for many companies.

Record-high operating margins are an indicator that the fundamentals of large cap stocks are strong. This is bullish for stocks and makes the current decline look like a buying opportunity.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking. Follow him on Twitter @MichaelCarrGuru.