Early in my reporting days, I met a man named Frank.

He supervised a wastewater treatment plant in southern Kansas.

Frank spoke about the city’s need to replace its old, rusted metal water pipes.

The city finally agreed to spend millions to upgrade those pipes to PVC.

This ensured the drinking water would no longer contain rust and that the pipes would last longer.

In this chart, you can see the amount of PVC pipe we’ll use worldwide through 2030 will increase 72.5% from 2019!

See, PVC pipe is lightweight, strong, durable and recyclable … making it the go-to for water, wastewater and sewer lines.

Today’s Power Stock produces and sells PVC and plastic pipe around the world: Otter Tail Corp. (Nasdaq: OTTR).

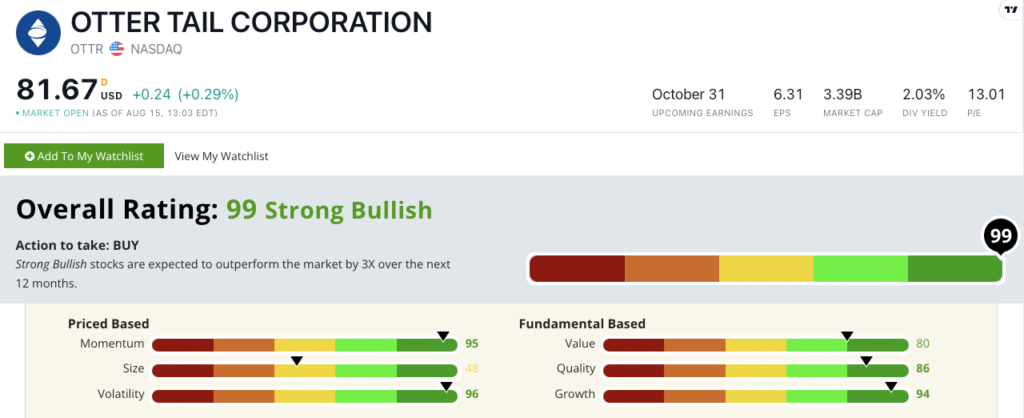

OTTR Stock Power Ratings in August 2022.

Along with PVC and plastic pipe manufacturing, OTTR makes specialized metal and plastic parts.

It even runs an electric utility company that supplies power to parts of Minnesota, North Dakota and South Dakota.

Otter Tail stock scores a “Strong Bullish” 99 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

OTTR Stock: Strong Fundamentals + Momentum

Highlights from Otter Tail’s excellent second quarter include:

- Increased net income to $86 million — up 104% from the same quarter a year ago.

- Operating revenue was 40% higher than the same quarter in 2021.

When it comes to fundamentals, OTTR is an outstanding stock.

As you can see above, its growth numbers are strong … it earns a 94 on our growth metric.

OTTR also outpaces its peers on quality: Its net margin is a solid 18.4%, while the industry average is just 3.3%.

It’s a solid value stock. Its price-to-cash flow ratio is a modest 9.6. The industry average is 11, so OTTR is undervalued compared to its peers.

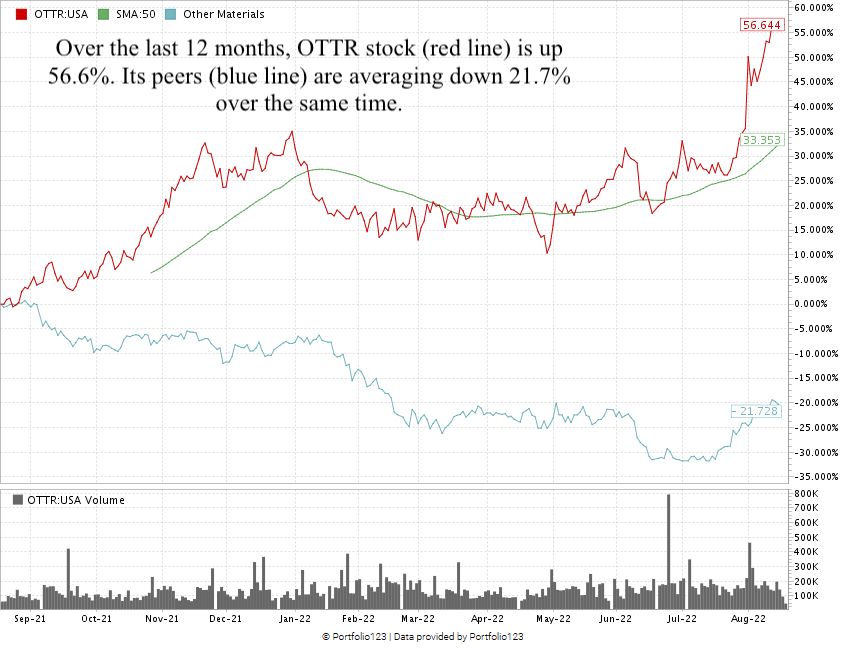

Since the broader market downturn in May 2022, OTTR stock has gained 42%.

The stock is 56.6% higher than a year ago. It continues to trounce the materials industry, which is down 21.7% over the same time.

Otter Tail Corp. stock scores a 99 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

PVC pipe is the go-to for cities upgrading their water and sewer lines, as well as for home construction.

OTTR’s excellent fundamentals and momentum make it a solid Power Stock for your portfolio!

Bonus: The company’s 2% forward dividend yield pays shareholders a $1.65 annual dividend for every share they own.

Stay Tuned: Top HVAC Distributor

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on the largest distributor of air conditioning, heating and refrigeration equipment in the U.S.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.