I finally did it. After equivocating for months, waiting for a dip that never seemed to come, I decided to buy a little bitcoin.

Why didn’t I do it earlier?

Simple inertia. Up until very recently, it was a pain in the rear to buy it. I first tried a decade ago, when it was still the Wild West and mostly the domain of computer geeks and hackers. There was no consumer infrastructure at the time, and it was just a little too far over my head. I gave up.

Even now, the infrastructure is lacking. No mainstream stock brokers offer it, and Coinbase is the closest thing to a real broker you’re going to get.

PayPal Holdings Inc.’s (Nasdaq: PYPL) recently allowed crypto trading, and that finally pushed me into purchasing some of the cryptocurrency. I’ve had a PayPal account for well over a decade. Buying bitcoin via an existing account linked to my bank account made it pain-free enough to move forward.

The introduction of crypto trading apparently got Wall Street’s attention as well. After announcing the move in October, the shares have been on fire. PayPal’s stock crested $300 per share, a 50% increase since October, before settling back recently.

Apart from the crypto buzz, PayPal continues to evolve into a diversified financial services firm. Its Venmo mobile platform is the payment vehicle of choice for many smaller transactions among friends. (I’ve lost count of how many dinner and bar tabs I’ve settled using Venmo.) And PayPal continues to grab market share from banks while also working alongside them.

It’s a compelling story. But let’s see how it stacks up on Adam O’Dell’s six-factor Green Zone Ratings model.

PayPal’s Stock Rating

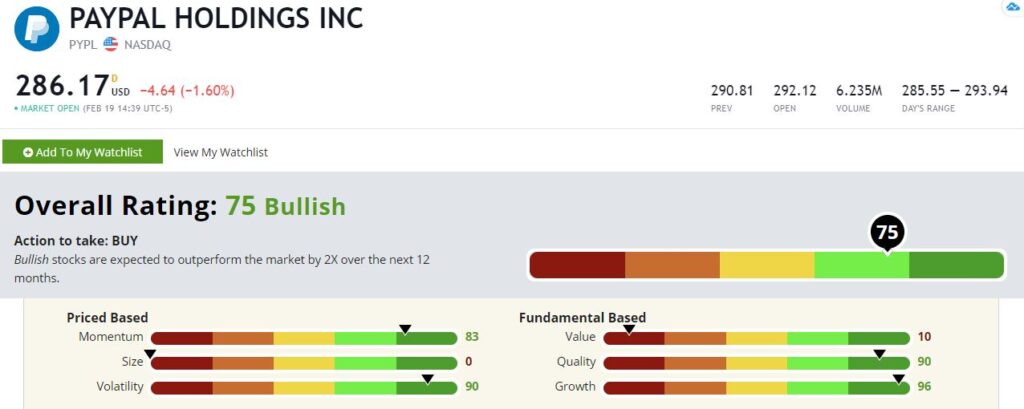

PayPal has an overall rating of 75, putting it solidly in “Bullish” territory for us and not far from “Strong Bullish” territory. (Stocks with scores of 60 or higher are Bullish, and those with scores of 80 or higher are Strong Bullish.)

PayPal’s Green Zone Rating on February 19, 2021.

Let’s break it down further.

Growth — PYPL is first and foremost a growth stock with a 96 out of 100. This is not at all surprising. The company is growing its revenues at more than a 20% annualized clip. It has competition from other fintech firms like Square (Nasdaq: SQ) along with traditional banks looking to up their fintech game, but PayPal has a solid lead in this space.

Quality — PayPal stock also rates well in quality, scoring a 90. “Asset-lite” tech firms tend to rate well on this metric, as it is driven by good balance sheet management and profitability. PayPal has no net debt, as it has more than enough cash on hand to pay back all liabilities. Tack on solid profitability with a return on equity over 20%, and we’re golden.

Volatility — I’ll admit I was a little surprised to see PayPal rate as high as it does on volatility, with a score of 90. We look for low-volatility stocks, so a rating of 90 means that the stock is less volatile than all but 10% of the stocks in our universe. Not too shabby!

Momentum — The past year was strong for tech stocks, and PYPL’s 83 momentum rating puts it up there with the best of the best in tech.

Value — Alas, PayPal stock isn’t cheap. It rates a 10 based on value. This isn’t unusual. Investors pay up for high-quality growth stocks, and most tech stocks rate poorly based on traditional value metrics. PayPal isn’t alone here.

Size — PayPal is a large company with a $330 billion market cap. As such, it rates a big fat zero based on size, scoring lower than more than 99% of the stocks in our universe. Again, this is to be expected. After the move in tech stocks, many have become behemoths.

Bottom line: PayPal is a solid buy based on our criteria. Given the recent weakness, it might be smart to wait for this dip to run its course before buying new shares. But overall, PYPL looks like a solid stock to hold for years, especially during the crypto craze.

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.