During a recent get-together, I had the opportunity to meet my new neighbors in South Florida.

I found out about their family: What they do for a living.

How living in the Sunshine State has always been their dream.

But something else stuck with me. They had to move in a hurry. You see, their home up north sold much faster than they were expecting.

That prompted some research. I found that one sector of the stock market is getting stronger.

Adam O’Dell is Money & Markets’ Chief Investment Strategist.

I use his proprietary stock rating system to look at companies. One stock will surge on the strength in this sector … giving investors a great opportunity.

A Jump in Refinancing Spells Opportunity

Mortgage rates — the interest you pay on a home loan — are the lowest they have ever been.

30-Year Mortgage Rates Hit Lows

In this environment, your payments on a home can be much lower than ever before.

Mortgage applications are near their highest levels in more than 11 years, according to the Mortgage Bankers Association (MBA).

Current homeowners are also taking advantage:

“Mortgage rates dropped to another record low in MBA’s survey, leading to a 10% surge in refinance applications,” said MBA’s Associate Vice President of Economic and Industry Forecasting, Joel Kan.

Refinancing often results in lower monthly mortgage payments. This is a great option for households as they try to navigate the uncertain economy.

And one company will benefit from this trend.

Value and Growth Point to This One Homebuying Stock

Adam’s stock rating system has found one company to benefit from these trends in homebuying and refinancing.

PennyMac Financial Services Inc. (NYSE: PFSI) operates in mortgage banking and investment management in the U.S.

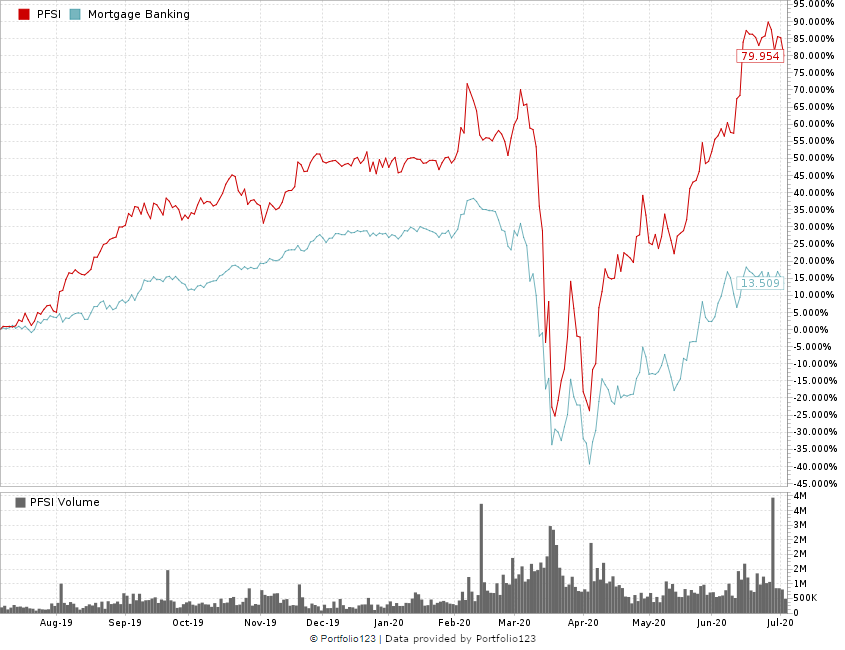

PFSI Outgains the Mortgage Banking Industry

The California-based company issues home loans.

Adam’s Take on PFSI

PennyMac is the perfect example of a stock that’s rated highly on just about all the major factors Adam’s model considers.

PFSI is rated in the 90s on value and growth. Yes, that’s right: You can find a high-growth company that’s also a great value!

The company’s returns are better than 84% of the entire market right now. And it’s handed investors those returns with low volatility to boot — its risk-adjusted returns are rated 88 out of 100, according to Adam’s ratings model.

Its quality metric is thriving thanks to strong returns on assets and equity. PFSI’s profit margins are better than 91% of all rated stocks.

It’s clear that this company is in hyper-growth mode, making hay as the sun shines in this hot housing market!

Get this: The company’s sales growth is rated 92 according to Adam’s model. Its earnings-per-share growth is rated 96, and its net income growth has earned a 99.8 rating. It doesn’t get any better than that!

The Takeaway

Adam’s system shows that PFSI is beating the rest of the industry.

And as the trend of low mortgage rates continues, mortgage bankers will grow as more folks buy and refinance homes.

Jump into this trend to realize big gains now with this homebuying stock — and in the future.

Adam and I see PennyMac Financial Services Inc. as the perfect way to do that.